I’m not trying to repeat the subject, yet we have indeed been asking this same question for countless years of building ventures across sectors, solutions and stages, only to realise that with each time the real question is – For you, what comes after product-market fit?

Before we go any deeper, let’s all be on the same page to this question – To attain product-market fit (PMF), what comes first?

Did you say market? Because that’s what I believe too. The market dictates PMF, yet the product is a key component and a close second place in this hierarchy.

While there are several of you who would believe the product comes before the market, once they both match, we need to establish the same answer, ‘What Next?’

So, in the next 5 minutes, let’s go on a journey into a post PMF world.

Product-Market Fit – Check! But…What Next?

We first need to restore order. Before confirming you have reached your product-market fit, you need to know what need you’re solving for or is it a want that you have created a demand for. In case it’s a need, well, the element of creating a habit is easier for you because it’s all about catering to the correct communication, and distribution.

For a want, you need to focus on the element of creating urgency for your product or the curiosity to establish some sort of usage, to get first movers locked in.

Ask yourself, is your product ‘water’ (a need) or ‘soda’ (a want). Other comparisons in our lives of a need and a want are medicines for a persistent ailment versus the launch of a new phone. While the medicine needs to communicate trust and awareness of efficacy, the mobile brand needs to draw you into a group of users through features or the best marketing (not always effective for retention) to create the fear of missing out. OnePlus has famously captured the want based audience with some of these mentioned hacks, and many more to establish their presence in what was a difficult market at one time and is now space where they are used as examples of ‘want-based’ success.

Before jumping into the next stage post-PMF, establish what your PMF has taught you about some of the following* –

- Are you a want or a need?

- Cost of Customer Acquisition.

- Stabilisation of Costs to Service/Produce.

- Distribution Channels that work versus those that don’t work (and reasons for them not to work)

*The list is almost endless, but these four parameters will act as pillars to repeatedly grow.

A Post Product-Market Fit World Has Rules To It

Be a detective: Know what is working, by:

Speaking to your first 50* customers:

Data to gather and analyse from these conversations with your customers:

1. Did they trust you because of your product formulation or due to your service being unique? Is it because of your price or they haven’t researched enough about your market and competitors?

Each question needs to help you arrive at a separate data set that either helps you identify costs within your company that are not justified or revenue realisation through assessing your customers’ stickiness and with that, their lifetime value.

2. Inspect if your consumer will miss your product or service and whether this proportion is a majority of the consumer set.

If most of your survey indicates your customers will not miss you, you need to probe why and then distinguish, if this is a factor of a poor product/service or a small market and at times a market that is not ready.

For instance, if we study the example of all the ‘Thrasio models’ out in India, would these have been as relevant as they are today, had they emerged in India a few years ago?

Therefore, it’s important to assess the scope of the market, before understanding how far it can really go in comparison to what you believe it will grow to. Simply put, assumptions placed need to align with the market (not perceived but the actual market).

3. Who you are to you and who you are to your customer needs to be in alignment with each other. It’s best to analyse what your customer defines you in order to know how you’re really perceived, and where you should go from there is a direct correlation to the core values, they reap from you.

For example, if you sell tea, while that makes you an FMCG brand, how you are consumed, be it for weight loss/management or as a casual beverage, determines your distribution channels and your communication.

*Why stop only at speaking to 50 customers? Keep the number as high as you can maintain the feedback data and ensure the customer feedback loop has a recurring trend to it. This could be after a new product/service launch or after each successful/unsuccessful quarter or (and this is my personal favourite) reaching out to a set of customers you see a drop-off from, because if there’s one thing you know about them is that they gave your brand a chance once and converting them through improvement at your end will seal the deal towards retention.

Identifying who didn’t retain and where they are now

This can help by understanding the competitors your consumers have left you for and compare this with the reason why your existing customers stayed on.

Conducting this analysis of what your competitor does correctly will help you establish what it is you want to improve on. It’s not about doing it all, or doing it their way, as much as it is analysing what your product/service/brand stands for.

