Dear Reader,

How do you make payments for crypto investments?

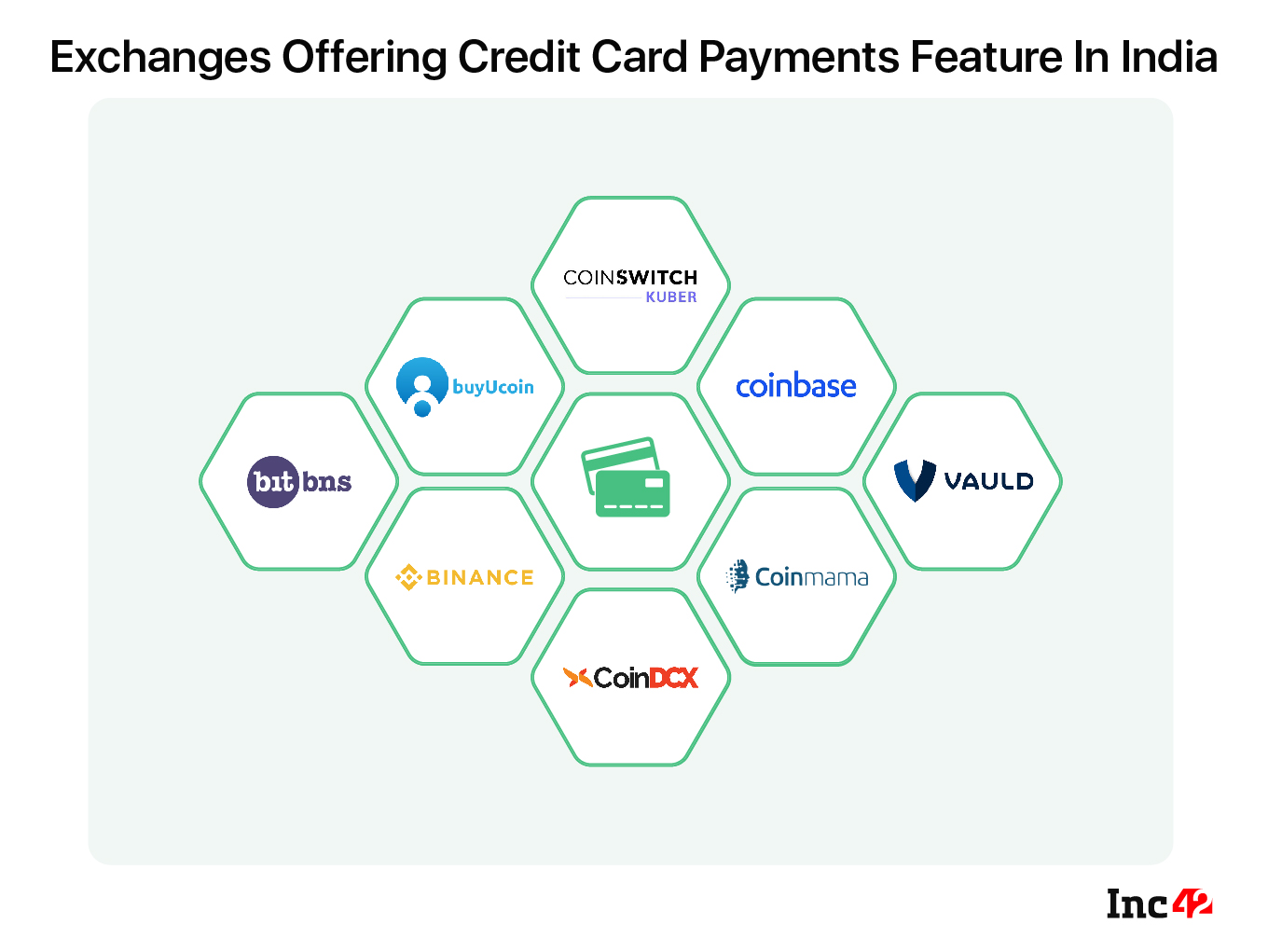

Of course, there are easy and popular ways, including IMPS, NEFT, RTGS and UPI. And in recent months, many exchanges have enabled credit card transactions for crypto trading.

This takes us back to the fundamental question: Do we perceive crypto as digital/virtual currencies or assets to be purchased like any other?

Assets, of course, one would say. In fact, most people think of it as a new asset class with great returns in store. However, the Securities and Exchange Board of India (SEBI), the capital market regulator in the country, has strictly banned the use of credit cards for all sorts of investments. The reason: It is advised that investments should not be made out of liabilities but from the surplus money that one may have. As short-term debts offered by credit cards fall under liabilities, these should not be used for investment or trading purposes.

