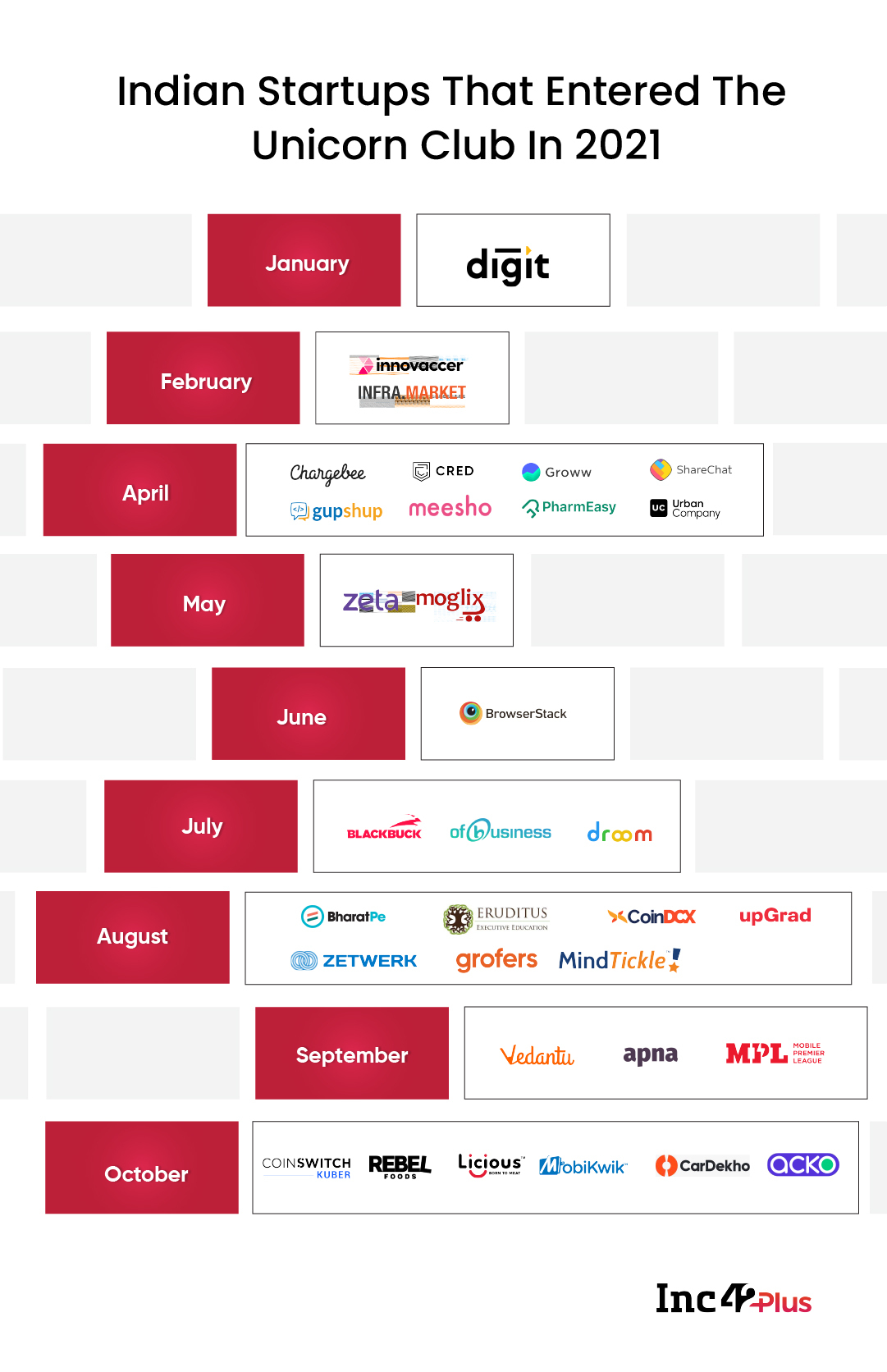

It’s raining unicorns in India amid an unprecedented funding spree for Indian startups across sectors. 33 Indian startups have already made it to the unicorn club. Well over $28 Bn has been raised till September this year, with several of the rounds producing Indian unicorns in 2021.

The unicorn story of 2021 is the one with many firsts, as the ecosystem witnessed the entry of the first healthtech, social commerce, epharmacy unicorns. The total count of Indian tech startups that have entered the unicorn club to date stands 75.

At this rate, India will manage to get more than 100 unicorns by 2023, much earlier than the previous estimation of 2025 as suggested by Inc42 Plus reports in the past.

