In a fast-evolving, tech-driven world, cryptocurrencies have made waves and passed through several hype cycles to reach the kind of value that no traditional asset class can ever expect to achieve. That does not mean investors are not subjected to extreme volatility and wild price swings. But overall, the prices of Bitcoin, Ethereum and many other digital coins are rising in spite of rough patches, doing away with the reservations that initially plagued crypto investments in India.

As the global user base of cryptocurrencies and crypto-assets surpassed 200 Mn, India also saw a jump in crypto adopters. Currently, active crypto users in the country are around 15 Mn with more than $1.5 Bn in digital assets. The number of blockchain startups has risen to 300+ in 2021, while the daily crypto trading volume stands at $350-$500 Mn.

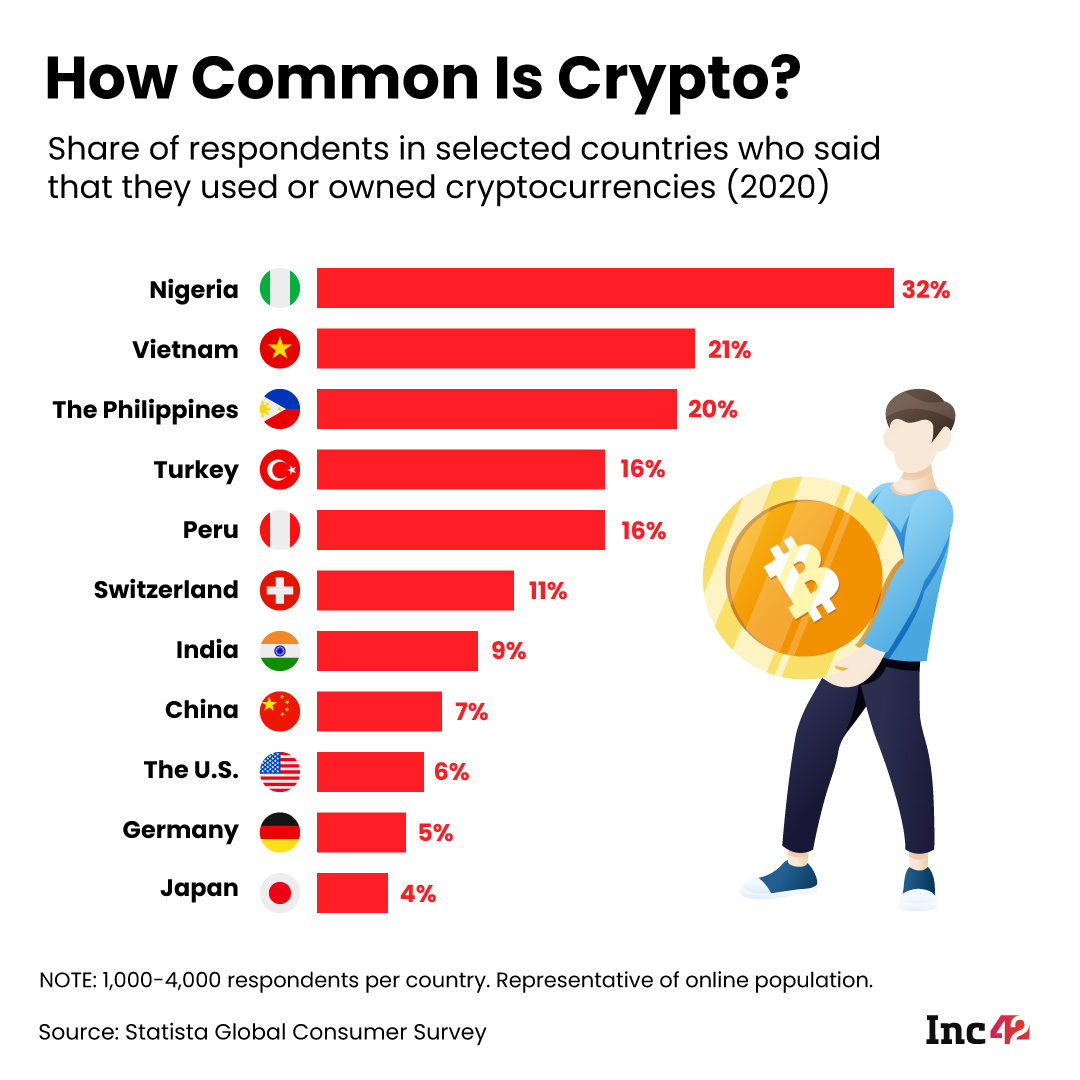

According to a Statista Global Consumer Survey in 2020, around 9% of the respondents from India said that they used or owned cryptocurrencies. Globally, India ranked higher than China, the US, Germany and Japan in crypto adoption, while Nigeria, Vietnam and the Philippines topped the survey list.

