Health insurance is critical in nature, but a couple of years ago, it was more of a fringe benefit provided by startups (and other small enterprises) and not a key trigger for recruiting and retention. However, the onslaught of Covid-19 pandemic since 2020, especially this year’s more deadly second surge, makes it a top benefit and most people are likely to choose companies that provide comprehensive health cover for employees and their families.

Health benefits started trending in 2020 as part of a value-added social benefits package offered by companies to attract the blue-collar workforce. But it is now essential to offer this powerful perquisite across the board to ensure better employee welfare, preserve employee morale and thus improve productivity. Besides, a good health insurance coverage often helps startups stand out in the competition for talent and bring down operational costs by reducing sick days and high employee turnover.

As employers are leveraging health benefits to attract and retain people during the ongoing pandemic, it has been a big shot in the arm for the health insurance industry in India. With more and more people needing hospitalisation due to Covid and medical costs continuing to skyrocket, both individuals and enterprises are signing up for private health insurance. So, in 2020, for the first time, health insurance became the most valuable segment for non-life insurers in terms of premiums collected, leapfrogging motor insurance.

According to figures compiled by the General Insurance Council and the Insurance Regulatory and Development Authority of India (IRDAI), the health insurance portfolio grew 11% year on year in FY21 to INR 58,584 Cr, due to the pandemic.

The Spike In Insurance Demand Is Driven By Digital Initiatives

Historically, health premiums have been driven by ‘group policies’ as organisations typically buy umbrella covers for their employees. The pandemic has further accelerated these initiatives, especially during the second wave since March-April this year, as smaller businesses and startups impacted by the health crisis rush to safeguard their employees.

“The situation in 2021 is markedly different as both employers and insurers are witnessing a huge spike in cases and deaths across their own employee base. So, the demand for insurance has grown, but the capacity to service that demand has also been challenged,” says Abhishek Poddar, cofounder of Bengaluru-based Plum, a digital insurance startup focussing on group health insurance for companies.

According to him, the company started witnessing a demand spike in late March when the second wave hit India. Compared to a 30% month-on-month growth that the startup had seen in the number of policies prior to the second wave, it is dealing with a 90% MoM growth since mid-March.

Consequently, the burden of claim settlement has also increased. The second wave has resulted in higher hospitalisation and the need for extended hospital care, says Pradeep Satya, CEO and founder of Bengaluru-based Synergy Strategic Solutions, an insurance-focussed technology service provider. The cost of treatment and medicines, and the associated costs of PPE kits, masks, gloves and post-hospitalisation care have driven up the number of healthcare claims during this period, he adds.

“The rise in health claims is certainly a cause for concern. On average, each Covid claim payout is in the range of INR 1.5-2 Lakh, with a settlement rate of nearly 83%. However, the group health portfolio has seen a modest premium increment of 10% in FY21,” says Satya.

Insurers have also seen a 10% rise in premium defaults in the months of March and April this year, according to industry estimates.

Given the grim nature of the second surge, it is not surprising that the number of claims filed in April 2021 equals around 60% of the total Covid claims in FY21, according to Ensuredit, an insurtech startup from Bengaluru that helps insurers improve customer experience using AI. Considering the lead indicators in Covid claims, insurers expect the number of claims to shoot up in the coming days. “This is perhaps an inflexion point for mainstreaming health insurance in India. Higher loss ratios in group insurance will make all stakeholders in the industry focus more on retail insurance,” says Rohit Sadhu, cofounder and COO of Ensuredit.

The loss ratio is calculated by dividing the total incurred losses by the total insurance premium collected. Soo, the lower the ratio, the more profitable is a company, and vice versa.

