On 15th March, the finance ministry through a notification allowed domestic private provident funds to invest upto 5% of their surplus in Alternative Investment Funds (AIFs).

This development means that private provident funds, superannuation funds and gratuity funds will now be able to participate in the venture capital (VC) investment ecosystem. AIFs put money in sectors that are not traditional (for example, equities or fixed income). AIFs and industry stakeholders have welcomed the move as it will offer more capital to startups in India.

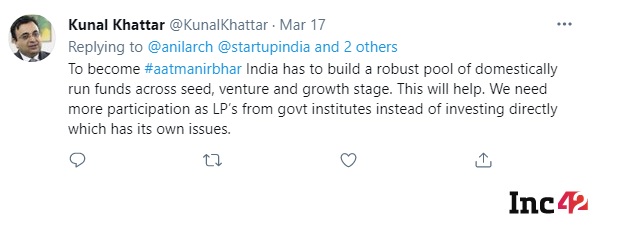

In the wake of developments in the country’s Foreign Direct Investment (FDI) policy seeking to restrict Chinese investment in India’s growing startup ecosystem, government and industry stakeholders have been exploring various ways to increase access to under-utilised asset classes within the country.

This notification follows a report from July 2020, which noted that The Department for Promotion of Industry and Internal Trade (DPIIT) was in talks with the Insurance Regulatory and Development Authority of India (IRDAI) and Securities and Exchange Board of India (SEBI) to deliberate whether state-run insurers and pension funds can be allowed to invest in government-backed startup-focused fund-of-funds.

Deepak Gupta, Founding partner of WEH Ventures, a seed stage fund, notes that most of the AIFs pursuing venture capital, MSME or social sector investing will be eligible for these investments. “ As per last reports, the Employees Provident Fund Organisation (EPFO) had assets under management of the order of INR 10 Tn. At 5% we are talking of something like INR 50,000 Cr ( $6.9 Bn) which is quite significant. The annual VC investment in India is of the order of $8-10 Bn,” said Gupta.

The startup community has been pushing for private Indian pension funds to be able to invest in AIFs, in addition to foreign pension funds that are already allowed to do so.

How Does An AIF Function?

Securities and Exchange Board of India (SEBI) classifies AIFs under three broad categories- Category I, Category II and Category III. Typically investments in real estate funds, private equity funds (PE funds), funds for distressed assets, etc., are registered as Category II AIFs.

AIFs are generally set up in the form of a trust. They include private equity, venture capital, hedge funds, and angel funds. Indians, including non-resident Indians (NRI), Person of Indian origin (PIO), and overseas citizens of India (OCI), are eligible to invest in AIFs subject to eligibility criteria.

To establish an AIF, an Indian company or a limited liability partnership is incorporated which acts as the investment manager to the fund. Separately, a sponsor is also identified, who is one of the investors in the body.

According to the 15th March notification, the sponsor of an AIF should not be the promoter in the pension fund, and AIFs can not be managed by an investment manager who is directly or indirectly managed by that pension fund.

According to the notification, the (pension) funds can only invest in AIFs which have a minimum corpus of INR 100 Cr. The exposure to a single AIF should not exceed 10% of its total size. However, this limit will not apply to a government-sponsored AIF, as per the notification.

For Category II AIFs, at least 51% of the total corpus should be invested in either of the infrastructure, SME, venture capital or social welfare entities. The funds (pension) have to ensure that investments should not be made directly or indirectly in securities of the companies or funds incorporated/ operated outside India.

“Across the world, pension funds invest in VCs. So both for the Indian provident funds as well as the investment ecosystem this is a beneficial move. It is risky capital but it will provide added returns. And the fact that we are only looking at 5% of their surplus bakes in an element of safety as well,” said Rema Subramanian, cofounder and managing partner at Ankur Capital which has two AIFs.

Can Risk Averse Retirement Funds Put A Brake on Innovation?

Subramanian suggests that even in case of SIDBI or the India Aspiration Fund, the government has been very supportive towards investments in novel technology solutions. Today, the notification includes private provident funds but there is a hope that it will also open up for government provident funds eventually, she adds.

“This is a defining moment for India as it would mean government backing and support towards domestic managers and funds,” said Ishpreet Singh Gandhi, Founder and Managing Partner, Stride Ventures, a Delhi based VC.

These (domestic provident funds) funds typically invest a minimum 45% in government securities, besides new instruments, such as exchange-traded funds and real estate investment funds, and equity-related instruments, explained Gandhi.

The government is looking for ways to attract domestic capital to Indian startups and make the new economy “Aatmanirbhar”. Since venture debt funds have a fixed return component, this would work well for pension funds, he says.

“Generally, banks are risk averse to lending to certain segments, the only challenge is to see how open pension funds would be investing in AIFs,” he adds.

Gandhi suggests venture capital funds and social venture funds working with early and growth stage startups would benefit the most from this move.

According to Inc42 Plus data, in 2020, seed stage startups raised 58% higher funding over 2019 at $403 Mn. However growth stage startups received 51% lower funding in 2020 compared to 2019. India is among the top five startup ecosystems globally with the number of startups growing by around 7,000 in 2020 and the number of seed-stage deals growing by about 13%, with a dozen new companies achieving ‘unicorn’ status in 2020, the most in a year, according to a report by consultancy firm Bain & Co.

Additionally, impact investing is an emerging theme and would benefit social venture capital enormously, said Gandhi.

The post What Investments From Domestic Private Provident Funds In AIFs Will Mean For Startups In India appeared first on Inc42 Media.

0 Comments