Why don’t all startups scale? Experts in this space cite many crucial reasons – from the product not finding market fit to botched-up execution. However, the two that stand out prominently are running out of cash to support the working capital cycle and an inability to make better, data-driven business decisions to keep growing. There are currently 38,815 startup businesses in India, but historically, as many as 90% shut shop within five years of existence.

Startups attempt to address these issues by raising capital to plug their working capital gap and buy more time to figure out a path to profitability. While raising funding from angel investors and venture capitalists is traditionally seen as a source to add to the capital base, fundraising is a complicated process and many companies fail to meet prerequisites eyed by venture capitalists, resulting in high entry barriers. Venture capitalists solely scout for founders who are on the “go big or go home” path, but what about founders who want to build a profitable online business?

If startups in the early growth stage fail to attract angel or VC money, few other options exist for raising funds, each with its own unique constraints. For instance, business loans from institutional lenders like banks and financial institutions come with significant collateral and personal guarantee requirements. Additionally, traditional financiers can struggle to understand online businesses and their traditional underwriting processes may fail to work for this segment. None of these sources of capital is ideal for a business that while on the one hand has transparent, online cash flows is still tinkering with different channels for growth or product prototypes.

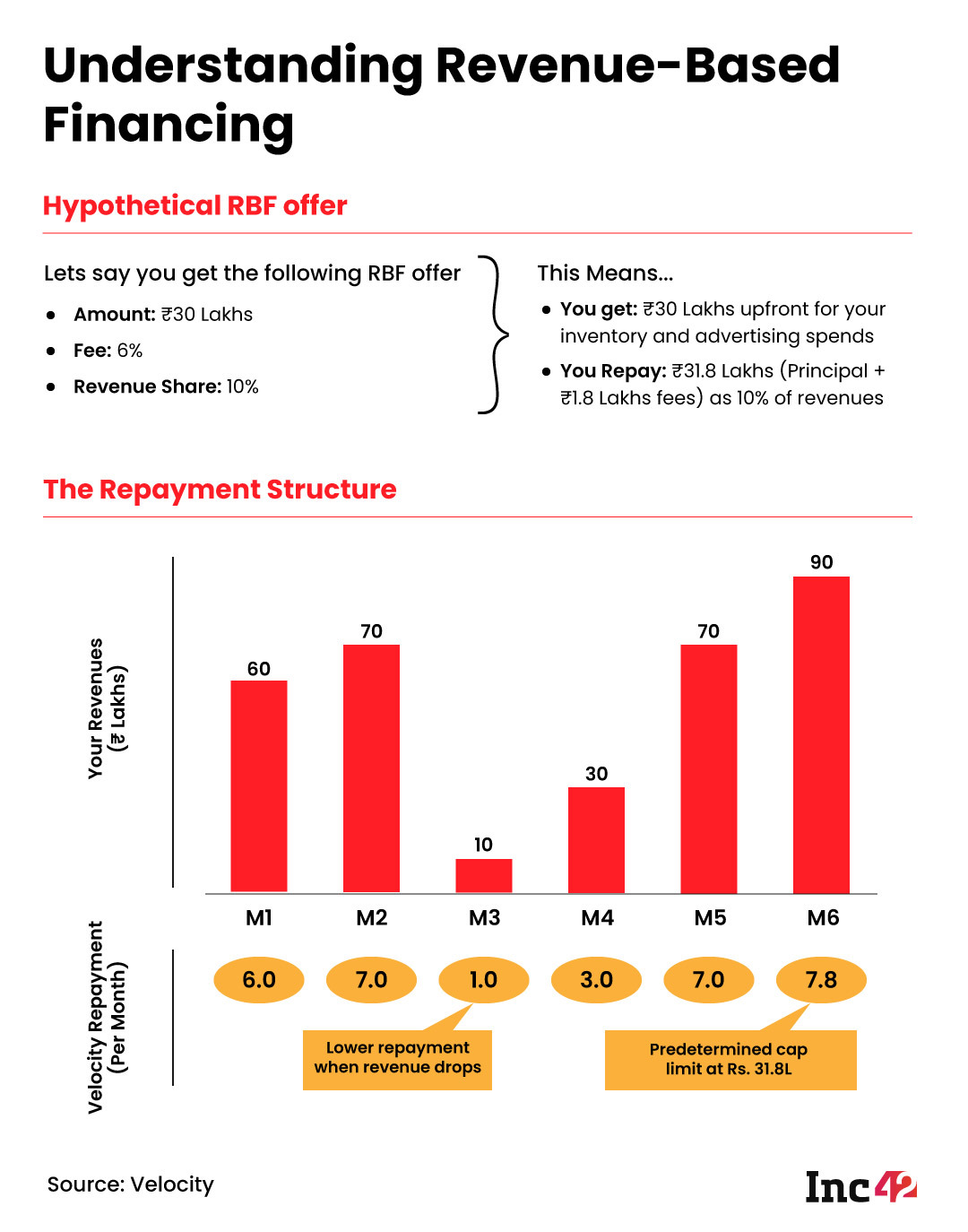

A solution to these capital constraints is revenue-based financing. In this way, a business raises capital and pays it off in instalments as a percentage of the company’s future revenue. Although a recent concept, the model has gained popularity in India due to its flexible nature of debt repayment. Simply put, a company only pays if it generates revenue in a given period. When the business is not generating any revenue, it will pay zero repayments for the month. The tenure, while typically modelled for a 4-6 month duration, can vary based upon the actual revenue trajectory. Players like Velocity, GetVantage and N+1 Capital have already tapped into this lucrative space and started offering their solutions to businesses.

