The nation’s gradual recovery from Covid-19 second wave in June had a positive impact on the unified payments interface (UPI) ecosystem which reported a month on month 10% spike in transaction volumes and 11.5% spike in value of transactions.

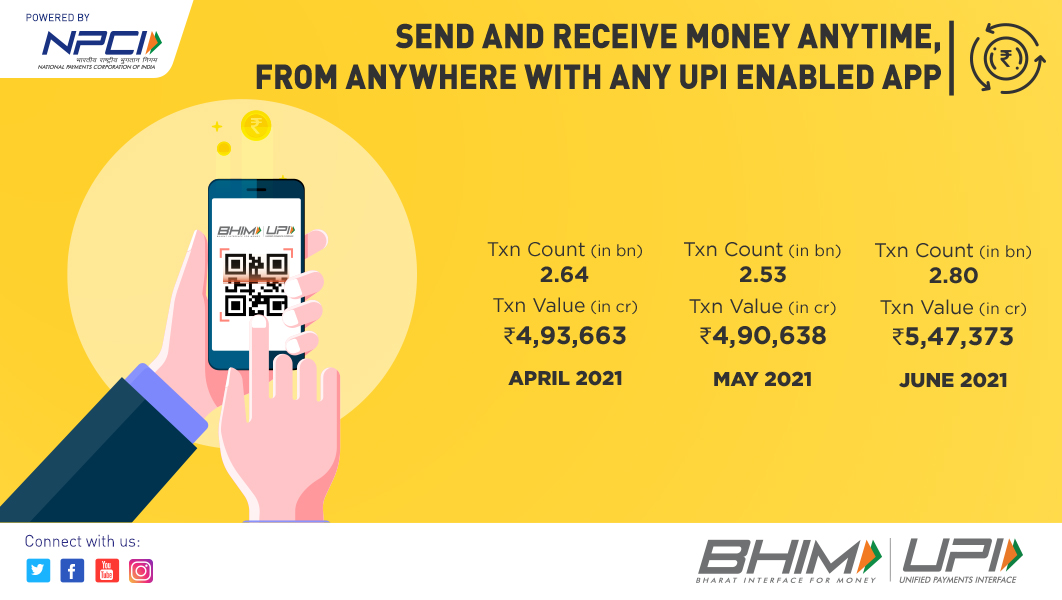

During June, the National payments Corporation of India (NPCI) clocked a record 2.8 Bn transactions, up 10% month on month. It also reported transactions worth INR 5.47 Bn. The previous best performance, since inception, was in March 2021.

To be fair, the lockdowns imposed during the second wave (April onwards) severely impacted payments. During May, NPCI reported 2.53 Bn UPI transactions, down 4% month on month compared to 2.64 Bn transactions in April. Value of transactions also registered a marginal decline to INR 4.90 Lakh Cr (down 0.6% month on month) compared to INR 4.93 Lakh Cr in April. In March 2021, UPI had reported its best ever figures with 2.73 Bn transactions amounting to INR 5.04 Lakh Cr.

Although UPI transactions recorded a jump in March as the economy recovered from the impact of the pandemic in 2020, the staggered lockdowns introduced across states starting April 14 impacted consumer behaviour again.

Launched in 2016, UPI transactions volume saw the first massive dip in April 2020, after falling below the 1 Bn mark to 990 Mn, while the value of transactions dropped to INR 1.51 Lakh Cr. This fall was in the wake of the Covid-induced lockdown and restrictions that shut down all major services including traveling, dining out, ecommerce and offline transactions.

UPI transactions started recovering soon after May 2020, and crossed the 2 Bn transaction mark in October 2020, but the story had been all about decreasing growth numbers since then.

While app-wise data for June UPI usage is yet to be released, in May Walmart-backed PhonePe increased its share of customer transactions (by value) marginally month on month. PhonePe controlled 47.73% of market share in the country. PhonePe processed customer transactions worth INR 2.34 Lakh Cr during the month.

Google Pay processed customer transactions worth INR 1.87 Lakh Cr while Paytm processed transactions worth INR 0.3 Lakh Cr.

The remaining platforms to report the highest transaction volumes compared to the rest of the ecosystem include BHIM (1.38%), CRED (1.25%), Yes Bank (0.91%) and Amazon Pay (0.98%).

The post As Economy Begins To Normalise, UPI Transactions Grow 10% In June appeared first on Inc42 Media.

0 Comments