Startups That Entered The Unicorn Club In 2021

Digit Insurance

Bengaluru-based insurtech startup Digit Insurance was the first startup to enter the Indian unicorn club in 2021. The company had raised $18 Mn (INR 135 Cr) from existing investors A(! PArtners, Faering Capital and TVS Capital in January, at a valuation of $1.9 Bn.

This was the company’s second external funding round, the first one coming in January 2020. The company had raised $84 Mn (INR 614 Cr at the current conversion rate) as a part of this round, in which Indian cricketer Virat Kohli and Bollywood actor Anushka Sharma infused about $340K (INR 2.5 Cr). Overall, the company has raised $200 Mn to date for internal and external infusion.

Digit Insurance is a tech-driven general insurance company, founded in 2016 by Kamesh Goyal and Prem Watsa’s Fairfax Holdings. The company offers customised policies on health, auto, travel, smartphones, commercial properties such as stores and holiday homes. It claims to have recorded a 31.9% growth between March 2020 to December 2020, with 20 Lakh Indians opting for its illness insurance product which offered protection against Covid-19 and seven vector-borne diseases including dengue, malaria and others

Innovaccer

The strain on global healthcare due to Covid-19 was enormous and shocking with the fear of mass infection hanging over the public. If not for the healthcare providers putting in the extra effort to ensure smooth recovery of those infected, the global tally of deaths would have been significantly higher. As the world stepped into lockdown, healthcare became of utmost importance as did solutions for the sector.

Innovaccer was one of the shining stars of the Indian startup ecosystem, and ended up becoming the first Indian healthtech unicorn. The company which develops solutions for western markets like the US, analyses healthcare data to provide actionable insights to healthcare providers, hospitals, insurance companies and other organisations and businesses.

The product is used by several governments and private institutions to maintain medical records of more than 3.8 Mn patients and generates savings of $400 Mn for healthcare providers. The startup aims to take its current number of patient records to 100 Mn+ and reach out to 500,000 caregivers over the next five years.

In a year that pushed many startups to the brink, healthtech companies brought in record levels of funding. The healthtech startups raised about $15.3 Bn in 2020, representing a 44% spike from 2019’s $10.6 Bn. In India, healthtech startups raised $455 Mn across 77 deals.

Meesho

The Indian social commerce segment may be at a nascent stage at this point but it is poised to grow at a compound annual growth rate (CAGR) of 55%-60% to reach $16 Bn-$20 Bn gross merchandise value (GMV) by 2025. One of the biggest milestones of the segment has to be Meesho’s entry into the unicorn club, which will have an overall impact on the segment and its growth momentum.

Founded by IIT-Delhi graduates Aatrey and Sanjeev Barnwal in 2015, Meesho is an online reseller network for individuals and small and medium businesses (SMBs), who sell products within their network on social channels such as WhatsApp, Facebook, and Instagram. The platform has about 13 Mn individual entrepreneurs, bringing the ecommerce benefits to 45 Mn customers pan India.

The company claims to have registered 100K registered suppliers to over 26K postal codes across 4,800 cities, generating over INR 500 Cr ($68 Mn at current conversion rate) in income for individual entrepreneurs. It has raised $415 Mn funding to date, from investors like SoftBank, Prosus Ventures, Facebook, Shunwei Capital, Venture Highway and Knollwood Investment.

It competes with other younger companies GlowRoad, Dealshare, CityMall and Bulbul, who too have a lengthy list of investors backing them.

Infra.Market

There are very few Indian unicorns that have maintained profitability from the very beginning. This year, there was another such startup, Infra.Market, that entered the club riding on its profitability and strong growth. The company, founded by Aaditya Sharda and Souvik Sengupta in 2016, is a B2B online procurement marketplace for real estate and construction material that leverages technology to offer fair pricing and a smoother procurement experience for its customers.

The platform aggregates demand and matches it with the supply chain, with wholesale pricing on materials, along with affordable credit or financing, which is not always available for small businesses in this sector.

In the financial year 2020, Infra.Market had noted a 5.5X increase in revenue, from INR 63 Cr in FY19 to INR 250 Cr in FY20. It reported a profit of INR 1.74 Cr in FY19 and INR 8.59 Cr in FY20. Infra.Market had previously claimed that it would hit a monthly revenue run rate of INR 150 Cr by the end of first quarter of 2021.

Checkout The Indian Unicorn Tracker

PharmEasy

With eyes on market dominance and the unicorn club, API Holdings had set out to forge a merger between its subsidiary PharmEasy and its rival Medlife in 2020. After the merger came through in the latter part of last year, the company was able to achieve one of its goals — entering the unicorn club. The company raised $323 Mn in a Series E funding round, at a valuation of $1.5 Bn. Notably, it is the first Indian epharmacy unicorn.

