When millennials become parents or the Gen Z jobseekers land their first pay cheques, the chances are that they will search for insurance online and get bombarded with messages, calls and brochures, selling a life cover of INR 1 Cr at a monthly premium of INR 450-512 (the younger the person is, the less he/she pays). The picture-perfect family smiling at the aspirants from some digital promo always looks like a bunch of high networth individuals, and the person buying the insurance mostly holds a cushy job.

When insurance players look for potential customers, this income bias plays a crucial role, quite apparent from India’s extremely low insurance penetration. Overall insurance coverage across the country has been historically low, reaching 3.76% in 2019 from 2.71% in 2001, according to the Economic Survey 2020-21. Although lack of awareness is one of the key reasons behind low insurance penetration in India, the high cost of distribution and high premiums have limited its growth to a premium user base. Of course, most insurance companies target the large, underpenetrated insurance market in their business pitch, but in reality, they are vying for a small section of the target group.

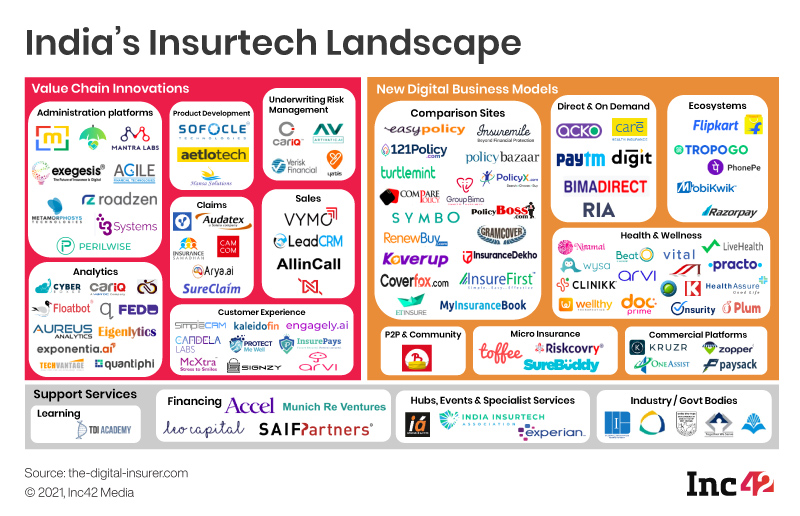

Things had started changing only in the past decade when platforms like PolicyBazaar, Acko and Digit, among others, created an ecosystem for flexible and customised low-ticket products. But insurance needs to cover a lot of ground than it currently does. In fact, there are only a few low-premium insurance products in the market right now such as the Pradhan Mantri Suraksha Bima Yojana (accident insurance) and Pradhan Mantri Jeevan Jyoti Bima Yojana (life insurance).

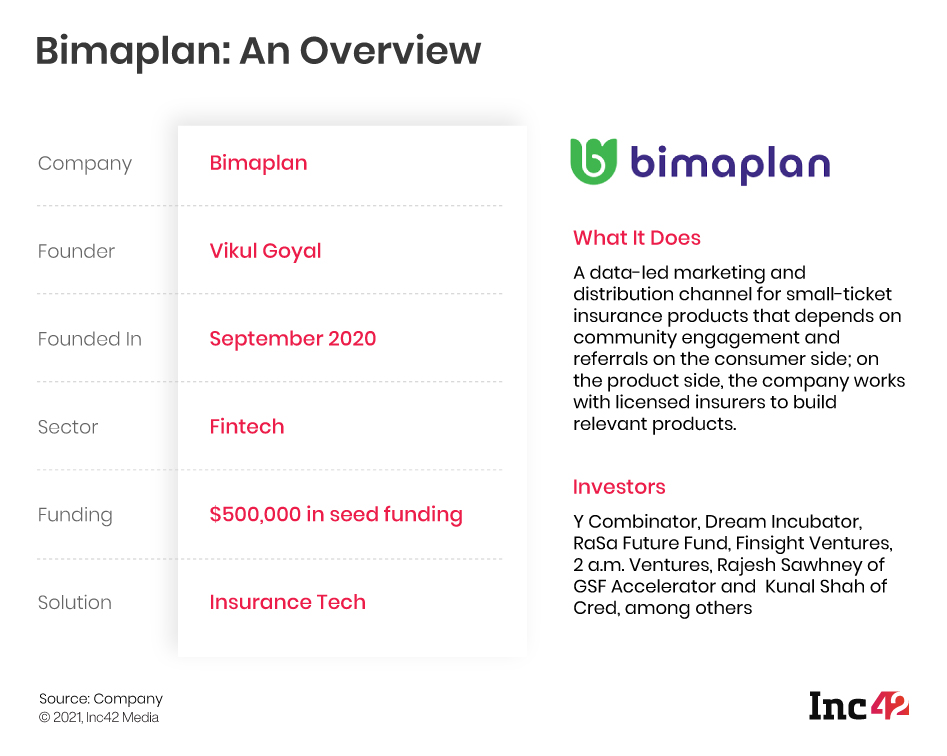

Mumbai-based Bimaplan is trying to overcome this business bias towards high premium payments and bridge the coverage gap. In brief, its target audience is the largely ignored class of customers who cannot pay upwards of INR 450 for insuring their lives. Launched in 2020, the insurtech startup uses a mix of content and community-led approach to offer low-ticket insurance products that can be purchased even on WhatsApp.