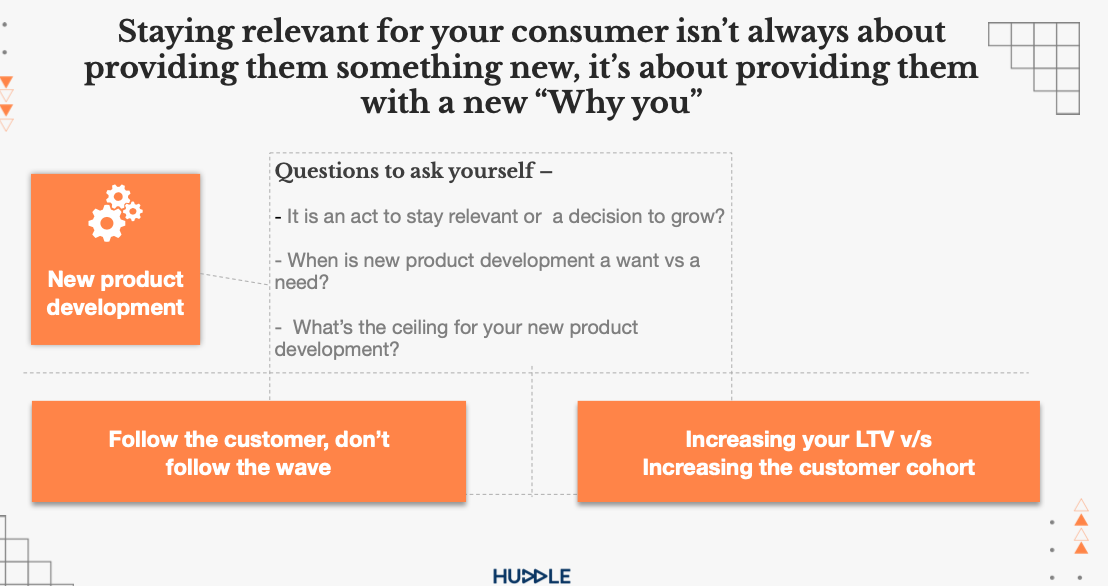

Brand positioning vs new product development?

Aim for explosive growth before diversifying.

This ties into the next point but before, start to assess questions like those below –

- Can you change your product pricing?

- Do you need to add more layers of experience for your customers to resonate with your product?

- Are you equipped enough as a team to add more and newer products and if so, will you be able to service the consumer as well?

1 repeat customer is always better than 2 unique customers

What we need to focus on is, how to become a part of your customers’ daily habits. Hacks we’ve seen work are, educating your user on how they can consume your product with uttermost efficiency. There’s a reason content is so key to customer experience.

Gamify the process…who doesn’t like games? Make your customers realise they are getting better through your offerings. Create tools that help them track their progress before, and after having become your consumer. Data doesn’t lie and showcasing data in simplified forms of how your consumer has improved since being a part of your user base is the best way to earn their trust.

New Product Development (NPD)

It’s important to assess, is your market large enough in the moment or for the long run?

Versus

Assessing whether your product is marketed by a requirement that is temporary?

This will help answer, is your new product development:

- An act of relevance to your customers’ current consumption pattern vs a decision to grow your customer base to a new user cohort.

Note – PMF is not only about the product and market coming together. It’s about knowing the cost to generate revenue. Repeat to yourself – ‘It’s not only about finding PMF, but also about optimising the path to repeated PMF.’