Given this scenario, are credit card payments allowed to buy crypto?

According to Sharat Chandra, a Bengaluru-based blockchain and emerging tech evangelist, credit card transactions can be allowed for small-ticket crypto transactions. Legal experts are not opposed to it either. N.S. Nappinai, a Supreme Court advocate and founder of Mumbai-based nonprofit organisation (NPO) Cyber Saathi that focuses on increasing awareness cyber crimes and its remedies, says, “As the Supreme Court has struck down the RBI circular that restricted banks and payment systems from facilitating crypto transactions, there is no impediment to using credit cards for crypto-related payments. However, any investor would be well advised to exercise caution in such cases.”

With crypto being an unregulated asset class so far, neither SEBI nor the RBI can mandate the payment mode for crypto trading.

Raj Dhamodharan, executive vice-president, blockchain and digital asset products & digital partnerships at Mastercard, said earlier this year, “We are seeing this fact play out on the Mastercard network, with people using cards to buy crypto assets, especially during Bitcoin’s recent surge in value. We are also seeing users increasingly take advantage of crypto cards to access these assets and convert them to traditional currencies for spending.”

However, some crypto exchanges such as WazirX and Unocoin have no provision for credit card payment. Sathvik Vishwanath, cofounder and CEO of Bengaluru-based Unocoin, says, “Credit card transaction fees are approximately 2%. Hence, a credit card is certainly not a good instrument to invest in crypto, given the risk and the volatility. One of the major reasons why some crypto trading platforms allow credit card transactions is that they have been facing issues while accessing their bank accounts.”

As of now, credit card payments may not be illegal for crypto trading. But is it legitimate to promote credit cards as a payment instrument for crypto transactions?

Shashi Jha, head of compliance and legal at WazirX, elaborates the rationale. “We do not support credit card payment on our platform mainly because at this stage of crypto adoption, we encourage people to use their surplus funds for safe trading.”

With more than 15 Mn users currently trading/investing in crypto, is it not the right time for SEBI, the RBI, and most importantly, the finance ministry to clear the air?

Tweet Of The Week

Two tweets by Elon Musk, and, Dogecoin registered a 7% rise.

For Binge Reading

For Binge Reading

Is Buying Expired Domains A Good Idea?: Handshake.org, a decentralised open naming platform secured by a decentralised peer-to-peer network, has reserved the domains of the top 100,000 websites to prevent squatters from buying and reselling them. Although real owners of these websites can claim them without paying and get many handshake tokens for free, domains do expire. The Netherlands-based serial entrepreneur Marc Köhlbrugge has decoded how one wallet claimed almost 150 such websites to make $15,000 in claimed tokens. It is a story told in a series of tweets. Read it here.

Investors’ Perspective On Bitcoin Taproot Upgrade: In June this year, bitcoin miners signalled support for Taproot, a bundle of three upgrades to improve network security, privacy and scalability. In a recent report, the Coindesk team delves into the merits and potential drawbacks of these upgrades. Read their findings here.

Crypto This Week | News Doing The Rounds

Cabinet Note Is Ready: FM Nirmala Sitharaman

In a recent interview, finance minister Nirmala Sitharaman said that much of the regulatory work regarding crypto had already been done. “We have done a lot of work on it. We have taken stakeholders’ inputs. The Cabinet Note is ready. We have to see when the Cabinet can take it up and consider it so that we can move it,” she said.

“From our side, I think one or two indications I have given is that, at least for fintech, experiment and pilot projects, a window will be available. The Cabinet will have to take a decision,” she clarified.

Govt May Bring Foreign Crypto Exchanges Under GST Radar

The department of indirect taxes is considering taxing foreign entities catering to the Indian market. According to reports, the Indian government may categorise foreign exchanges as online information database access and retrieval (OIDAR) services and ask them to pay 18% GST accordingly.

