Food aggregator business Zomato filed its much-awaited draft red herring prospectus (DRHP) with the market regulator securities and exchange board of India (SEBI) yesterday (April 28), for INR 8,250 Cr ($1.1 Bn) initial public offering (IPO) this year. According to the filing, the offer consists of fresh issue amounting to INR 7,500 Cr and a secondary component of INR 750 Cr, which will come from the company’s largest stakeholder Info Edge.

Besides the foodtech startup’s IPO plan, the filing has outlined several major updates of Zomato’s operations, ranging from the company’s unit economics, revenue, daily orders, delivery partners and more.

Here’s what you need to know about Zomato growth so far:

Zomato To Raise INR 1,500 Cr Before IPO

Zomato will be raising INR 1,500 Cr ($200 Mn) as a pre-IPO exercise. However, the company has already raised INR 1,800 Cr ($250 Mn) in funding from Tiger Global, Kora and others in the fourth quarter of FY21.The company was veiled at $5.4 Bn for this round.

The Five Bankers & Advisors For Zomato’s IPO

Zomato has on boarded Kotak Investment Banking, Morgan Stanley, Credit Suisse, Bank of America Securities and Citigroup Global Markets India as the book running lead managers. Link Intime India, on the other hand, will act as registrar to the office.

Where Will Proceeds Raised Go?

Zomato said it will use the raised capital for both organic and inorganic growth initiatives, which includes creating delivery as well as technology infrastructure. Beyond this, the company would focus on marketing and promotions towards customer and user acquisition activities, which involves acquisition and retention cost as well as market and branding cost. The fund would also be directected towards new acquisition.