Despite the recent growth, several regulatory hurdles in India have hindered large-scale investments in these virtual assets. Talks are rife regarding regulatory scrutiny, but there has been no clear framework in place to implement the same. For instance, it was reported in May 2021 that the Indian government might form a new panel of experts for creating a regulatory road map involving crypto and blockchain usage. Also, the finance ministry is reportedly monitoring people’s growing interest in crypto and the rising crypto trading activities while gauging supervisory options. But the path has not been defined yet either by the government or other regulatory bodies.

Due to such regulatory uncertainty, top crypto exchanges are now joining IndiaTech, an industry association representing the country’s consumer internet startups, unicorns and investors, to increase pressure on the government to regulate crypto in India.

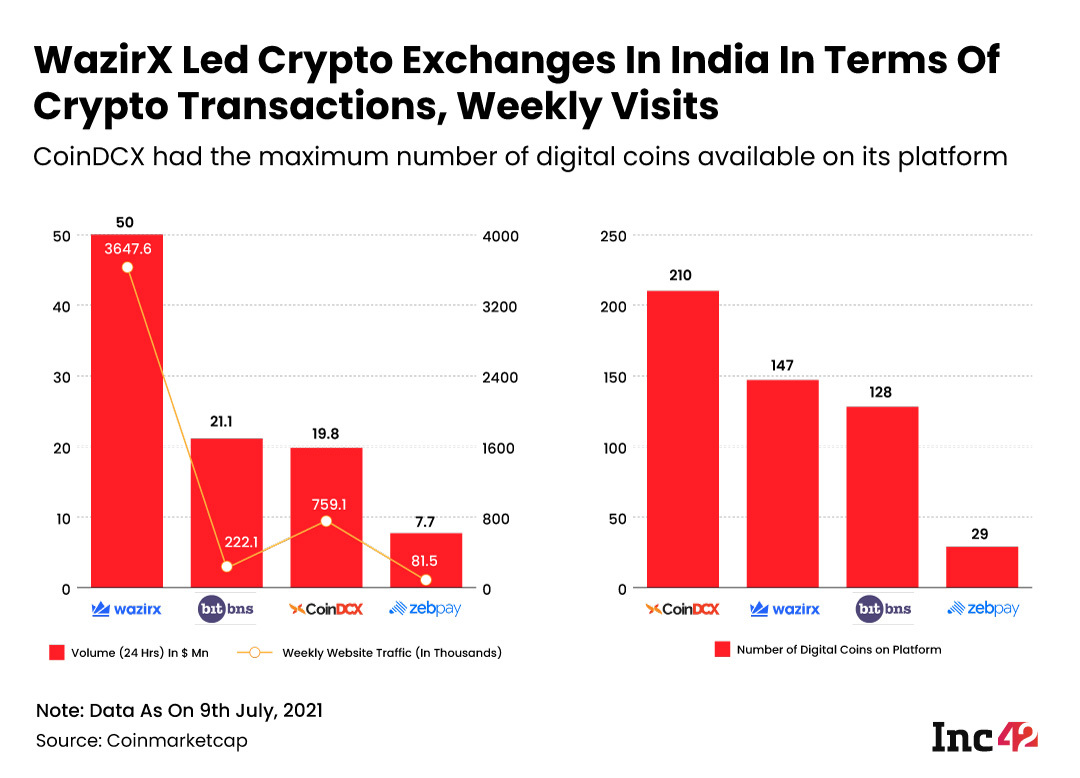

WazirX Vs CoinDCX Vs ZebPay: Who Is Leading?

Several crypto exchange startups in India are gaining traction due to the growing appetite for underinvested crypto assets ranging from the most popular Bitcoin and Ethereum to not-so-familiar tokens like dogecoin, ripple, litecoin and more.