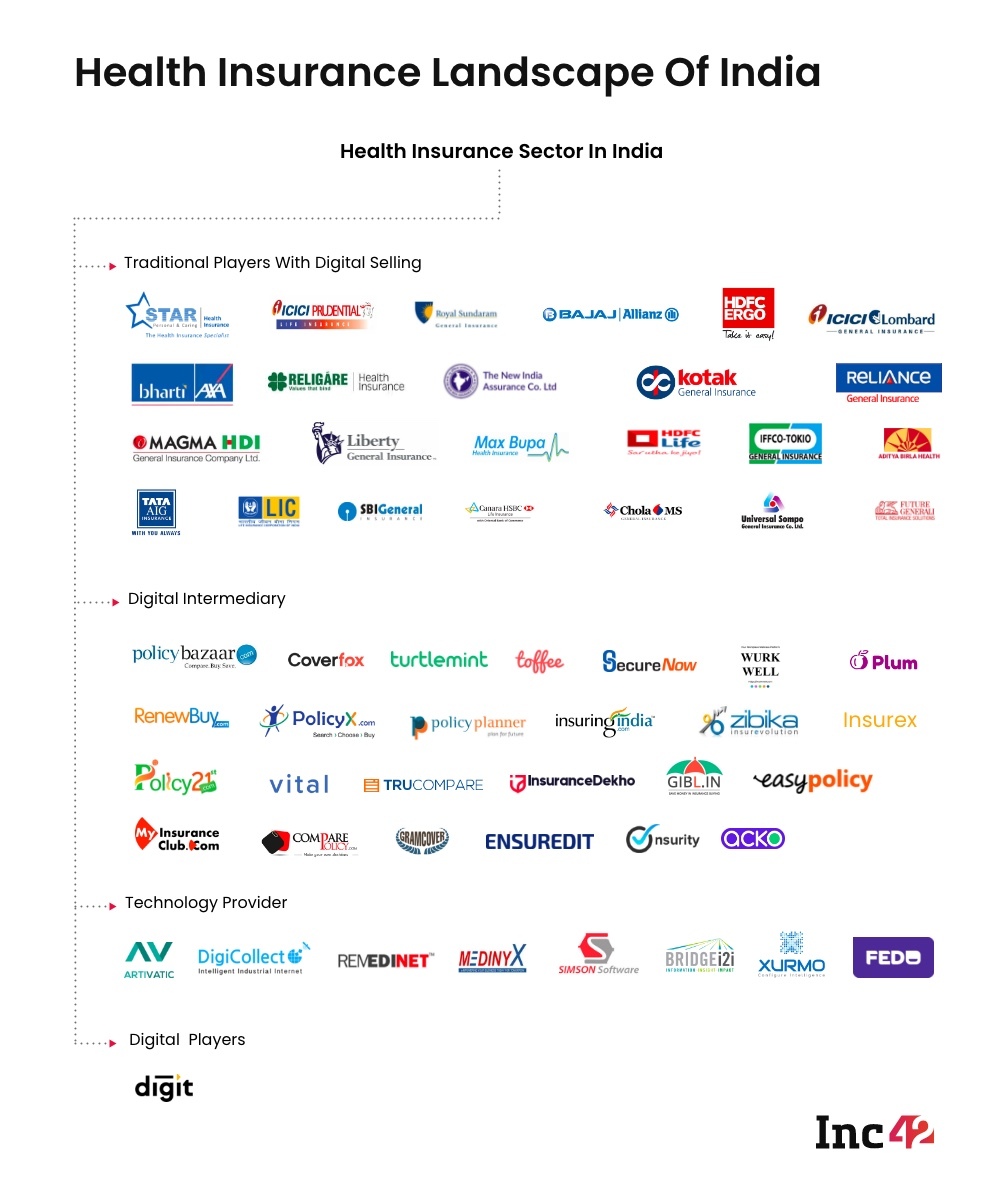

There is another paradigm shift. While traditional insurers have depended on a network of agents to push products and drive sales, pandemic-induced lockdowns and social distancing norms have been the perfect trigger for digital insurance channels.

