“The idea germinated from the fact that there are over 60 million small business owners in the country, making the total employed population about 180 million. It is a huge number.” – Chqbook cofounder and CTPO Sachin Arora

Neobanking and fintech startups are changing the game for the small and medium businesses (SMBs) and bridging the gaps in the traditional banking and financial services industry (BFSI).

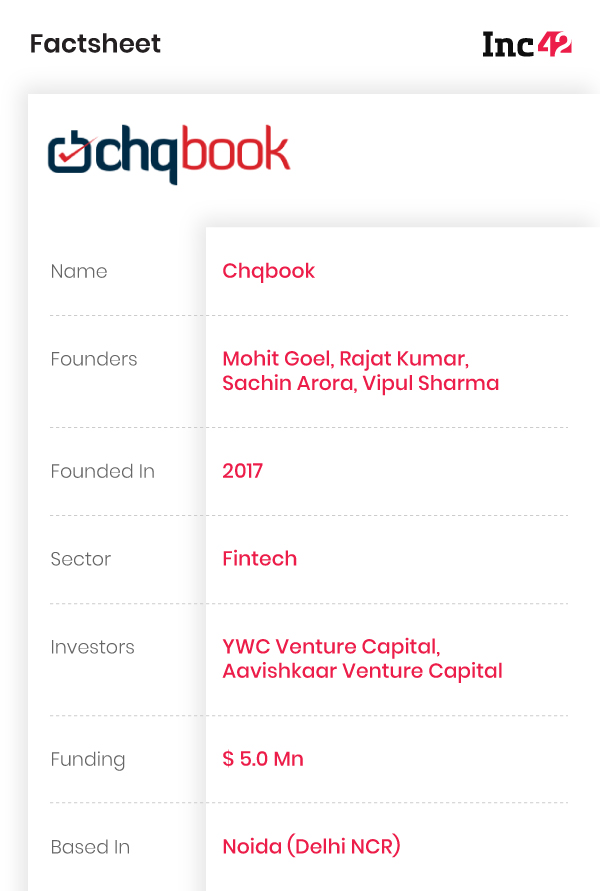

More than 15 companies are currently operational in India, including key players such as Open, Namaste Credit, NiYO, YeLo, Walrus, Finin, Chqbook, and RazorPay X, besides the digital operations of mainstream banks. And most of them have forayed into business management solutions such as cash flow analysis, tax filing, payment collections (generating links to accept payments on behalf of businesses), payroll management, and accounting management to cater to their corporate and SMB clients.

Neobanks have been a draw for investors too, as they are focussing on small and medium enterprises (SMEs), a mostly underserved and untapped market in India. They are not only helping bridge the gap but also aiding the digital transformation of these businesses. One of the biggest challenges remains retaining these customers after acquiring them through value-additions and features.

With a target to enable 60 Mn small business owners to be financially secure, Gurugram and Bengaluru based Chqbook, for example, saw that it needs to add features to support a range of small business owners such as kirana stores, small merchants, traders, chemists and more with its range of financial services. Cofounder and chief technology and product officer, Arora, explains that Chqbook is all about bridging a gap left by big financial institutions. “There was no proper lending channel that served the needs of these small business owners. There are many lending institutions in the country, but there were none to meet the unique requirements of this sector. So, there was a space that we thought we should grab.”

Arora feels that these small business owners serve the country in their own way and require better financial services to meet their business challenges. Though the lending system in the country has developed well and offers products for many situations, the small business segment does have its unique requirements that are currently unmet.

For example, in this segment, 98% of customers want shop insurance, but the product was not easily available. Here, affordability was not an issue since owners were willing to pay.

Chqbook stepped in and filled the gap and is now continuously working to create more products that match the demand and supply. Chqbook’s mobile app is positioned as a ‘financial control center’ that places the power of managing day-to-day financial requirements in the hands of small business owners, on-demand and on the go. The full suite of products includes loans (including supplier credit), current account, digital bookkeeping (khata), and members-only insurance plans. Transactions across these services are powered by an industry-first rewards system built for this customer segment. The startup is also investing heavily into promotional channels to educate the business owners that may require such services, Arora tells Inc42. He believes the startup understands that small business owner may not have the time or inclination to go through tedious documents or blogs to know about the products that can be availed to run or expand their business. So Chqbook continuously iterates its products and conducts experiments to make this target group aware of the products available and educates them about how to best use the available funds to run their businesses.