PharmEasy was founded in 2015 by Dharmil Sheth and Dr. Dhaval Shah to the chronic care segment and offers a range of services such as teleconsultation, medicine deliveries, and sample collections for diagnostic tests. It connects over 60K brick-and-mortar pharmacies and 4K doctors in 16K postal codes across India.

The platform also offers a SaaS solution for pharmacies to use in procurement combined with delivery and logistics support, and credit solutions. It claims to have served over 20 Mn patients since its inception.

The company’s merger with Medlife was in the aftermath of the rising competition in the segment. Reliance had acquired rival Netmeds, Amazon launched its own epharmacy vertical and Flipkart too was contemplating its entry. The only other competition left was 1mg, which too was in talks with the Tata Group for an acquisition deal. The company hopes to fend off the competition to reach 100K pharmacies in the next year.

CRED

With only INR 57 Lakh ($76K, at current conversion rate) as operating revenue in the financial year 2020, Kunal Shah-led fintech platform CRED entered the unicorn club at a whopping valuation of $2.2 Bn.

Several big names of the VC ecosystem like DST Global, RTP Global, Tiger Global, Greenoaks Capital, Dragoneer Investment Group and Sofina has placed their bets over CRED, which focuses on premium credit card users, offering them rewards and benefits for paying credit card bills. In the last two years, CRED claims to have added over 5.9 Mn credit card users with a median credit score of 830.

Last year, the company decided to experiment with ecommerce to shore up revenue and capitalise on its user base. It forayed into ecommerce with CRED Store and in December, CRED launched CRED Pay to allow users to use their CRED reward coins across ecommerce sites and unlock discounts.

The company is in the process of closing deals with ecommerce partners such as BigBasket, Dineout and ixigo. It partnered with Razorpay and Visa to develop the features. Before launching the payment feature, after a pilot project with over 30 merchants including the likes of Vahdam Teams, The Man company, Epigamia and Man Matters among others.

Groww

India found its second wealth management unicorn in Groww only eight months after bootstrapped Zerodha valued itself above $1 Bn. Just like Zerodha, Groww allows users to invest in stocks, mutual funds, ETFs, IPOs, and Gold using its tech platform available via mobile application and web platform. The company had also launched stocks with an easy-to-use interface for do-it-yourself (DIY) investors.

The five-year-old company was founded by ex-Flipkart employees Lalit Keshre, Harsh Jain, Neeraj Singh, and Ishan Bansal, and has over 15 Mn registered so far. More than 60% of Groww’s users come from smaller cities and towns in India and 60% of them have never invested before, the company claims.

The company raised $83 Mn in its Series D funding led by Tiger Global this week, becoming the fiftieth Indian unicorn. The company had raised $30 Mn in Series C round last September. It intends to use this capital to invest in new products, acquire talent and continue building our financial education platforms.

ShareChat

ShareChat has finally found its way to the unicorn club, after capturing the attention of users across Tier II and III India. The regional language social media startup has witnessed massive growth in 2020, as its monthly active user base grew 166% from 60 Mn to 160 Mn in one year. The most interesting trend that the startup witnessed was that it stepped out of its comfort zone in Tier II and Tier III regions of India and started garnering attention in Tier I and metro cities during the pandemic, without having an English interface.

ShareChat, which was founded by IIT-Kanpur alumni Farid Ahsan, Bhanu Singh and Ankush Sachdeva in 2015, started its journey in 2015 as a content-sharing tool for WhatsApp with users sharing about 100K content pieces per day. It found its calling in the vernacular social media platform and has been focusing on it ever since.

The company also launched a short video platform Moj last year, after the Indian government banned Chinese apps like TikTok and Likee. Moj has also been garnering the attention of the audience and has about 80 Mn monthly active users currently.

ShareChat has raised $828 Mn in eight funding rounds, with $502 Mn coming in its Series E round. The funding ends speculation around the possible investment by Google in Sharechat.

Gupshup

San Francisco-headquartered Gupshup is the ninth startup to enter the unicorn club in 2021, after raising $100 Mn in its Series F funding round led by Tiger Global Management. The company has been valued at $1.4 Bn in the round. It also hinted that the current funding will be followed by a second close with significant additional funds, which will be used to further scale its product suite and go-to-market initiatives overseas.