The Opportunity That Triggered Bimaplan

Most people do not realise how badly they require a ‘protective’ insurance layer until they deal with an emergency. Consumers have typically faced the double whammy of limited penetration and rising premiums. But all these factored in to open an all-new market opportunity that Vikul Goyal wanted to tap into when he started his latest startup Bimaplan (registered as Bima, Inc.).

Goyal’s previous startup Carcrew, an after-sales service provider, was acquired by TVS in February 2020. Before that, he was part of the core management teams at Craftsvilla, HappyFresh and Burger King and also worked as an investment professional at Bessemer Venture Partners in India. So, his entry into the fintech space is not much of a pivot as he had worked with Bessemer and evaluated deals across fintech and consumer services sectors.

“The grave situation that followed the Covid-19 outbreak and the pandemic’s impact on millions of people made me think about the financial security of the poor and the underserved,” says Goyal.

What started as a white paper on the need for insurance tech solutions soon evolved into an idea that interested Y-Combinator, he adds. With advisors like Kunal Shah (founder, CRED), Sanjay Jain and Swaraj Krishnan (insurance experts and angel investors) guiding the company, research and product development accelerated by the end of 2020. Bimaplan piloted its first insurance product in mid-February this year, an INR 50/month accident cover policy worth INR 1 lakh.

On March 16, the startup announced a $500K seed round led by Titan Capital and Dream Incubator. A slew of investors, including RaSa Future Fund, Finsight Ventures, 2 a.m. Ventures, Rajesh Sawhney of GSF Accelerator, Anupam Mittal of Shaadi.com, Kunal Shah of Cred, Jitendra Gupta of Jupiter, Ritesh Malik of Innov8 and serial entrepreneur Pallav Nadhani also participated in this round.

Bimaplan will use the funds to expand its team and product offerings. The company hopes to achieve a $1 Mn average rate of return (ARR) after getting its product-market fit right in the next 12 months.

As of now, the insurtech firm has an eight-member team and intends to keep it as lean as possible. Goyal has been hiring executives from insurance and consumer companies to ensure that the early hires understand insurance products well and create online engagement with the target demographic.

Incidentally, this space is already populated by several VC-backed insurtech startups, including Acko, RenewBuy, PolicyBazaar, Digit, Coverfox and Turtlemint, all of which focus on customising products for people with different spending capacities. A few of these solutions also intersect with Bimaplan’s offerings. These startups mostly work with established insurers who are also trying to figure out ways to tap into the micro-insurance segment but have not found the right fit yet. But as mentioned before, the penetration of insurance products has been abysmally low, with most people viewing insurance as an ‘expense’ rather than an ‘asset’, adds Goyal. So, the challenge comes from other players pursuing the same path and potential customers who need a mindset shift.

The Growth Road Map

The startup is working with insurers to create over-the-counter (OTC), low-premium insurance products to cater to low- and middle-income people. Annual premiums will be in the range of INR 350-3,500 ($5-50). Bimaplan’s insurance partners will underwrite all policies, but these will be co-branded and distributed by the startup. The company will leverage the power of WhatsApp and social media platforms to reach potential customers.

According to a report by the Indian Brand Equity Foundation (IBEF), overall insurance in India was expected to reach a market size of $280 Bn by the end of 2020. The country’s life insurance industry is also expected to grow 12-15% annually over the next three-five years. This speaks of a huge market opportunity that the company is eyeing.

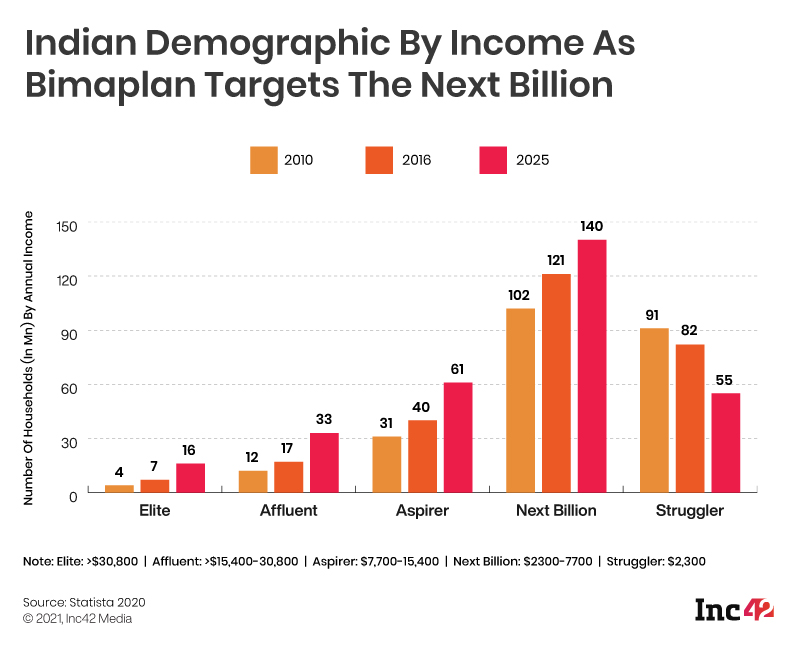

So, who will be Bimaplan’s target customers? The company is looking at around 130 Mn households with an annual income ranging between INR 1.5-5.5 Lakh ($2,300-7,700). The focus will be on suburban populations in metros and urban dwellers in Tier 1 and Tier 2 cities – mostly blue-collar, white-collar and informal sector workers (in blue-collar jobs) who come under the specific income range and have smartphones/mobile internet access.