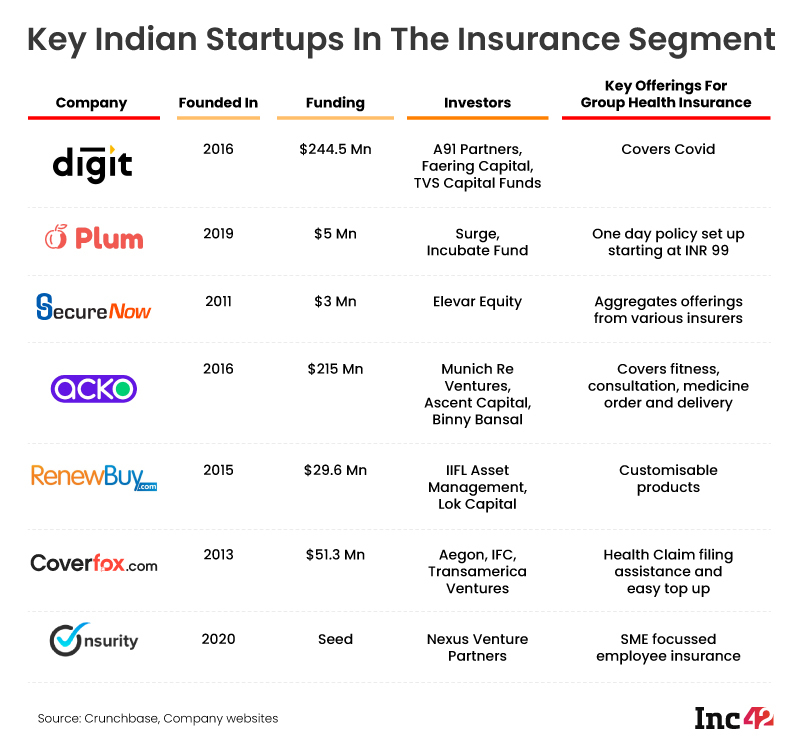

According to S&P Global market intelligence data released this week, at least 335 private insurtechs are operating in the Asia-Pacific region. China and India are collectively home to nearly half of the private insurtech companies in the APAC region. Understandably, these two will continue to corner the lion’s share of investor interest due to their large and fast-growing insurance markets.

Does it mean that digital-first insurtech startups will rule the roost and personnel-intensive traditional businesses will gradually shrink and disappear? It may not be so. Eventually, digital businesses are also run by people who are equally susceptible to the virus. According to various estimates, 25-35% of startup employees have been impacted by the pandemic during the second wave, which means people responsible for underwriting and processing policies and claims are also struggling to cope with their capacity crisis.

A look at some recent data may also help ascertain whether the staff crunch due to Covid is affecting speedy settlements. As of April 28, 2021, 1.1 Mn Covid-19 health claims worth INR 15,568 Cr were filed with insurers (starting from May 2020, across all channels). Of these, 84% or 9,30,729 claims worth INR 8,918.57 Cr had been settled, according to GI Council data shared with the finance ministry. Of course, the delays may have stemmed from the fact that hospital bills have overheads that insurers and hospitals cannot agree upon. But that is a separate story.

How Startups Can Tap Insurtech To Budget For Employee Insurance

Earlier, only mid-to-large companies used to opt for employee health insurance, but the current health crisis is compelling even smaller startups and SMEs to come on board. What’s more, these policies are not limited to permanent employees. Even gig workers working for tech platforms are supposed to get their rightful share of benefits here. At least, that is what most of the leading startups are claiming. The actual story on the ground will unfold as and when such claims are raised.

All insurers which have spoken to Inc42 further underline a product preference sought by most employers. Instead of buying a basic cover with inpatient (IPD) benefits, companies now opt for a higher sum insured, outpatient (OPD) coverage and additional wellness benefits such as mental wellness consultation and physical activity monitoring. In addition, they are increasingly seeking life cover for their employees owing to the fatal nature of the pandemic.

“Life covers are increasingly in demand, and companies are ready to pay extra for Covid coverage. Plus, there is demand for identifying comorbidities for better risk management and product customisation,” says Prasanth Madavana, cofounder and CEO of Fedo, a Bengaluru-based insurtech startup that helps automate underwriting in the health and life insurance space.

But how will early-stage startups and small businesses with small budgets plan insurance for their employees?