Founded by Beerud Sheth in 2004, Gupshup is a conversational messaging platform that caters to businesses from multiple sectors including banking, ecommerce, hospitality, consumer goods among others. The company said that over 80% of its business comes from India followed by the US and Latin America.

Some of its clients include Kotak Mahindra Bank, IndusInd Bank, HDFC Bank, Ola, Zomato, and Flipkart. The 17-year-old company has so far raised $150 Mn and closed its Series E round in 2011.

Chargebee

Chennai-based subscription management platform Chargebee became the tenth unicorn of 2021, after raising $125 Mn in its Series G funding round at a valuation of a whopping $1.4 Bn. Once again, the round was led by Tiger Global, along with Sapphire Ventures and Insight Venture Partners. Steadview Capital also participated in the round, which tripped the company’s valuation in less than six months.

Chargebee is an automated subscription billing software platform, which was founded in 2010 by Rajaraman S, Thiyagarajan T, KP Saravanan and Krish Subramanian. The company integrates with payment gateways to automate payment collections, invoicing, email notifications and customer management. Its latest product updates enable clients to optimise revenue operations, compliance and revenue recognition.

The company claims to cater to 2500 businesses across 53 countries. Chargebee’s customer portfolio includes the likes of access management company Okta, Freshworks, Calendly, Study.com, among others.

Urban Company

Gurugram-based hyperlocal service provider Urban Company is the latest startup to join the unicorn club, as the company is said to be valued at $2 Bn in its latest $188 Mn Series F funding round. The investment was led by Prosus, with participation from DF International and Wellington Management. While it has not confirmed the $1 Bn+ valuation after Series F, Urban Company had raised its $75 Mn Series E in 2019 at a valuation of $933 Mn. The company has raised over $370 Mn to date.

Founded in 2014 by Abhiraj Bahl, Raghav Chandra, and Varun Khaitan, Urban Company (formerly known as Urban Clap) is a home service company that focuses on beauty and massage, appliance repair, plumbing, carpentry, cleaning, and painting. It is currently present in more than 10 Indian cities, along with four international markets Australia, Singapore, Dubai and Abu Dhabi.

The company had reported a revenue of INR 256.4 Cr (IND-AS) with expenses of INR 394.2 Cr, leading to a loss of INR 137.8 Cr, in FY20.

Last year, it rebranded itself to Urban Company, as it wanted a more globally acceptable brand name. The company also rebranded its various verticals and made them sub-brands of Urban Company. Its home beauty vertical was split under the women-focused brand Urban Beauty, men’s grooming brand Urban Grooming and Urban Spa for at-home massages, while home improvements and repairs came under self-explanatory Urban Cleaning, Urban Repairs, Urban Painting sub-brands.

Moglix

Industrial B2B marketplace Moglix entered the unicorn club in May 2021, after raising $120 Mn in Series E round. The company was led by Falcon Edge Capital and Harvard Management Company (HMC), with participation from Tiger Global, Sequoia Capital India and Venture Highway. The company was valued at $1 Bn.

“We started six years ago with a firm belief in the untapped potential of the Indian manufacturing sector. We had the trust of stalwarts like Ratan Tata, and a mission to enable the creation of a $1 Tn manufacturing economy in India. Today, as we enter the next stage of our evolution, we feel this financing milestone is a testimony to our journey of innovation and disruption,” Rahul Garg, founder and CEO of Moglix said, in a statement.

Moglix is an ecommerce marketplace for different kinds of industrial tools such as power tools, hand tools, adhesives, safety and security and electricals. It procures and supplies safety tools, hardware, office supplies and more to the industries. The company runs a supply chain network of 16,000+ suppliers, over 35 warehouses and logistics infrastructure.

It serves over 500K small and medium businesses (SMB) and big enterprises including Hero MotoCorp, Vedanta, Tata Steel, Unilever and Air India. It has also set up 3,000 manufacturing plants across India, Singapore, UK and UAE. Moglix has raised $220 Mn funding to-date,

Zeta

Headquartered in Bengaluru, Zeta offers a cloud-native neo-banking platform for the issuance of credit, debit and prepaid products that enable companies to launch engaging retail and corporate products, besides offering digitised solutions to enterprises such as automated cafeteria billing and more. The solutions are available in India, Italy, Spain, Brazil, Vietnam and Philippines.

The fintech firm has about 500 employees and claims to be recording 1 Mn transactions per day. It currently serves more than 14K corporate customers with 2 Mn+ users. It includes 25 fintech firms and 10 banks such as Axis Bank, Kotak Mahindra Bank, Yes Bank, Induslnd Bank, and HDFC Bank.