“Think of it as an insurance model parallel to the neobanking solutions meant for this population. We will be designing the product and taking it to the market while licensed insurance providers manage the underwriting and regulatory part. Legacy insurance deals with the high cost of distribution, but we hope to address that by making people within these target segments the distributors of these products,” says Goyal.

Ask how it will be done, and the founder-CEO is immediately ready to elaborate. To start with, a big chunk of the traditional expenses includes the money spent on legacy distribution channels. However, Bimaplan is developing a variable cost strategy with the help of a micro-agent model by introducing social commerce elements. These micro-agents will have the opportunity to earn supplemental income in addition to their regular incomes. Or they can make this a full-time career option and focus on selling insurance. They can grow into franchises with sub-agents working with them.

“We believe that scale will be achieved by focussing on selling insurance products rather than providing a diversified set of financial products. If there are too many products, distributors will lose the product focus. Having said that, we will be looking for affiliate partner channels, including banking correspondents and microfinance institutions (MFIs). But we will focus on building a proprietary distribution network,” explains Goyal.

According to him, the micro-agents will be trained in explaining the fine print of insurance products to customers, and they will have the opportunity to earn a secondary income of INR 5,000-10,000 per month through Bimaplan. They can use the content that Bimaplan offers or make their own content depending on what their respective communities understand best. “We have already seen some agents making videos in their dialects,” says Goyal.

Customer leads will be developed by agents or directly through marketing campaigns, referrals and organic traffic. Based on simple responses to queries from an AI chatbot, customers will also get relevant product recommendations. And finally, they can raise claims through WhatsApp or reach out to their respective agents for assistance. The idea is to build more and more relevant and affordable products based on usage data.

Will the low-cost model and micro-agent marketing serve the two critical purposes Goyal has in mind – serving the underserved and bringing down distribution costs?

According to a fintech consultant who does not wish to be quoted, insurance is a push product, and a few variations like bundled sachet travel insurance plans (targeted towards elite customers) and two-wheeler insurance (popular among delivery executives) have worked well. “For a low-income user base, the most critical requirement is financial literacy before people can be convinced to shell out any amount. Such social commerce models have worked for retail, but to extend it into insurance will require a strong content engagement model,” the consultant says.

However, cost reduction may happen sooner than expected due to a convenient, digital-first model. According to a PWC report (2019), digitisation can reduce around 20-30% of the cost of non-life insurance products and 15-20% of the cost of life insurance cost.

Bimaplan’s Long-Term Ambitions In Insurtech

The year 2021 has already started on a good note for Indian insurtech companies. Earlier this year, Bengaluru-based Digit Insurance became the first Indian insurtech startup to enter the unicorn club after raising INR 135 Cr ($18 Mn) from existing investors at a valuation of $1.9 Bn. Soon after, Union Finance Minister Nirmala Sitharaman announced the government’s plans for an LIC IPO, divesting stake in a general insurance company and privatising two public sector banks. Most importantly, the FM increased the foreign direct investment (FDI) limit in the insurance sector from 49% to 74%, a move long demanded by the insurtech industry.

This also means entry barriers are getting lower and more players from the traditional and startup sectors may seek to enter this space. One example is WhatsApp that announced its entry into micro-insurance and pension products late last year. In fact, both WhatsApp and Indian telcos are working with various financial institutions to offer sachet insurance and micropension products. Bimaplan uses WhatsApp as a key distribution channel, but other distribution channels are also under consideration.

“We certainly want to learn a lot from the FMCG and telecom distribution channels, and these will be explored as the products grow. But our micro-agents will be a key part of the solution,” says Goyal.

This brings us back to the most crucial parameter of business growth, a product-market fit (PMF). It has been a little over a month since the mint-fresh insurtech startup has launched its first product. How long will it take to achieve a PMF?

“We hope to reach the PMF when we have around 100,000 users, which should also give us an ARR of $1 Mn,” says Goyal. It may take Bimaplan around 12 months to fulfil these goals, but the company is already seeking pre-Series A funding to drive its product innovation plans.

“The important metric that we are looking for, given the financial sensitivity of this segment, is the persistency ratio. If we see 80% of the users sticking to their insurance plans, it will be a great signal for the business model,” concludes Goyal.

The post Bimaplan Adds Social Commerce To Insurance Sachets; Will It Trigger Persistency? appeared first on Inc42 Media.

0 Comments