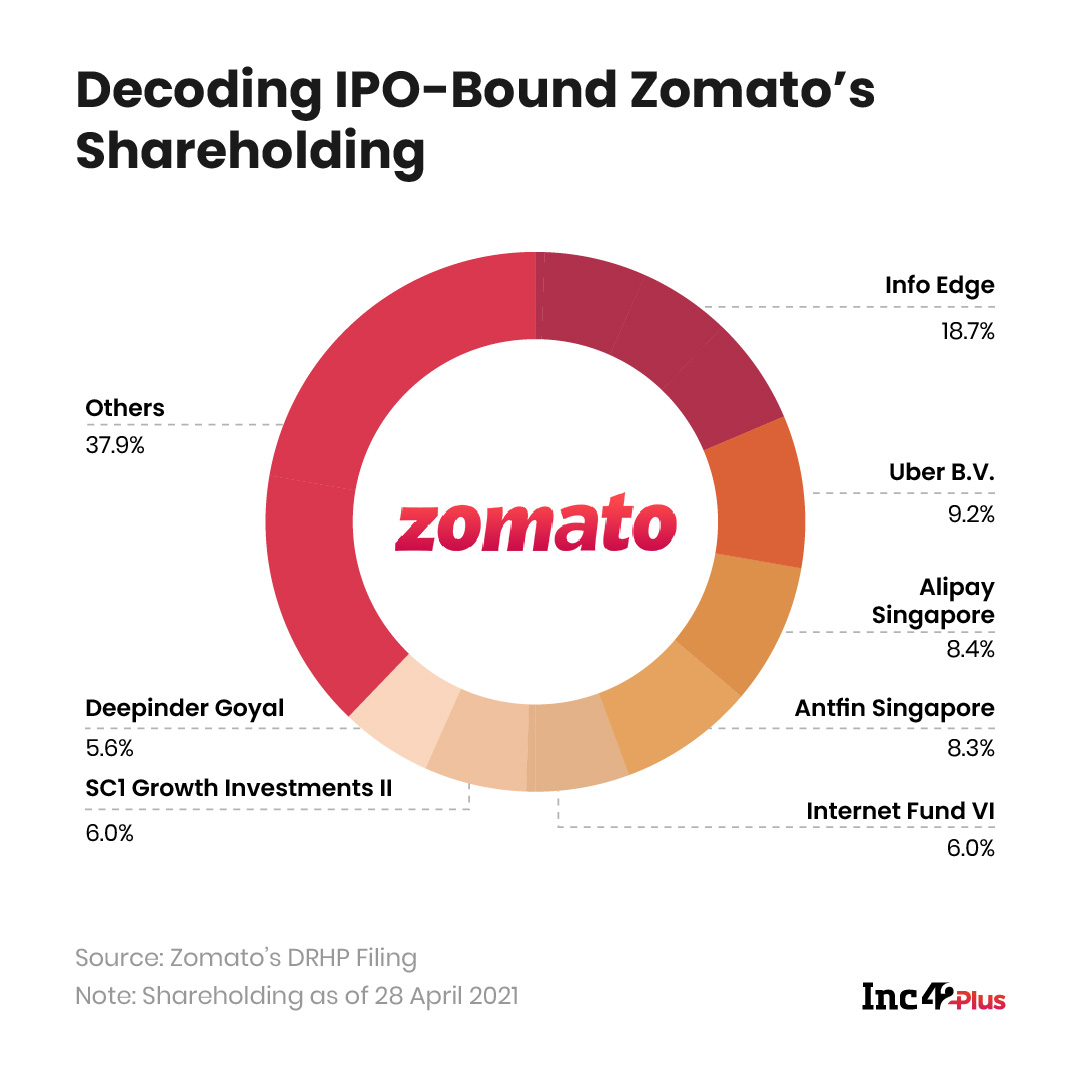

Uber Is The Second Largest Stakeholder In Zomato

The DRHP filing revealed Zomato’s shareholding structure as well. Uber is the second largest stakeholder in Zomato with shareholdings of 9.13%. Uber shareholdings was a result of Zomato’s acquisition of Uber Eats India business in January 2020. Chinese investors like Alipay and ANT Group (formerly known as Ant Financials) were the second and third largest stakeholders, respectively, in the company. But Zomato decided to give them a partial exit, reducing their shareholdings to 8.20%-8.33%, due to rising geopolitical tension between India and China.

Though Zomato has about 75 shareholders as of today (April 28), only 18 of them hold more than 1% shares in the company. Zomato’s CEO Deepinder Goyal holds 5.51% shares in the company. Info Edge is the largest stakeholder in Zomato with 19.55% shareholdings, however, it will be selling off shares worth INR 750 Cr ($100 Mn) in the IPO.

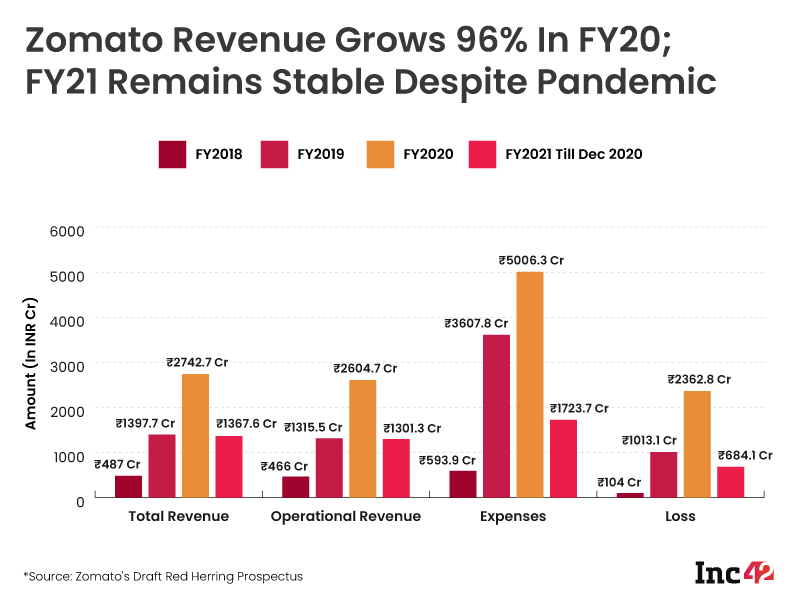

Revenue Recovery In Q3 FY21

Zomato has reported a revenue of INR 1,367 Cr in the first three quarters of the financial year 2021. The company’s expenses were at INR 1,724 Cr in the same period, leading to a loss of INR 684 Cr. The company’s overall revenue for FY21 is bound to increase as the company witnessed more stability in the last quarter due to decrease in covid cases.