The company founded in 2015 by serial entrepreneurs Bhavin Turakhia and Ramki Gaddipati. It entered the unicorn club on May 24, 2021, after raising $250 Mn in its Series C funding round led by Japanese conglomerate SoftBank. Notably, the company’s valuation has jumped 4.8X from its last round, which had valued the company at $300 Mn in July 2019.

Checkout The Indian Unicorn Tracker

BrowserStack

Software-as-a-service (SaaS) startup BrowserStack has raised $200 Mn in Series B funding. Post funding, BrowserStack reached a valuation of $4 Bn. The funding round made BrowserStack the ninth Indian SaaS startup to join the unicorn club and also makes it the highest valued SaaS firm in the country.

The funding round was led by Silicon Valley investor Mary Meeker’s Bond along with participation from Insight Partners and existing investor Accel.

The company, which is a web and mobile app testing platform claims to have four million developers spread across 50,000 companies, including tech giants such as Google, Microsoft and Twitter. BrowserStack plans to use the funding to double its team size within the next 18 months, and to make strategic acquisitions to increase its market capabilities.

“We want to be the testing infrastructure of the internet, and to do this we need to scale our operations quickly both in terms of people and infrastructure,” said Nakul Aggarwal, cofounder and chief technology officer of BrowserStack.

With an increase in its team size from 300 to 800 in the last two years, the company is looking to exit 2021 with a team size of over 1000.

BlackBuck

Bengaluru-based logistics company BlackBuck raised $67 Mn in its Series E Round at over $1 Bn in valuation in July. Founded by Rajesh Yabaji, the company claims to be the largest online trucking platform in India with over 90% market share. It enables the digitisation of fleet operations for truckers and operates a marketplace to help match trucks with relevant delivery loads.

The platform says it has more than 700K truckers and 1.2 Mn trucks on its platform, and with more than 15 Mn in monthly transactions. BlackBuck is the third logistics startup to become a unicorn after Delhivery, which is planning an IPO this year, and Rivigo.

The unicorn round was led by Tribe Capital, IFC Emerging Asia Fund and VEF. Existing investors Wellington Management, Sands Capital, and International Finance Corporation also participated in the round. The company said it will use these funds to further penetrate the market and launch new service offerings for its customer base.

BlackBuck’s revenue grew by 27% year-on-year (YoY), from INR 1803 Cr in the fiscal year 2018-19 (FY19) to INR 2281 Cr in FY20. However, during the same period, the company’s expenses also grew 27%, from INR 2148 Cr in FY19 to INR 2726 Cr in FY20. Thus, the company’s net loss grew 29% from 2019 to INR 446 Cr in FY20.

Droom

Gurugram-based Droom entered the unicorn club with its valuation soaring to $ 1.2 Bn after a pre-IPO round of $200 Mn. New investors such as 57 Stars and Seven Train Ventures have participated along with existing investors. The automobile marketplace said it is gearing up to go public either on NASDAQ or in India next year.

Founded in 2014 by Sandeep Agarwal, Droom provides an online platform where users can buy & sell used and new automobiles in India and other emerging markets. Droom has four marketplace formats like B2C, C2C, C2B, and B2B, and three pricing formats such as fixed price, best offer and auction.

Droom has more than 1.1 Mn automobiles to choose from with a listed inventory of $15.7 bn+ from over 20,000 auto Dealers and a presence in 1,105 cities. The company’s current annual run-rate is $1.7 Bn for GMV and $54 Mn for net revenue. The startup is aiming for GMV of $2 Bn and net revenue of more than $65 Mn by the end of 2021.

OfBusiness

B2B ecommerce platform OfBusiness became the latest entrant to the celebrated unicorn club in the Indian startup ecosystem with fresh funding worth $160 Mn, led by Japan’s SoftBank. The round valued the startup at around $1.5 Bn. While the Masayoshi Son-led SoftBank pumped in $150 Mn, Falcon Edge, Matrix Partners invested the remaining amount.

The startup said it would use the funds to execute acquisitions and strategic investments in the supply chain of petrochemicals, metal, plastics, food grains, among others.

Founded in 2016 by Bhuvan Gupta, Vasant Sridhar, Ruchi Kalra, Nitin Jain, and Asish Mohapatra, the marketplace facilitates raw material procurement and credit for SMEs in the manufacturing and infrastructure sectors. The startup integrates technology to SMEs buying behaviour to make available better products, at better prices, in better timelines to customers with comprehensive online and offline support.

Ofbusiness competes against B2B ecommerce unicorns Infra.Market, Moglix as well as Udaan besides other companies such as publicly-listed IndiaMART and Zetwerk.

