As the second wave of the Covid-19 pandemic eases up, we will progress towards a post-pandemic world, and the adoption of digital technology and solutions by businesses and consumers will soon reach its peak. Technology will also create new growth avenues, which can be easily inferred from the surge in venture capital investments into Indian tech startups in 2021.

The end of June also marked the end of the first half of the calendar year (CY) 2021, when investor confidence in Indian startups was at an all-time high. According to Inc42 Plus data, between January and June, 2021, the total capital inflow in Indian startups stood at $10.8 Bn across 614 funding deals. More importantly, both half-yearly funding and deal count were at their historical peak. Compared to the year-ago period (H1 2020), total funding amount in H1 2021 surged 2.1x, while it recorded a 72% increase compared to H2 2020.

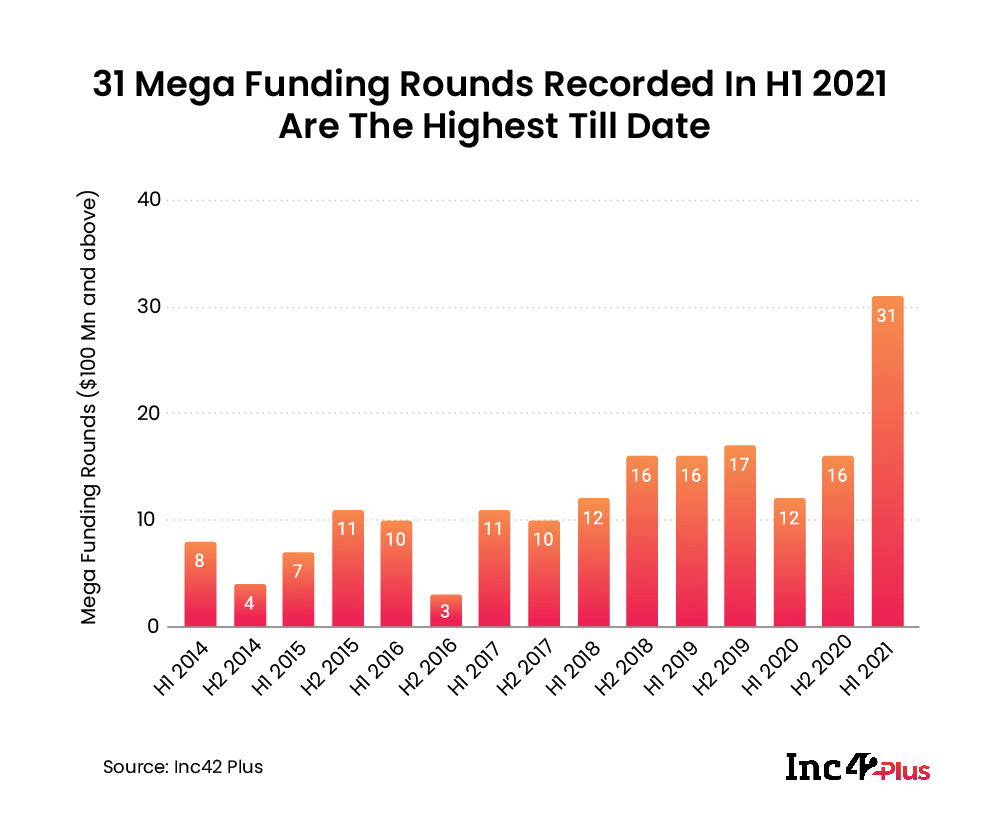

Interestingly, fintech, enterprise tech and edtech startups in India have spearheaded the funding bull run in 2021. The three-sector combine accounted for 48% or 15 out of the total 31 mega funding deals (funding rounds of $100 Mn or above) recorded in the first half of 2021. In addition, media and entertainment (fuelled by gaming and social media), ecommerce (driven by D2C consumer brands) and healthtech (led by the growing adoption of telemedicine and e-pharmacy) are also gaining significant investor traction.

In the latest release from Inc42 Plus — Indian Tech Startup Funding Report, H1 2021 — we have highlighted more metrics, affirming that CY2021 is going to be the best year in terms of capital inflow into the Indian startup ecosystem.