“Current models of financing are becoming outdated. Revenue-based financing is a necessity to plug gaps in traditional financing options like venture capital or bank debt. Further, startups today look for more than just capital, they also seek a long term growth partner. Any successful financier must have the ability to add value beyond capital.” says Abhiroop Medhekar, cofounder and CEO of Velocity.

The High-Velocity, Revenue-Based Financing

Set up in March 2020, Bengaluru-based Velocity is the brainchild of IIT-Bombay graduates Medhekar, Atul Khichariya (COO) and Saurav Swaroop (CTO). Of them, Medhekar has a VC background as he was part of Elevation Capital and led fintech, financial services and healthtech investments for the fund.

In March this year, the fintech startup raised $10.3 Mn in seed funding, led by the New York-based VC firm Valar Ventures. It also marks the VC firm’s (cofounded by Peter Thiel) first bet on an Indian startup, highlighting the growing potential of revenue-based financing.

To offer a better alternative for managing operating expenses across marketing and inventory management, Velocity provides ecommerce businesses and direct-to-consumer (D2C) brands revenue-based financing options ranging from INR 10 Lakh to INR 2 Cr, without any collateral or equity dilution. According to the startup, businesses with a monthly revenue of INR 5 Lakh and above are eligible for their capital. The fintech platform charges a fixed 4-7% fee against the funding. For repayment, a monthly revenue share between 5% and 20% is charged, as agreed upfront.

Businesses raising financing need to share their financial and marketplace data with Velocity, which is used to underwrite loans and is encrypted with bank-level standards. The startup claims to disburse its financing within seven working days if a business fulfils all eligibility criteria. The basic requirements include a steady state of at least INR 5 Lakhs in revenues being earned via online channels. The loan approval process requires minimal documentation and is entirely digitised to hasten loan disbursal.

“We consider ourselves partners in the growth of companies that receive our capital. We disburse funds within a week of receiving an application and receive repayment based on the growth of the company. This flexible financing coupled with our partnerships with D2C-enablers results in an accelerated growth trajectory of our portfolio companies” says Medhekar.

Adding Value To Funding With Insights

While capital is an essential component for any business to function, objectively, it is just a component. Ecommerce businesses, even the ones that do raise funding have failed without the correct business intelligence on where to deploy their capital.

While on a macro level, these issues can be addressed by hiring the right strategic mind, on a micro level this issue is of lack of actionable insights. Modern business building is all about failing fast and learning quick. And insights are imperative to learning in this scenario. Most businesses operating in marketplaces suffer from not tracking their sales data and understanding what is and what is not working when it comes to their marketing.