BharatPe

BharatPe became the fifth fintech startup to enter the coveted unicorn club in India this year after it bagged $370 Mn in a Series E equity round led by Tiger Global at a valuation of $2.85 Bn. Dragoneer Investment Group and Steadfast Capital have come on board as new investors, while the likes of Coatue Management, Insight Partners, Sequoia Growth and others added to their earlier investments in BharatPe.

The company was founded in 2018 by Ashneer Grover and Shashvat Nakrani, BharatPe launched India’s first UPI interoperable QR code for merchants, and it has expanded into other financial services. BharatPe, along with financial services player and NBFC Centrum, has also acquired a small finance bank license from the RBI by taking over PMC Bank.

In the fundraise, employees, holding vested ESOPs were given full liquidity in a secondary sale. Besides the valuation, the other big story from BharatPe has been that Suhail Sameer, who joined the fintech startup in August last year as a group president, has now been appointed as the chief executive officer of BharatPe and will also join the board of directors.

Sameer would be responsible for the overall business and P&L, merchant network expansion, monetisation, lending, banking foray and the brand. Sameer replaces cofounder Ashneer Grover as CEO; Grover has now been elevated to the managing director post and will lead strategy, product, technology, capital (IPO, equity & debt) among others.

Mindtickle

Sales-focussed software-as-a-service (SaaS) company Mindtickle entered the unicorn club with a $100 Mn round from SoftBank, which valued the company at $1.2 Bn. This takes the company’s tidal funding to $281 Mn. This is Softbank’s second investment in Mindtickle. In November 2020, the SaaS startup raised $100 Mn in a mix of equity and debt funding led by SoftBank at a valuation of $500 Mn.

Founded in 2011 by Krishna Depura, Nishant Mungali, Mohit Garg and Deepak Diwakar, Mindtickle is a SaaS platform that focuses on improving the sales function in businesses by understanding ideal sales behaviors, increasing seller knowledge and skillsets, and incorporating real-world feedback from their meetings with customers.

The Pune and San Francisco-based company claims to cut training time for salespeople who need to be kept up-to-date on new product lines. It also offers solutions for onboarding, micro-learning, skills development and coaching to companies that have been using legacy learning management systems (LMS).

upGrad

Mumbai-based startup upGrad became the third edtech unicorn in India, after raising a total of $185 Mn from Temasek, IFC (International Finance Corporation, a sister organization of the World Bank and member of the World Bank Group), and IIFL in August 2021, at a valuation of $1.2 Bn.

Founded by Ronnie Screwvala, Mayank Kumar, Phalgun Kompalli and Ravijot Chugh, upGrad offers higher education courses in collaboration with various universities. It claims to have a million users globally, of which 45,000 are paid learners.

Screwvala, who is also the chairperson, said that the edtech startup will announce further updates on merger and acquisition in the coming days. The company’s funding round came days after it had acquired Bengaluru-based KnowledgeHut to venture into short-term skilling courses.

In 2020, upGrad acquired recruitment and staffing solutions company Rekrut India and Bengaluru-based coaching institute The Gate Academy (TGA). In August last year, the company raised INR 50 Cr debt from IIFL Income Opportunities Fund. In April this year, the edtech startup raised $40 Mn from IFC at $850 Mn valuation.

CoinDCX

Crypto exchange CoinDCX became the first crypto unicorn in India with a $90 Mn (INR 670 Cr) Series C funding round, led by Facebook cofounder Eduardo Saverin’s B Capital Group as well as Coinbase Ventures, Polychain Capital, Block.one, Jump Capital among others, alongside and returning other unnamed investors.

Founded in 2018 by Sumit Gupta and Neeraj Khandelwal, CoinDCX raised $13.5 Mn in its Series B funding round in December 2020. It claims to have more than 3.5 Mn users. It operates CoinDCX Go, a crypto investment app, a professional trading platform called CoinDCX Pro and DCX Learn, a crypto-centric investor education platform.

In the coming months, the company said it will launch the CoinDCX Prime product for HNI and enterprise customers, providing legally vetted and safe investments, as well as Cosmex, CoinDCX’s global trading product.

The company said it would use a bulk of the funds to improve crypto awareness in India. ‘The funds raised will be allocated to expand (bring more Indians to crypto / make crypto a popular investment asset class in India) and strengthen our workforce that will cater to our growth story. We will hire talent across multiple functions, and focus on new business initiatives,” said cofounder and CEO Gupta.