Bull Run In Startup Funding May Drive 2021 Capital Inflow To Record High

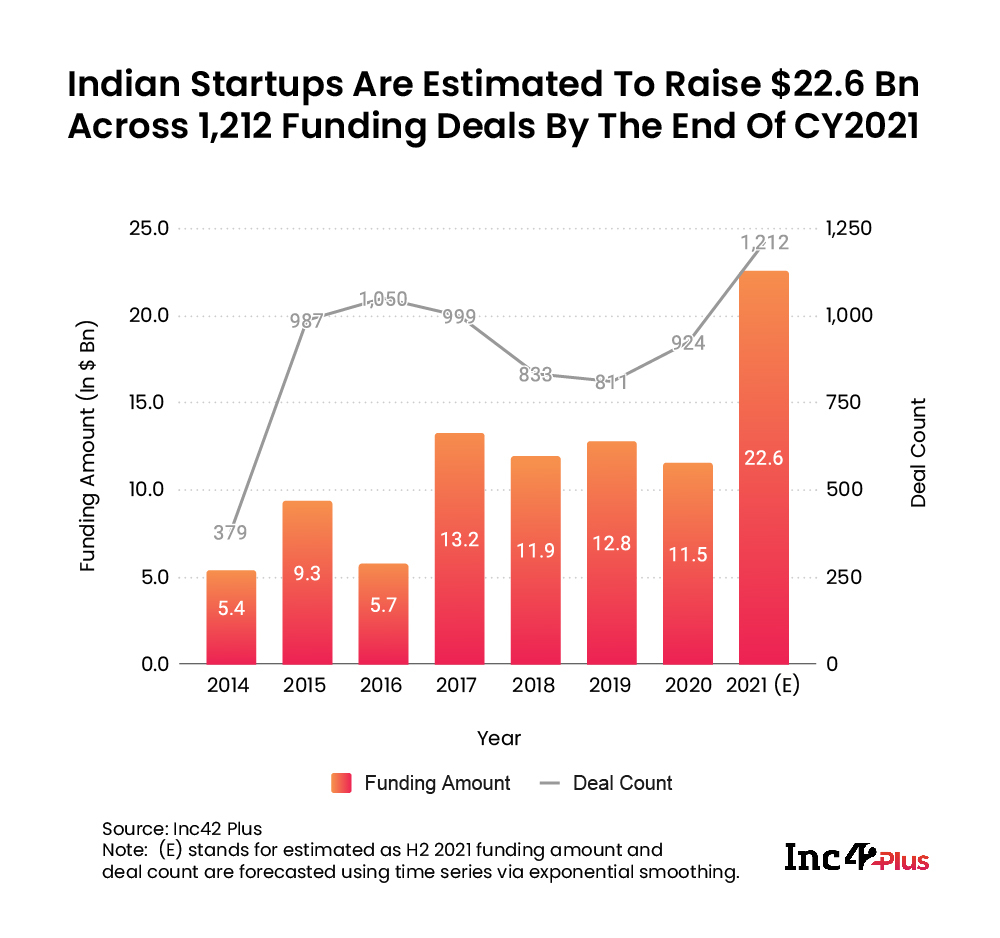

According to a time series forecasting based on quarterly time stamps, total capital inflow in Indian startups is likely to range between $19 Bn and $23 Bn, estimated under usual and optimistic scenarios, respectively. Similarly, we estimate the deal count to be in the range of 1,152-1,212.

Irrespective of both usual and optimistic scenarios, there is a strong probability that the Indian startup ecosystem will witness a record high venture capital inflow by the end of the calendar year 2021.

Fintech, enterprise tech and edtech startups will continue to attract mega funding rounds in the second half of the calendar year 2021, along with healthtech, ecommerce and media and entertainment. The primary reason for an estimated funding surge is that these sectors have a substantial number of growth stage startups that are looking for transitional capital to enter the late stage. Between 2018 and H1 2021, the total number of growth stage startups across these six sectors stood at 70% (483 out of 691). Out of these six, fintech had the highest number of growth stage (Series A and B) startups in the given period.

Mega Funding Rounds At Historical Peak In H1 2021

Besides total funding amount and deal count, another important macro indicator underlining overall investor sentiment towards the Indian startup ecosystem is the number of mega funding rounds, where mega funding rounds equals $100 and above in total deal size.

Compared to H1 2020, the total number of mega funding rounds in H1 2021 surged 2.5x, from 12 to 31, indicating a relatively bullish start to the current calendar year as against 2020.

To get more insights into startup investments in H1 2021, download our latest release Indian Tech Startup Funding Report, H1 2021.

The post Indian Startups Are Estimated To Raise $22.6 Bn In 2021, The Highest Annual Venture Capital Inflow Till Date appeared first on Inc42 Media.

0 Comments