How Crypto Exchange Apps Stack Up

Inc42 partnered with AppTweak to understand how various crypto exchange apps have performed in the past few months in terms of downloads, views, app power and more. Here are a few takeaways:

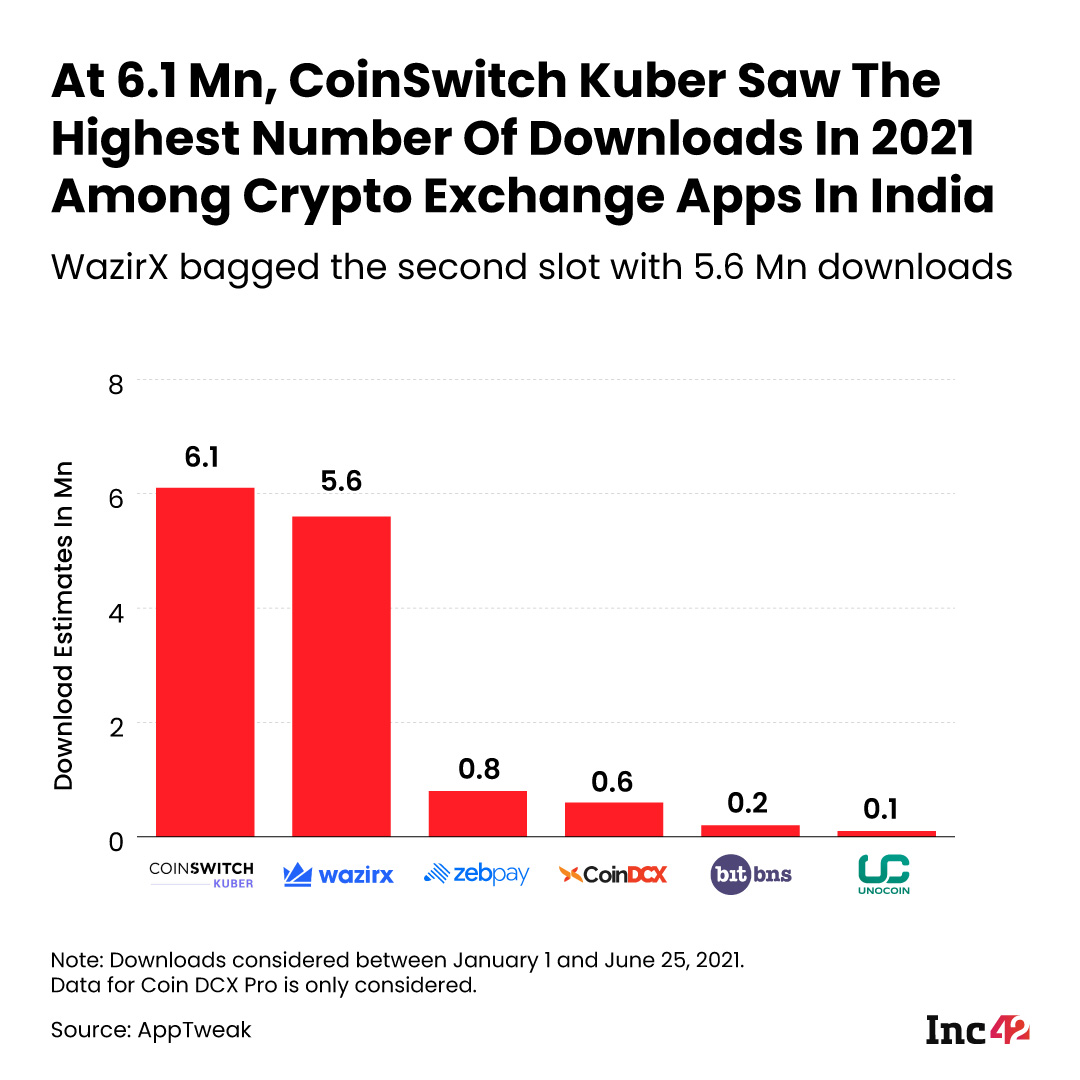

CoinSwitch Kuber Is The Rising Star Of Crypto Apps In India

Bengaluru-based startup CoinSwitch Kuber is arguably the first cryptocurrency exchange to resort to mainstream ads to grow its user base in spite of the uncertainty over the future of crypto. It witnessed a 3.5x rise in registration after launching an ad campaign on Disney+ Hotstar for IPL 2021 and aims to onboard more than 10 Mn users by the end of 2021.