He added that CoinDCX will enter into partnerships with fintech players to expand the crypto investor base, set up a research & development (R&D) facility, and work with the government to introduce favorable regulations, bring the policy discussions into public discourse, besides hiring and product development.

Zetwerk

After Inc42’s exclusive report on Zetwerk entering the unicorn club, based on the company’s regulatory filings, the manufacturing services startup confirmed a $150 Mn equity round, led by New York-based D1 Capital Partners. It raised the funds at a post-money valuation of $1.33 Bn.

New investors Avenir and IIFL also participated in the round, along with existing backers. The round also included angel investors such as OYO founder Ritesh Agarwal, CRED founder Kunal Shah, Alarko Ventures managing partner Cem Garih, among others.

Founded in 2018 by Amrit Acharya, Srinath Ramakkrushnan, and Vishal Chaudhary, Zetwerk is a manufacturing services platform that connects manufacturing companies with vendors and suppliers for customised products, industrial machine components and other equipment. Zetwerk is the 24th Indian startup entering the unicorn club in 2021.

Grofers

Publicly-listed foodtech giant Zomato acquired 9.16% stake of an online e-grocery firm Grofers India private limited for INR 518.2 Cr, which saw the online grocery delivery company enter the unicorn club.

In a filing, Zomato informed the BSE that it has also completed the acquisition of Hands on Trades Private Limited (HOTPL), a private company owned by Singapore-based Grofers International Pte Ltd, that is in the business of B2B wholesale trading. Zomato has acquired an 8.94% stake on a fully diluted basis in Hands-on Trades for INR 222.8 Cr. Overall, Zomato had to shell around INR 740 Cr ($100 Mn) for the deal.

The investment in Grofers is expected to bring back Zomato into the ever-growing grocery segment that it quit after a brief period of time during the first COVID19 wave last year. Zomato’s rival Swiggy continues to deliver doorstep delivery to date through Instamart.

Eruditus

Mumbai-based edtech startup Eruditus became the fourth edtech unicorn in India, after it raised $650 Mn funding led by Accel US and Masayoshi Son-led SoftBank Vision Fund II. The fresh capital infusion has quadrupled the valuation of Eruditus to $3.2 Bn from $800 Mn last year.

The startup will be receiving $430 Mn in primary capital and $220 Mn of secondary sale proceeds will go to existing investors who are offloading part of their shares. Cofounder Ashwin Dhamera and other top management personnel announced that they would be liquidating shares worth around $100 Mn in the round.

Eruditus was founded in 2010 by Chaitanya Kalipatnapu and Ashwin Damera. It provides executive education programmes in association with global business schools such as MIT, Columbia, Harvard Business School, INSEAD, Tuck at Dartmouth, Wharton, UC Berkeley and London Business School.

Checkout The Indian Unicorn Tracker

Mobile Premier League

The Bengaluru-based gaming platform became the second Indian startup in the gaming segment to enter the unicorn club. The esports giants raised its Series E round of $150 Mn from Legatum Capital, Accrete Capital and Gaingels LLC, at a pre-money valuation of $2.3 Bn. Existing investors including Moore Strategic Ventures LLC and RTP Global have also participated in the round.

This round came months after it raised $95 Mn at a valuation close to $925 Mn.

Founded in 2018 by Sai Srinivas Kiran G and Shubh Malhotra, MPL offers various gaming options such as skill-based games like daily fantasy sports and chess to casual games such as 8 Ball Pool and Fruit Ninja.

At present, MPL claims to have 85 Mn users in India, the US, and Indonesia. Over the course of years, the startup has partnered with several game developers and added over 70 games to its platform.

Apna

Apna, a job marketplace for India’s blue-collar workers, entered the unicorn club after raising $100 Mn in a Series C round led by Tiger Global, along with participation from Owl Ventures, Insight Partners, Sequoia Capital, Maverick Ventures and GSV Ventures, at a valuation of $1.1 Bn.

Founded by Nirmit Parikh in 2019, Apna provides communities for skilled professionals such as painters, carpenters, sales agents, among others. A job seeker can find the available opportunities on the platform and even connect with his peers. The platform claims to have grown 125X in the past 15 months and, at present, conducts 18 Mn interviews per month from a million it recorded in August 2020.

It claims to have served more than 16 Mn job seekers, and helped 150K employers hire talent through its platform. At present, the platform has over 5 Mn jobs available and has more than 70 job categories and vertical communities. Some of the clients that Apna serves are newly-listed Zomato, Urban Company, PhonePe, BurgerKing, edtech giant BYJU’s and Bharti AXA, among others.