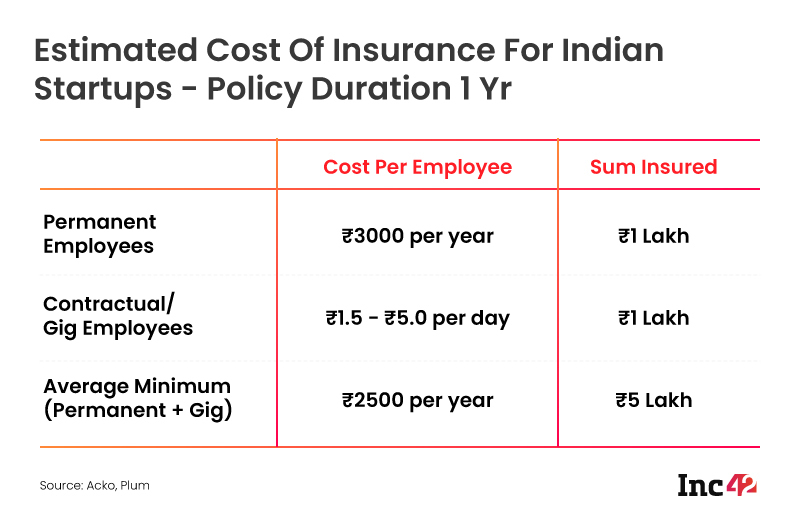

Generally speaking, a good IPD cover costs a company around INR 3,000 per employee for an annual policy with INR 1 lakh sum insured, says Biresh Giri, executive vice-president, actuary and underwriting, at Acko General Insurance. A comprehensive health policy covering other benefits like the OPD can cost up to INR 5,000 per employee for the same sum insured for a year. However, the per-employee premium also depends on various factors such as the sum insured, benefits, dependents covered in a policy and more. It can go up to INR 20,000 per employee with INR 5 Lakh sum insured that covers the employee and their parents.

“Insurance for gig employment differs a bit as the use cases may depend on a worker’s tenure, active period and the nature of the service, among other factors,” says Giri.

Companies on a tight budget can even find daily plans ranging from INR 1.5-5 per employee based on the sum insured, benefits and specific requirements.

On average, the cost may reach INR 2,500 per employee or gig worker per year (about INR 200 per month). So, a company employing up to 200 people will have to spend INR 5 Lakh, says Poddar of Plum. “Even if one or two employees use the insurance, the company will recover the cost,” he adds.

Miles To Go Beyond Startup Insurance

In recent months, IRDAI introduced several measures to open up the insurance ecosystem for better products. Again, in March 2021, Rajya Sabha approved a Bill to increase the foreign direct investment (FDI) limit to 74% from the current 49%. According to the Bill, the majority of directors on the board of an insurance company and the key management persons will be resident Indians. Moreover, at least 50% of the directors will be independent directors, and a specified percentage of profits will be retained as a general reserve. These initiatives are expected to bring more new-age insurers into the ecosystem and help build better underwriting technology.

In April this year, IRDAI submitted a report in which it made recommendations related to retail insurance products and also underlined certain standard covers to meet the needs of retail customers. The report says that better clarity of coverage and terms and conditions in the policy document will help in “realigning the industry to meet customer expectations better and vice versa”. The recommendations suggest relying on better data-driven insights and improving the language of policy documents to help buyers make informed decisions.

For instance, industry experts think that micro-insurance is one area where insurance companies have razor-thin margins. Hence, the reliability of the data and its correct interpretation will help improve consumer trust in insurance products. Overhauling traditional insurers to adopt more digital channels and data-driven approaches is essential in a country where insurance penetration is abysmally low at 3.7%, according to the latest Economic Survey.

That brings us back to the overall state of things in the insurance sector. Right now, businesses are pushing insurance adoption numbers to an unprecedented level due to the pandemic. But this does not essentially indicate a rise in overall demand or better awareness and penetration. In essence, the sector has miles to go to keep pace with more mature economies.

Most of the insurtech players with whom Inc42 has spoken also say that the adoption of companywide insurance products is yet to come from smaller towns and SMEs. While the businesses in Tier 3 and Tier 4 markets have a strong network of informal channels to support employees, such informal support is not on a par with formal insurance and its many benefits which are instantly available via digital tools during lockdowns. Indian insurtech startups can definitely play a key role here.

The post Can Insurtech Sustain The Demand Rush For Employee Health Covers? appeared first on Inc42 Media.

0 Comments