India’s digital payments market continues to gain great momentum on the back of the growth seen in ecommerce and in native direct-to-consumer platforms. The fintech ecosystem is now looking forward to the next phase of innovation which includes connecting the various dots in the digital commerce ecosystem.

Having seen the market evolve from 2014 onwards, Bengaluru-based fintech startup Razorpay has had an enviable vantage point to the developments. Having acquired the status of a unicorn in October last year, the company recently raised $160 Mn in its Series E funding round taking its valuation to $3 Bn, 3x the previous valuation. The round was led by Singapore’s sovereign wealth fund GIC and Sequoia Capital India. Other existing investors such as Ribbit Capital also participated in the new round.

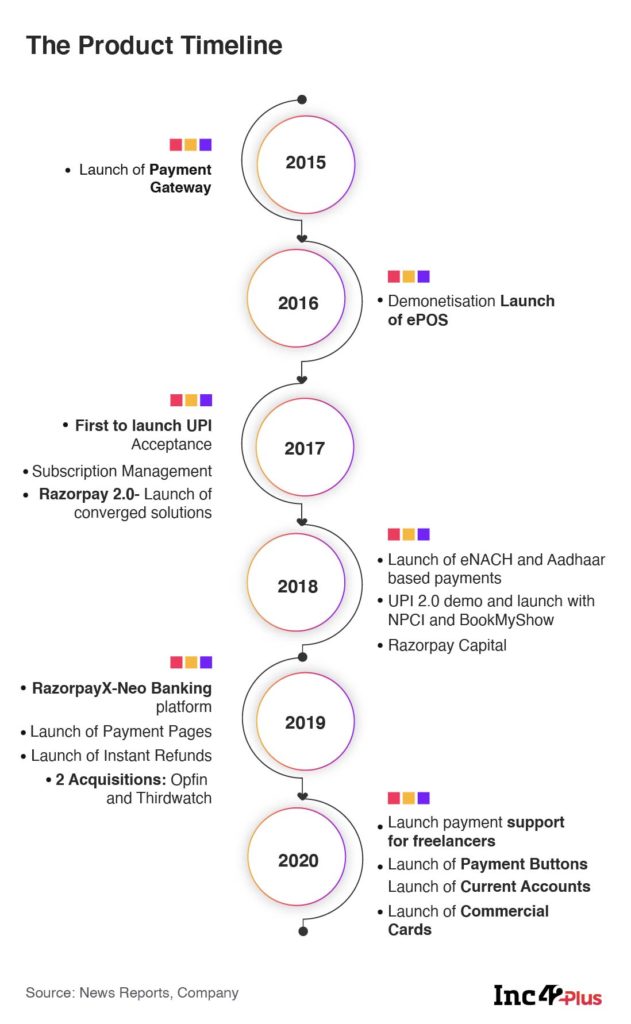

Founded by Shashank Kumar and Harshil Mathur, Razorpay is no longer just a payment gateway that it started off and now offers a wide range of solutions encompassing SME payroll management, payments, banking, lending and insurance needs. While its core business i.e. payments still accounts for 80% of its revenue, the company’s neobanking platform RazorpayX that was launched in 2018 now helps over 15,000 Indian businesses and claims to have recorded 400% growth in transaction volume in the last 12 months. In FY20, the company’s revenue grew by a massive 163% to reach INR 519.42 Cr, its expenses also grew at a similar pace to reach INR 525.41 Cr in the fiscal.

With this latest round of funding, the company has come up with some big plans which include expansion in Southeast Asia, and acquisition plans and more.

To talk more about the company’s plans, Inc42 spoke to founder and CEO Harshil Mathur.

Here’re the excerpts from the conversation…

Inc42: Barring 2017, you have successfully managed to raise funding almost every year. Have you devised any particular formula as far as funding is concerned? What’s the secret, as some might call it?

Harshil Mathur: I think there’s no formula per se, but there is definitely a strategy. The view we carry out is that we are in the B2B space. And, in our business, the burn rates are not very high. So, we don’t actually need too much cash. One of the basic strategies we have is that we don’t raise too big rounds. We have avoided raising like $200 Mn or $300 Mn type rounds in the past, even if we were offered something like that.

Our intention is to raise smaller rounds and increase valuation so that the dilution remains low. One of the fundamental objectives is that both the founders want to ensure that we maintain significant ownership in the company as it scales up to become bigger.

That is the fundamental idea otherwise, of course, funding depends on a lot of things such as market dynamics and so on.

Inc42: How are you going to utilise the latest funding as part of your short, medium and long-term goals?

Harshil Mathur: So, there are three short term or medium-term goals because of which we have raised the funding. In the last six months, we have seen really good traction on our banking and lending products. Despite being fairly new products, RazorpayX and Razorpay Capital have scaled very well in the last six months. So, the first use of the funding amount would be to deploy funds in creating additional products.

Both of these umbrellas on the banking side help businesses manage their finances better. So, we’re looking at things like treasury management, tax payments, and other forms of SaaS tools that can help businesses manage payments better. Similarly, on the lending side, we recently launched corporate credit cards and we’ll expand and add other forms of lending under that umbrella. So that’s the first need.