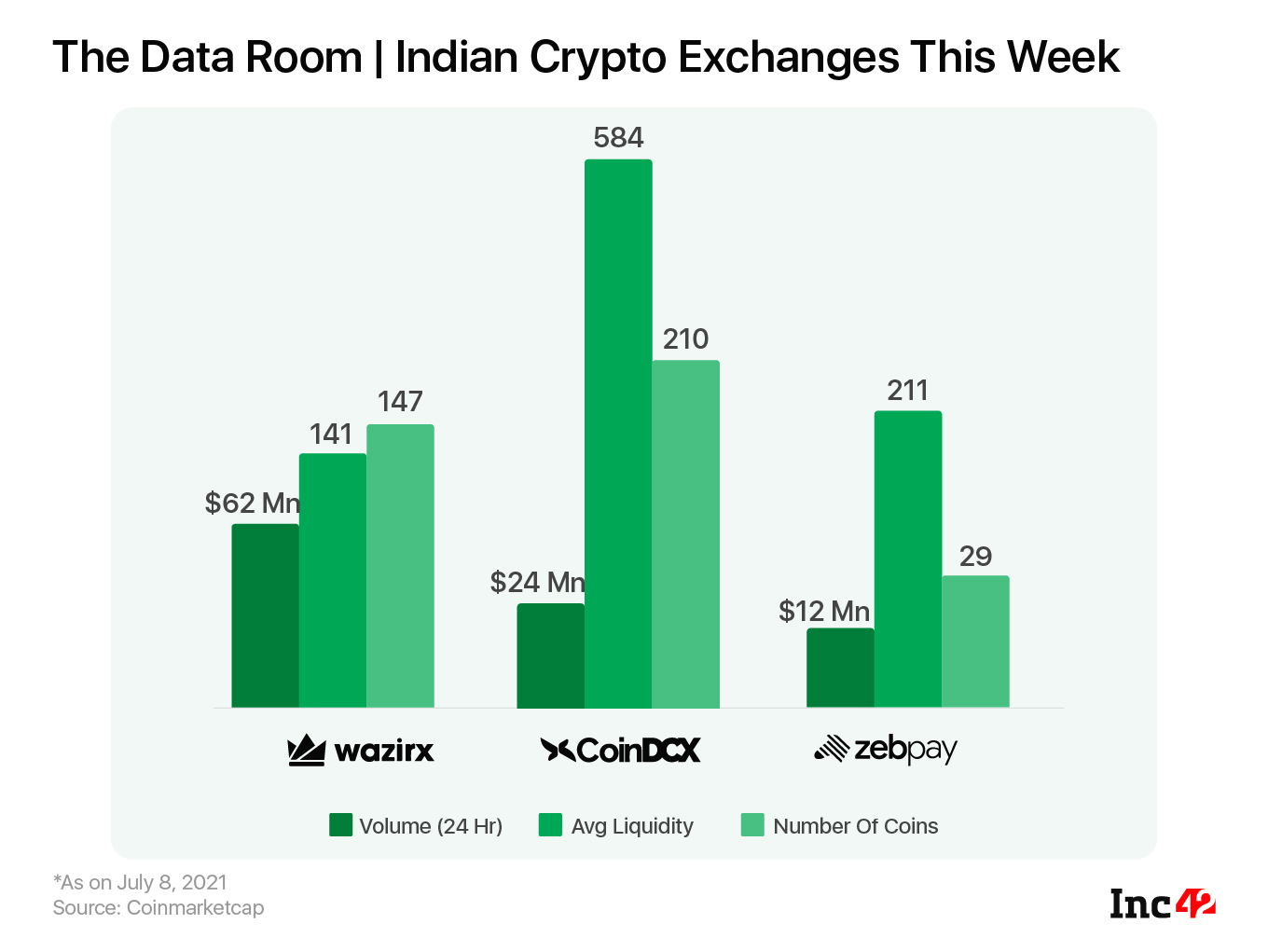

ZebPay Enables Returns On Users’ Crypto

Ahmedabad-based cryptocurrency exchange ZebPay has launched ZebPay Earn, a feature enabling its users to earn returns on the crypto in their spot and trading wallets. Earnings will be calculated every day based on the daily eligible balance. The earnings cycle spans a month, and monthly earnings will be credited by the 7th of the following month.

Thailand Files A Criminal Complaint Against Binance

Thailand’s financial regulator filed a criminal complaint against top global crypto exchange Binance for operating digital assets in the country without a licence. Earlier, the U.K. authorities banned the exchange from operating in the country. British multinational bank Barclays has told its customers that they have been blocked from sending their funds to Binance in order to “keep their money safe”.

Binance’s troubles have piled up in recent years, and the giant crypto exchange has been facing regulatory issues in many countries. Besides the UK and Thailand, India, Canada and Japan have accused it of violating local norms, while the US and Singapore are likely to probe it soon amid global scrutiny. In India, WazirX, a subsidiary of Binance, has been served a show-cause notice by the Enforcement Directorate.

Does this ring the bell for other exchanges, too, to comply with local authorities without any delay? Crypto has a dark history, and the stakeholders today cannot afford to go wrong if it has to enter mainstream operations.

Until next,

Suprita Anupam

The post India’s Crypto Economy | Crypto And Credit Card: A Mismatch Made In India appeared first on Inc42 Media.

0 Comments