While other lenders would typically look at parameters like income tax return documents to issue loans, Chqbook took a different route, as its target audience was different. Arora says, “We focused on the transaction history of the customer on our partner platforms and worked on a system that would do the assessment based on certain parameters.” This approach became successful since small business owners are not known for declaring incomes accurately.

Backing Scale With Technology

A big challenge for any internet-driven startup is to keep the system running 24×7. It is easy to develop a system, but the difficulty lies in running it round the clock. It requires technology that can auto-detect major and known problems and alerts system administrators when things are about to go wrong. Hence, not investing in technology cannot be an option for such startups, and Chqbook was no exception to this rule.

The company understood early that it was not humanly possible for any individual to look at multiple parameters and decide if the loan could be given to a customer. So, it invested in building a robust, technology-assisted system to do this complicated job with Amazon Web Services. The experience of its founders who have worked with companies like Myntra, Amazon, HDFC Bank, IndusInd Bank, Hutch, and ICICI Prudential, among others helped create the right network to kick start the tech operations.

Chqbook expanded and strengthened its systems and commenced operations in over 25 locations across India, essentially to be physically closer to potential consumers thanks to the scale supported by AWS. Arora says, “In this kind of business, it is most important to acquire customers where they are, and the company has to ensure its offline presence in such places.”

He added that how AWS helps startups get jump-started is an extremely important aspect for early-stage companies. It also offers a lot of flexibility and choice, which is something that is vital for startups, since they make the decision based on a number of factors.

“If you really want to build something that you want to scale, you have to invest in the cloud. The cost can be lower with a non-AWS environment, but this does not offer nimbleness. It takes a lot of effort to actually support this in-house. But it’s still important to choose the toolset that you need within the AWS suite, which will get the job done. That’s still on the startup.”

So Arora feels that a small dev-ops setup is important along with AWS for Chqbook, especially from a point of view of product evolution. Besides this, Chqbook invested efforts into creating an intuitive user interface for its customers to simplify handling financial operations. The neobanking startup uses artificial intelligence (AI) algorithms to identify the requirements of customers and match them with its offerings. Its AI tool assists their contact center team by sharing relevant details about the probable customer so that the company can pitch them the right product and not offer what could be unnecessary to them. The system also suggests what recommendations can be given to the potential customer, thus saving time and cost.

The ‘Buddy’ Culture At Chqbook

Chqbook secured Series A funding in March 2020, which took off its worries of funding day-to-day operations. It then focused on hiring the right employee base and launching products that would serve the target consumers well.

But Covid-19 posed a challenge in this plan, but Chqbook continued to hire people in this period through video interactions and encouraged the workforce to go back to their hometowns and work from home. Employees were inducted into the company and trained by a qualified team through virtual means. After initial hiccups, it proved to be a fruitful activity. It improved productivity and the cost per employee reduced.

The Chqbook leadership team is conscious of intra-department synergies doing wonders to employee performance, especially during the pandemic. For example, the leadership has created a process by which its key employees remain in constant touch and push each other to stick to the company philosophy.

Arora says, “For example, in our tech team we have a unique ‘Buddy Culture’, where two ‘buddies’ touch base every half-an-hour every day.” This allows them to bounce ideas off each other, take inspiration from the other and plug lacunae, if any, in delivering services to demanding customers.

The so-called ‘Buddy Culture’ allows new employees to acclimatise to the company, since workplace bonhomie may not develop till offices reopen fully. In one such instance, the company hired the head of engineering without anybody personally meeting him. Soon, he was part of the Buddy Culture and found himself at home within days.

Since Chqbook is a multi-line business, offering solutions for diverse financial scenarios, it becomes all the more necessary for employees to share consumer feedback with each other and the leadership team, so that suitable changes can be made in product offerings. It’s about keeping the various parts of the business in sync, which is something that startups tend to ignore. Arora uses a banking analogy to sum up why this system is in place. “Any cheque issued by Chqbook should not bounce”.

The post How Chqbook Leveraged AI, Cloud To Bring New-Age Neobanking To Underbanked SMBs appeared first on Inc42 Media.

0 Comments