The company revealed that revenue increased by a whopping 96% in FY20, from INR 1,398 Cr in FY19 to INR 2,743 Cr in FY20. However, this growth led to 39% increase in expenses, from INR 3,608 Cr to INR 5,006 Cr, in the same time period. This has increased the company’s losses by 133% or 2.3X to INR 2,363 Cr from the previously reported INR 1,013 Cr.

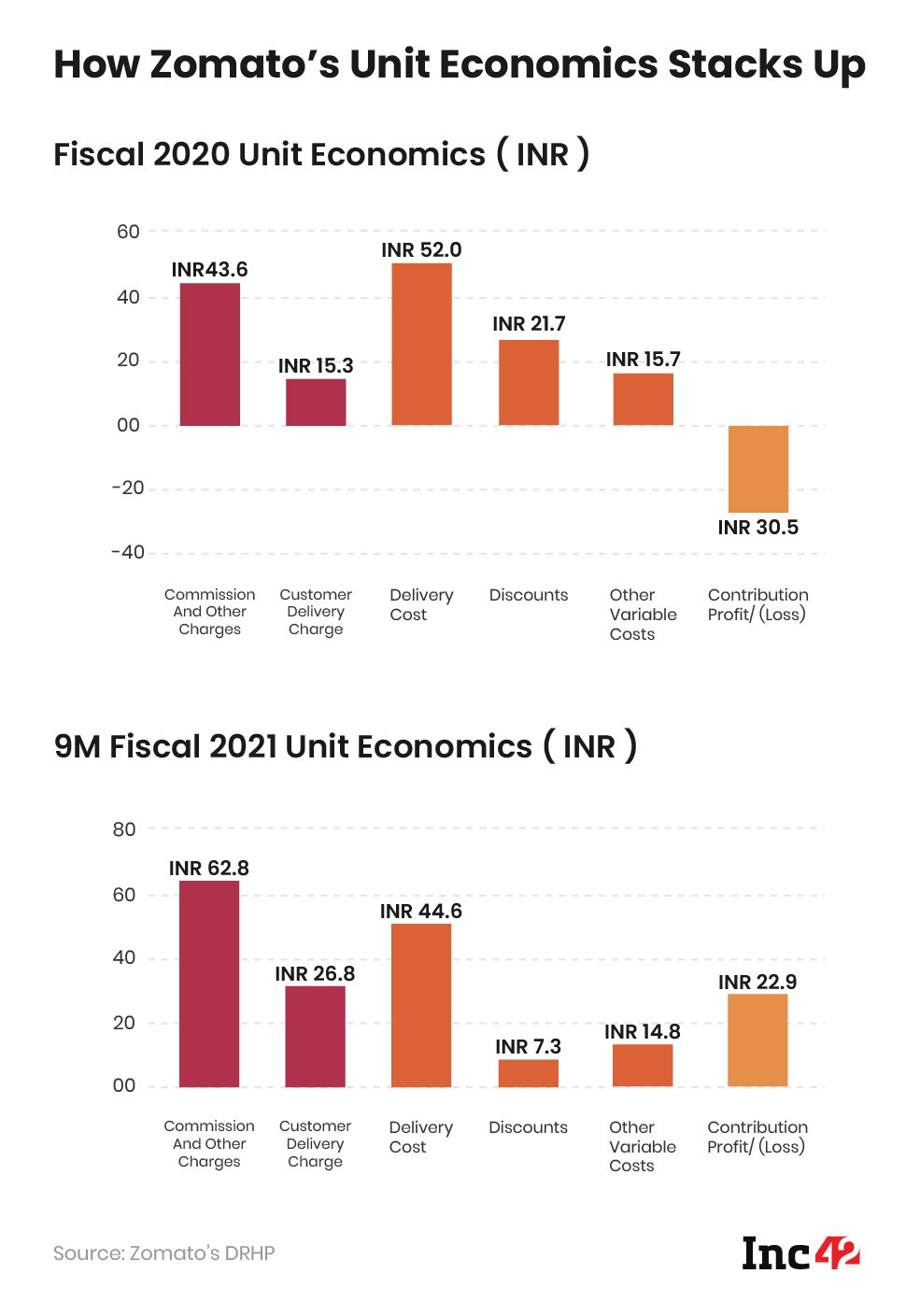

Zomato Posts Positive Unit Economics

Zomato said that it has achieved positive unit economics with a contribution margin of INR 22.9 per order on average till Q3 of FY21. This is a massive improvement from the negative INR 30.5 margin logged in FY20 (or March 2019 to March 2020), which means Zomato is actually making money per order on an average, rather than burning cash to fulfil deliveries. This has been made possible due to increase in commission from restaurants and ad revenues and delivery fees paid by customers as well as decrease in discounts and costs paid to delivery executives.

Average Order Value Per User Crosses INR 400

Zomato’s average order value per user touched INR 408 in Q3 of FY21, representing a 7% growth from INR 378 reported in the first quarter. Compared to pre-Covid value of INR 287 (Q4 FY20), the average order value has increased by 32%. The food aggregator has also noted a 7% spike in its gross order value (GOV), increasing from INR 2,785 Cr in Q3 of FY20 to INR 2,981 Cr in Q3 of FY21. This is also an all-time high quarterly GOV for Zomato.

![[What The Financials] Zomato Records INR 1,370 Cr Revenue Till Q3 FY21, Hits Positive Unit Economics](https://inc42.com/wp-content/uploads/2021/04/ZomatoAOVShareholding_Article-1.jpg)

Zomato Adds 1.4 Mn Pro Members