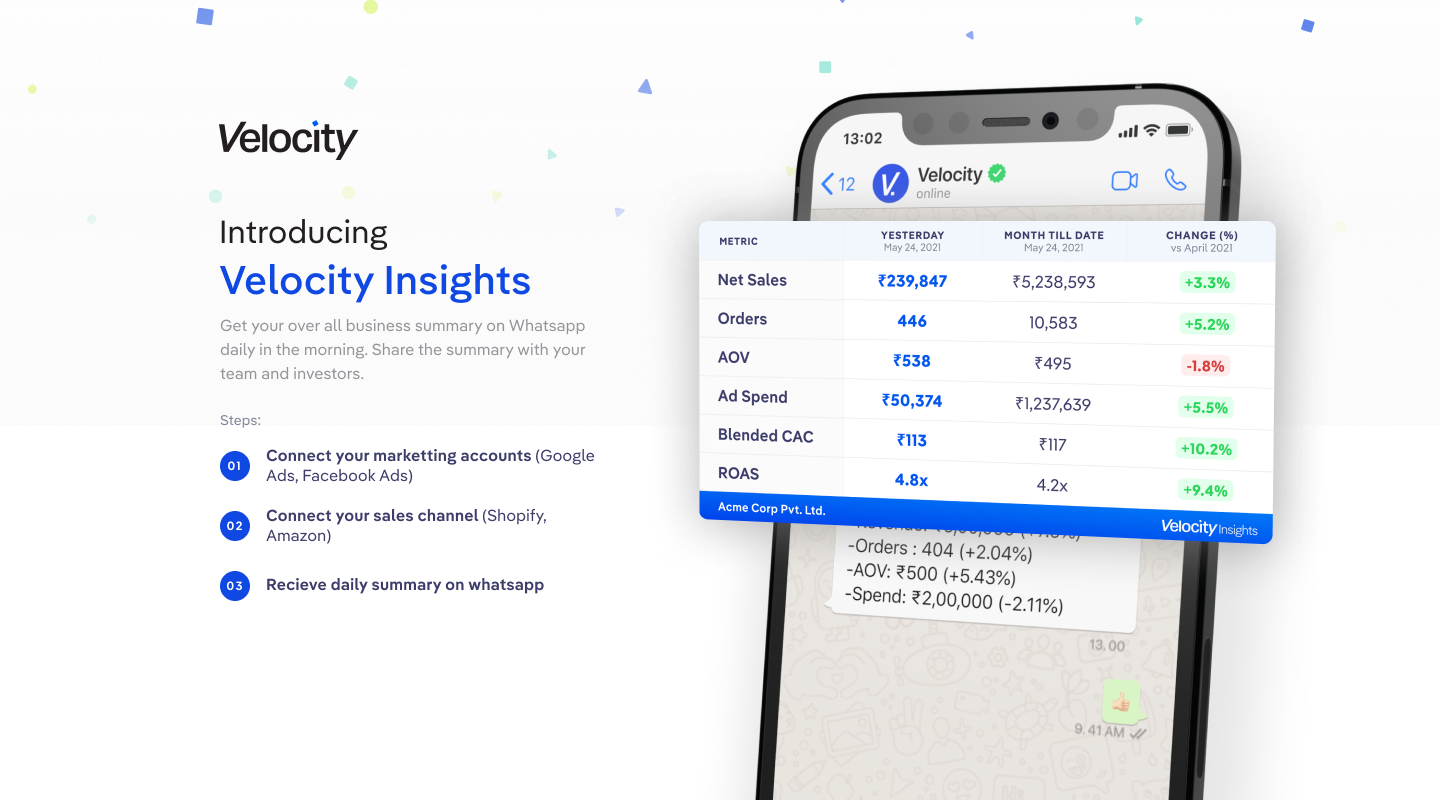

To address the same, the revenue-based financing startup has launched its new offering — Velocity Insights, an analytics tool kit that helps businesses gain actionable insights into their sales and marketing efforts and therefore streamline operations. The startup generates comprehensive reports on sales and marketing metrics across platforms such as Shopify, Amazon, Google, Instagram and Facebook to ensure that its clients stay at the top of their game by leveraging business intelligence. These reports are delivered to the founders via Whatsapp on a daily basis.

Reports generated by Velocity Insights include metrics that are critical to the success of a business. Insights enables a business to constantly monitor the pulse of their topline, marketing performance and unit economics. The company claims that future versions of the product will allow integration with more marketing channels, platforms and marketplaces. Further, a desktop version that will give users access to several more consolidated metrics is also in the works.

Some of the metrics that a brand can track using Velocity include order count, average order volume, advertising spends, customer acquisition cost and return on ad spend.

Focus On The D2C Space

The D2C segment in India is in a state of accelerated growth, given the large-scale internet penetration, the inclusivity of digital payments and the pandemic-induced adoption of a digital-first approach in every walk of life. According to a D2C report by Inc42, the addressable D2C market in the country stood at $44.6 Bn in FY21 and is expected to reach $100 Bn by FY25, growing at a CAGR of 25% during the period.

Attempting to capture a chunk of a fast-growing market requires D2C to aggressively scale its inventory and marketing expenses. However, this segment has historically remained largely neglected by Angel investors and venture capitalists. According to Inc42 Plus data, till March 20, 2021, Indian startups raised a total of $2.7 Bn where the D2C segment captured $241 Mn, a meagre 8.9% of the bucket.

Since D2C brands generate a stable level of revenue based on a repeatable working capital cycle, the flexible alternative of revenue-based financing works for them when it comes to financing their inventory and marketing expenses to fuel growth. Further, flexible repayments that are linked to revenues ensure that there is no fixed repayment obligation in down months. Given these variables, Velocity is exclusively focusing on the D2C segment to offer its revenue-based financing.

Velocity says that most small and medium D2C sellers lack access to comprehensive analytics and thus fail to map their revenue drivers and cost centres accurately. The company attempts to bridge the capital and knowledge deficit via its offerings. The company claims to have worked with hundreds of D2C brands since its inception.

Velocity claims that despite its scale working with several D2C brands, there have so far been no delayed repayments or defaults. This business success comes from the fintech platform’s comprehensive underwriting process. The startup analyses over 100 metrics such as the brand’s sales and marketing data across platforms, credit scores, financials etc to form a comprehensive picture of the historical and future performance of the company. Given that the underwriting process tracks a company’s performance beyond traditional metrics such as credit score, it is able to extend financing to a much wider set of companies than traditional financiers.

“We are currently focused on facilitating the growth of the D2C ecosystem as a whole in the country, regardless of where the company has raised money from Velocity Insights is a step in this direction, where any D2C brand in the country can sign up and start receiving actionable insights from the next day. In the long run, our vision is to be a full-stack financial services company that empowers new-age businesses through multiple innovative products” says Medhekar.

The post How This Fintech Startup Is Adding Velocity To India’s D2C Brands appeared first on Inc42 Media.

0 Comments