Food aggregator Zomato has finally filed its draft red herring prospectus (DRHP) for its $1.1 Bn (INR 8,250 Cr) initial public offering (IPO) this year. The company’s largest stakeholder Info Edge, which holds about 18.55% shareholdings in the food aggregator, will be selling shares worth INR 750 Cr (approximately $100 Mn) in this process.

Info Edge holds about 1.24 Bn (124 Cr) shares in Zomato, but its shareholding has been diluting for the past two years as more investors come on board to invest in the company. According to the DRHP document filed by Zomato, Info Edge held about 27.45% shareholding in the company two years ago on a fully diluted basis.

The shares were further diluted to 24.13%, with the entry of Uber, Chinese investor Sunlight Fund and others in 2019. In this round, Zomato’s cofounder Pankaj Chaddah, who held about 93 Mn (9.3 Cr) shares equating to 2.06% shareholdings, had sold off his shares as well.

In this process, Zomato’s CEO Deepinder Goyal, who held about 41 Cr equity shares in the company, also diluted his shareholdings from 9.05% to 7.96%. As Zomato’s cap table expanded further to 74 shareholders in the last one year, Goyal’s equity shares were further reduced to 369 Mn (36.9 Cr), taking his shareholdings to 5.51%.

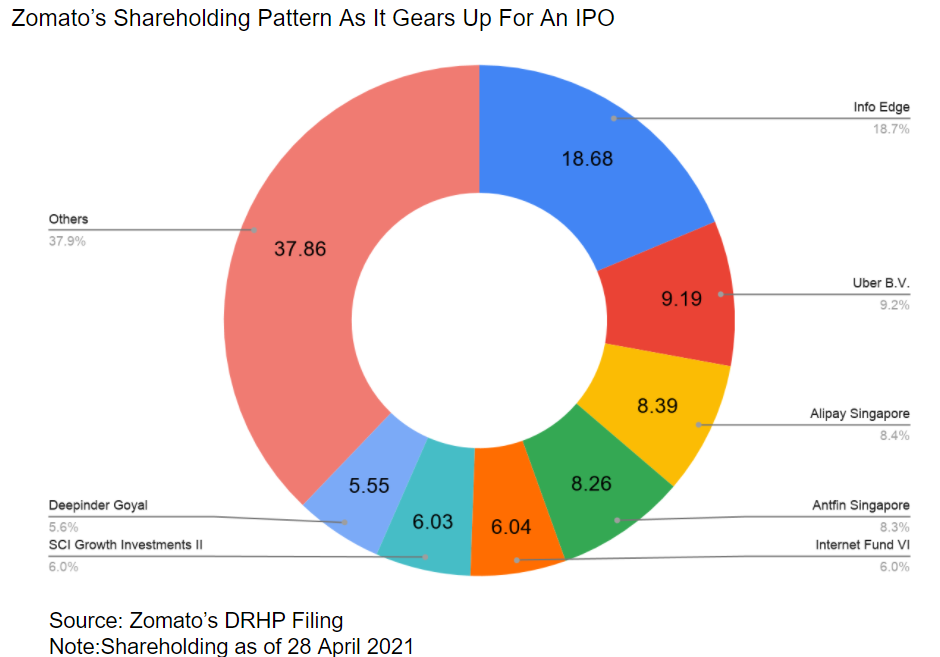

Though Zomato has about 75 shareholders as of today (April 28), only 18 of them hold more than 1% shares in the company. Cumulatively, these 18 investors account for 5.9 Bn shares or 89.33% of the shareholdings in Zomato.

Here’s What Zomato’s Shareholding Looks Like

[Note: The above mentioned list showcases investors that have more than 1% shareholding in Zomato]

- Zomato has added more than 10 new investors to its cap table in the last 12 months. These include Tiger Global (Tiger Global), D1 Master Capital Partners, MacRitchie Investments and Kora Capital

- Chinese investors like Alipay and ANT Group (formerly known as Ant Financials) have partially exited the company, reducing their shareholdings to 8.20%-8.33%.

- Another Chinese investor Sunlight Fund has completely exited the company, by selling of its 1.21% shareholding comprising 6.4 Cr shares

- Zomato had acquired Uber Eats India business in January 2020. As a part of the deal, Uber acquired 9.13% stake in the company. Uber is currently the second largest stakeholder in Zomato, followed by Alipay and ANT Group

- Info Edge shares will be further diluted, as it plans to sell of shares worth INR 750 Cr in the upcoming IPO

Founded in 2008, Zomato has raised $2.1 Bn to date, of which $910 Mn was invested in the last 12 months as the company planned on going public this year. It ended 2020 by closing a $660 Mn round, at a valuation of $3.9 Bn. Then again, it raised $250 Mn (over INR 1,800 Cr), at a valuation to $5.4 Bn. Sources aware of the development say that Zomato aims to hit an $8 Bn valuation with its IPO.

The post A Look Inside IPO-Bound Zomato’s Shareholding Structure appeared first on Inc42 Media.

0 Comments