The second is that as we scale up in banking and lending, we’re also looking at inorganic ways to grow. We’re looking at partnering with young companies, informal business partnerships, or, M&As. So, we’re looking at companies on the B2B SaaS side, which can come into the Razorpay umbrella, and solve a lot of problems for the businesses that we work with.

The third part that we were looking at is on the payments side. We are now in a leadership position in the internet space in India; we power one of the largest numbers of internet merchants in India today. So our goal is how can we take the learnings and the products that we have built in India in the last six years to Southeast Asia later this year! The plan is to launch at least in one or two markets in Southeast Asia, where the problems are very similar to what India saw a couple of years ago.

From a long term perspective, our vision is pretty clear. We want to build the entire financial ecosystem for businesses in India, which means everything that a business needs to manage finances, they should be able to do it on Razorpay in the next couple of years. And we are working dedicatedly towards that.

We’re still very early in our vision to build the full stack financial platform for businesses in India. There’s a lot of work to be done. And, I’m still very excited about building for businesses in India.

Inc42: Are you already in talks with B2B SaaS startups for the acquisitions? If so, is there any timeline pertaining to the closure?

Harshil Mathur: There are a lot of discussions underway, but we are looking at multiple things in B2B SaaS, especially the financial SaaS space. We’re looking at companies who can help businesses manage tax payments, invoices, business reconciliation, reporting, manage fintech pre-sales business, or even lending products on the B2B side. But, acquisitions require matching of vision with the founders, more than the domain. So if the vision matches, and if there’s a strong team, building a very good product, we would love to engage with them.

We are in talks with a lot of startups and companies as well. Lots of these discussions are underway. You should start seeing a couple of announcements in the next six to 12 months.

Inc42: So, is there a shift towards entering the SaaS segment from fintech?

Harshil Mathur: We already do. For instance, we acquired this company called OpFin which helps businesses manage payroll last year (November, 2019), and in the past year, it has grown 10x, it’s a pure SaaS offering. And, it is used by a very large number of businesses already. So, that is one provider for. Similarly, we launched vendor payments last year, which is a pure SaaS product under our banking umbrella, and it has been scaling very well. So under the banking suite of services, we keep adding more and more SaaS tools to help simplify the financial lives of businesses in India.

Inc42: In the last two years, your competition too has evolved, how would you segregate yourself in terms of product offering?

Harshil Mathur: When we launched in India, almost six years back, there were a lot of players in the market. So, competition is something that hasn’t deterred us, we have our own domain and own expertise and we focus on that.

So even when we had just started, a lot of people warned us that this is a very competitive space, but our motto was that we have a plan that we know a segment of customers which is not very well served, and we thought we could build best for them. And, in the last six years, that has gone very well.

And, we continue to build a lot of things for them, not just payments, but banking, lending. And, some of these things we have been the first like our neobanking platform for businesses, nobody else had ever built. So, I think we would continue to focus on that. As a company, our policy is that we focus on what our customers need. And as long as you keep doing that, we don’t need to worry about competition.

Inc42: There is another lockdown. What’s been the learning and impact on work culture at Razorpay?

Harshil Mathur: As a company, we’ll continue to work from home, even before the last lockdown began, and we never opened our offices back. So, for us, remote work has actually been working very fine. And, productivity hasn’t been that deeply impacted. Of course, we would love to come back to office but we have taken a call that we will not open our offices back for employees till the situation is completely back to normal and safe.

As an organisation, I think we have adapted very well to work from home. In fact, both of our last rounds of funding like the October round where we became a unicorn as well as this round happened completely while we were operating remotely. I think this is the new style of working. We have gotten pretty used to it.

And we’ll also see that even when things come back to normal. How can you incorporate learnings from this experience that we have had for almost a year? And how can we incorporate that to ensure the companies become even more productive when things come back to normal?

Inc42: MSMEs have been by far the worst impacted because of the pandemic. What’s been your observation in terms of product offerings for this segment?

Harshil Mathur: There’s no doubt that the pandemic has hit SMEs the most. I think bigger businesses have enough and more ways to manage, but small ones don’t have enough working capital to manage impacts like this. And now as we’re going through the second wave, it’s even worse for a lot of SMEs. I think being an SME-focused company, we are committed to working with SMEs, building a lot of products and services to digitize them. That’s why, a lot of these SMEs are now being able to serve their customers through WhatsApp groups, Instagram channels and other channels, where physical contact is low. In the past year alone, we have worked with 7 lakh plus SMEs through our platform, helping them distance themselves to payments, banking and lending services.

Inc42: You have announced plans to hire 600 people. Where are you gonna deploy them?

Harshil Mathur: Almost 50% of the open positions are in product, engineering and design while the rest of the positions are across remaining business functions. And we’re not just looking at Bengaluru, but we are hiring people in Delhi, Mumbai, Hyderabad, and we are even open to remote hires. Besides that, as we are expanding into international markets in Southeast Asia, some of these positions are also based in Southeast Asian markets.

[The language has been mildly edited for clarity]

The post Harshil Mathur On Razorpay’s Secret To 3X Growth, Acquisition Plans & The SaaS Foray appeared first on Inc42 Media.

0 Comments