Zomato’s premium subscription service Zomato Pro recorded 1.4 Mn members in India, as of December 31,2020. However, the Covid-induced lockdown did impact Zomato’s network in the first nine months of FY19, as active food delivery restaurants on the app had reduced to 1.32 Lakh by December 2020. The company had about 94K active food delivery restaurants on its platform in March 2019 (FY19), which was increased to 1.43 Lakh in March 2020 (FY20).

The Key People Leading Zomato

Last week, Zomato had announced the appointment of five new independent members on its board of eight people, four of whom are women. Zomato had a largely investor run board, but it has made some changes ahead of its IPO later this year.

With the new addition, Zomato’s board of directors includes CEO Goyal himself, ANT Group’s Douglas Feagin and Info Edge’s Sanjeev Bikhchandani. It has now added Sutapa Banerjee, who is also on boards of other companies like Godrej Properties, JSW Cement and Axis Capital among others; former Olympian Aparna Popat; Zalora Group CEO Gunjan Tilak Raj Soni; Airveda’s founder Namita Gupta; and TARI founder Kaushik Dutta.

The company’s management team includes cofounder and CTO Gunjan Patidar, cofounder and head of supply Gaurav Gupta, cofounder and head of new businesses Mohit Gupta, CFO Akshant Goyal, head of food delivery Rahul Ganjoo, head of people development Akriti Chopra, head of human resources Daminee Sawhney, head of customer experience Surobhi Das, company secretary and compliance officer Sandhya Sethia and general counsel Damini Bhalla.

The post 9 Key Takeaways From Zomato’s IPO Prospectus appeared first on Inc42 Media.

0 Comments