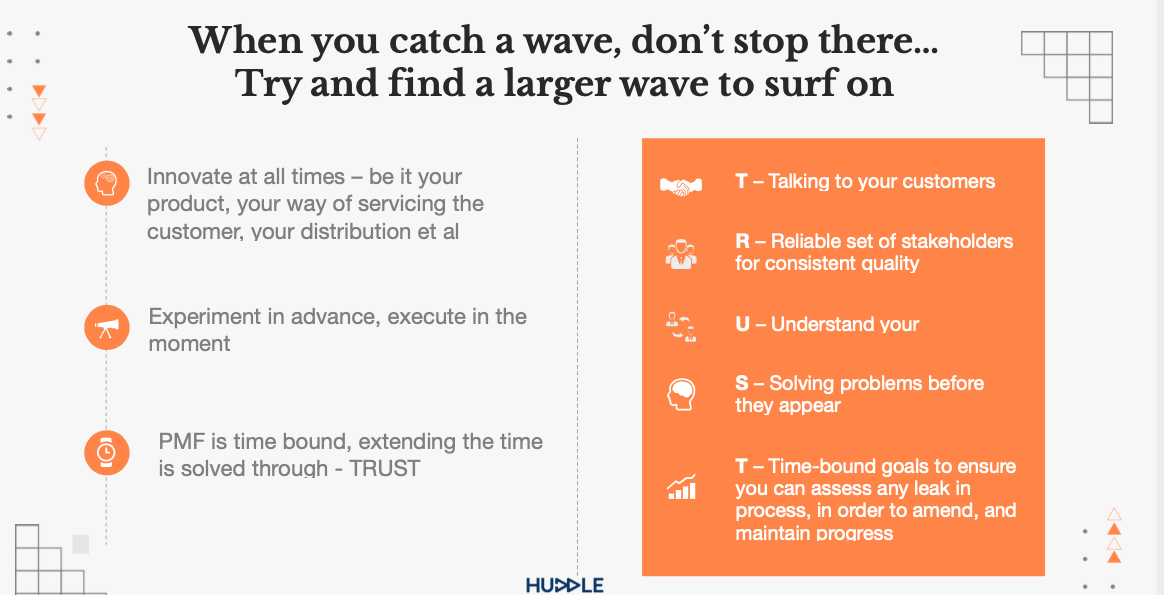

“When you catch a wave, don’t stop there…try and find a larger wave to surf on”

This doesn’t mean you have to scale into many products. The scale doesn’t always imply new products as much as it indicates optimisation.

So, let me elaborate on what I suggest you don’t do right after meeting your product-market fit and that is –

- Hiring too soon – just because you’ve found your PMF.

- Scaling too soon is a common mistake after finding your PMF. PMF is a bit like making the perfect shape of the product through wet clay. It’ll take a while for the clay to set before you can make more of the same pots. Wait it out before you scale.

- PMF takes time to set in – starting to build a large team too soon is not ideal until your current team is on the same page. Wait for everyone in your team to recognise why the PMF worked and create your internal playbook that’ll help the new team hires to learn from these templates.

- You need to focus on championing one product before you take responsibility for scaling to another.

Innovate At All Times

. . be it your product, your way of servicing a customer, your distribution, the list goes on….

The maturity of a product comes from the market. The market which is the customer dictates innovation. Innovation should take place internally, as a team in order to stay ahead of the curve of the sector you’re in.

Again, I point towards market research. You’ve got to create your next product or service as part of the upstream or downstream ecosystem of the consumer. This only helps reinstate a habit being created.

Experiment In Advance, Execute In The Moment

The importance of small customer cohorts for next in line strategies like pricing, demographic switch, etc. is important and stay close to your first set of customers for this research. They know you better than you might know yourself. To assess if PMF is not working and when you need to establish it again, assess the following two factors –

- Has the cost of acquisition increased? And has the word of mouth reduced?

Any venture that sells well, at scale has the best sales team — their customers. The moment your referral rate reduces, your customers reason or ‘why’ to pick you, has reduced.

Product-Market Fit, And Its Optimisation Is Solved Through TRUST

T – Talking to your customers

The market is like a casino, if your product is not timed well or distributed in the correct manner like the casino always wins, the market will win too.

To create for customers, look at the market fit and see how your customer is being serviced. Once you solve the pain point, you need to be ready for the next product.

R – Reliable set of stakeholders for consistent quality

Partner with stakeholders for your production, delivery, serviceability, everything, and anything that constitutes your stakeholders from a long-term point of view.

U – Understanding your competitors

Facing competition isn’t about doing what they do better, it’s about establishing your value proposition, which at an early stage is either created through providing content to create awareness or distribution through innovative means.

S – Solving problems before they appear

A startup needs to be flexible. Pivots are good as it doesn’t only showcase your ability as a team to adjust to adversity and recognise what is not right for the company but also showcases the versatility of your product to be able to evolve and adapt to the market.

T – Tight-knit goals to ensure constant reinforcement and growth

Large feats are met by the constant conquering of small goals. Assign time-bound call to actions that can be evaluated through each growth curve to identify what is working well to replicate the process and in case it’s not, identify mistakes early in order to ensure effective pivots to accelerate.

Product-market fit is the start, not the end goal. It’s not a one-time task, but a way of life for ventures to build, be relevant and lead.

The post What Comes After Product-Market Fit? appeared first on Inc42 Media.

0 Comments