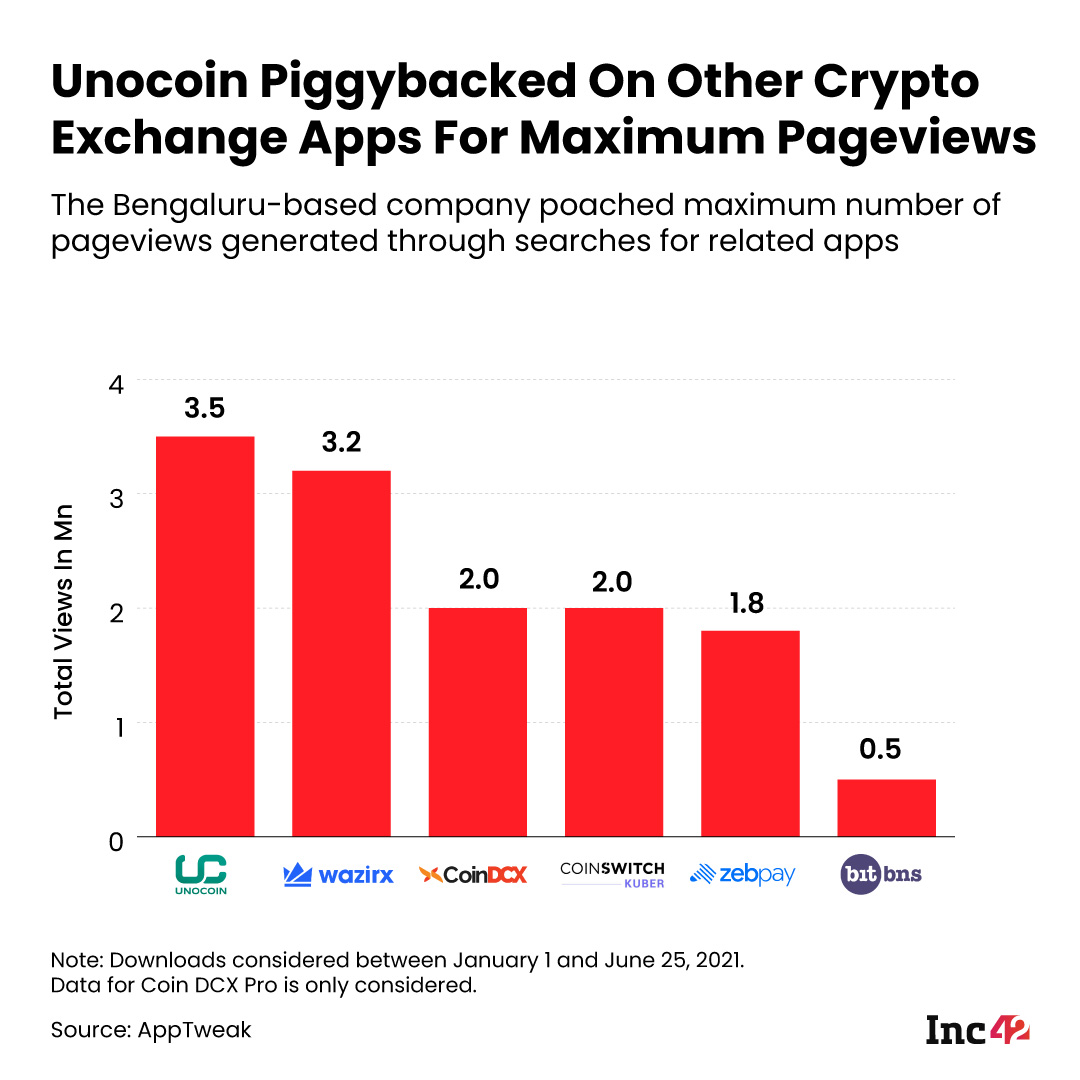

Unocoin Poaches Visits From Other Crypto Apps

Between January and June 2021, Unocoin had the maximum number of pageviews on the Google Play Store — a total of 3.5 Mn — but most of them were generated through searches for other crypto exchange apps. It had seen only 0.1 Mn downloads during this period.

WazirX, yet another popular crypto exchange app, saw the second-highest number of pageviews at 3.2 Mn, again generated through searches for other apps. It was also the second most downloaded crypto exchange app, with 5.2 Mn downloads during January-June 2021.

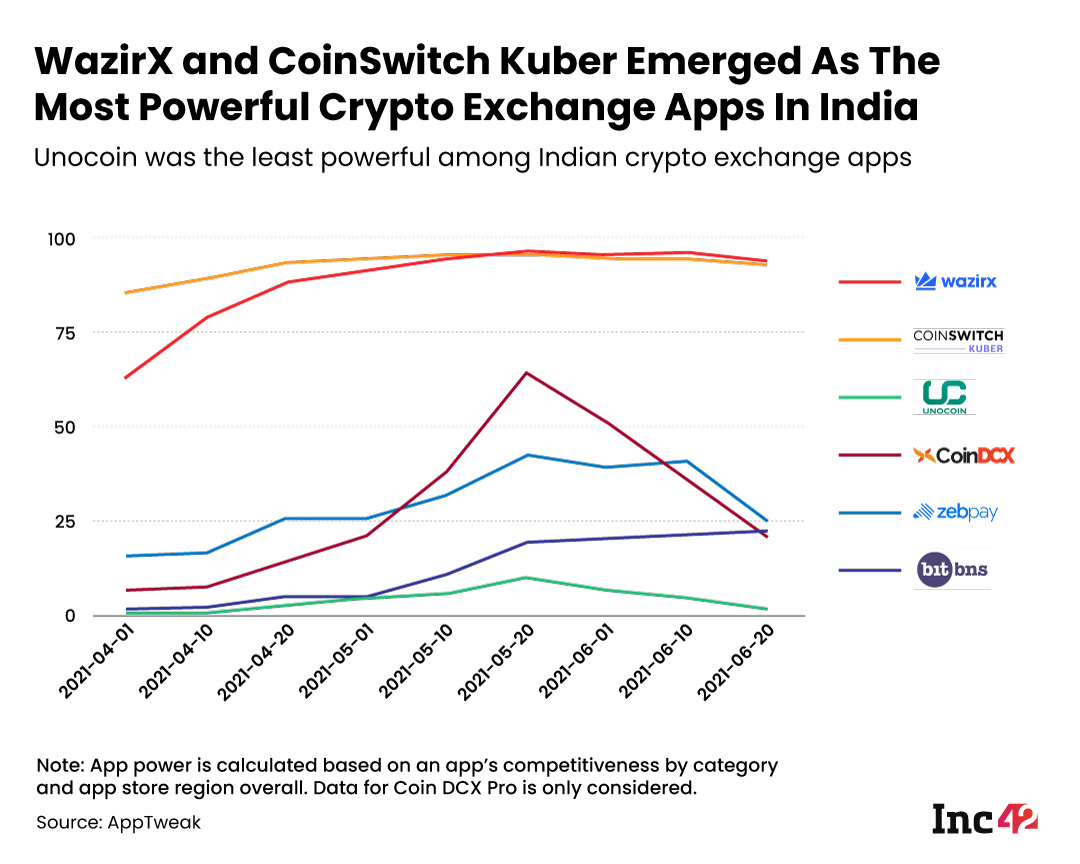

CoinSwitch Kuber And WazirX Are The Most Powerful Crypto Apps In India

According to AppTweak, app power is a key performance indicator (KPI) for assessing the overall performance of an app in the Google Play store. It considers various factors such as an app’s competitiveness by category and the app store region overall.

Interestingly, the power of most crypto exchange apps increased between April 1 and June 25, 2021. However, WazirX and CoinSwitch Kuber emerged as the most powerful throughout the entire period. On the other hand, the app power of the rest (CoinDCX Pro, Unocoin and ZebPay) reached their peak on May 20 and declined thereafter.

Will Crypto Be The Future Of Investment In India?

The Indian crypto market is gathering strength due to rising industry valuation, an influx of new investors and the emergence of startups going beyond the typical crypto exchange model. For instance, Unocoin allows people to use bitcoins for topping up wallets, recharging cell phones and paying for DTH services. It also supports a merchant gateway system so that online businesses can accept bitcoin for payment instead of fiat money.

Despite the regulatory uncertainty and the speculated ban on cryptos in general, global exchanges are eyeing a piece of the Indian crypto market, either through independent operations or through acquisitions. In essence, the crypto industry has a lot more potential to flourish across the country if its pain points can be resolved fast, paving the path for a robust, decentralised financial ecosystem. With the crypto exchanges and other companies coming together to lobby for clarity and regulation, India may soon witness the introduction of a new asset class and a decentralised innovation structure powered by crypto.

The post Who Is Winning The Crypto Battle In India? appeared first on Inc42 Media.

0 Comments