The startup had raised its Series A round worth $8 Mn in September last year and then raised $12.5 Mn in an extended part of the round in March this year. The startup, in June this year raised $70 Mn in Series B led by Insight Partners and Tiger Global.

Vedantu

Founded in 2014 by Krishna, Anand Prakash, and Pulkit Jain, Vedantu, an interactive online tutoring platform currently claims to have over 35 Mn+ students attending live classes every month and teachers delivering 8 Mn+ hours of LIVE classes with a growth of 220% during the early months of the lockdown.

Bengaluru-based online tutoring startup entered the unicorn club after raising $100 Mn making it the fifth Indian edtech unicorn.

The round was led by Singapore-based, Temasek-backed private equity firm ABC World Asia with participation from existing investors Coatue Management, Tiger Global, GGV Capital, and WestBridge.

The startup has previously raised about $100 Mn at a $600 Mn valuation in July 2020 led by US-based investment firm Coatue. Earlier this year, Vedantu acquired doubt solving app Instasolv for an undisclosed amount. In FY20, Vedantu posted revenue of INR 35.8 Cr, but its losses grew by 6x to INR 158.5 Cr. The startup spent about INR 194.3 Cr to earn an operating revenue of INR 24.6 Cr in FY20.

CoinSwitch Kuber

Bengaluru-based CoinSwitch Kuber became the second Indian crypto startup to enter the unicorn club. The crypto startup closed its Series C round at $260 Mn at $1.9 Bn valuation.

The round was led by Coinbase Ventures and Andreessen Horowitz (a16z), marking a16z’s first investment in India. Existing investors Paradigm, Ribbit Capital, Sequoia Capital India and Tiger Global also participated in the round.

Founded in 2017 by Singhal, Govind Soni and Vimal Sagar Tiwari as a global aggregator of cryptocurrency exchanges, CoinSwitch launched its India exclusive crypto platform, CoinSwitch Kuber in June 2020 to simplify crypto investments for Indian retail investors.

The startup claims to have 10 Mn users on its platform, with an active user base of 7 Mn users. It also claims to have witnessed a 350% growth in user base since January this year.

Prior to this round, the startup had raised $25 Mn in a Series B funding round from Tiger Global Management in April 2021, before which it has raised $15 Mn in Series A round. With the latest round, CoinSwitch Kuber’s total funds raised stand at $300 Mn.

Licious

Bengaluru-based gourmet meat startup Licious entered the unicorn club in October 2021. The meat D2C startup raised $52 Mn in its Series G round led by IIFL AMC’s Late Stage Tech Fund, Avendus FLF (Future Leaders Fund) and other private equity investors.

Two months prior to this round, the startup had raised $192 Mn in its Series F round led by Singapore-headquartered investment company Temasek, and other private equity investors including Brunei Investment Agency and existing investors 3one4 Capital, Bertelsmann India Investments, Vertex Growth Fund, and Vertex Ventures. To date, Licious has raised around $210 Mn from multiple investors including the current round.

Founded in 2015 by Abhay Hanjura and Vivek Gupta, Licious functions on the farm to fork business model, meaning that the company owns the entire back-end supply chain. This also includes stringent cold chain control, which helps it to maintain the quality and freshness of each product from the initial stages — procurement, processing, storage — till the time it reaches the customers.

Currently, Licious has a whopping INR 1,000 Cr annual revenue rate, a year-on-year growth of 500%, a team of 5K, and operations in 14 cities in India with over 2 Mn customers.

Rebel Foods

Founded in 2011 by Jaydeep Barman and Kallol Banerjee, Rebel Foods is parent to brands such as Faasos, Behrouz Biryani, Ovenstory Pizza, Mandarin Oak, The Good Bowl, SLAY Coffee, Sweet Truth, Wendy’s among others.

It operates multiple quick-service food brands independently, facilitating deliveries through its app or through online food delivery platforms like Zomato and Swiggy. The startup generates 50% of its demands through Zomato and Swiggy.

In October, Rebel raised $175 Mn in a Series F funding round. The funding round has been led by Qatar Investment Authority (QIA), existing investors Coatue and Evolvence also participated in the round taking the startup’s valuation to $1.4 Bn.

Rebel Foods claims to be moving towards profitability with annual run rate (ARR) sales of $150 Mn, growing 100% year-on-year (y-o-y). It is further eyeing an IPO in the next 18-24 months.

In FY20, ending in March last year, Rebel Foods’ revenue grew by 84% year-on-year (YoY) to INR 572 Cr, but its expenses shot up by 128% resulting in net loss growing 229% to INR 431 Cr in the year from INR 131 Cr in the previous fiscal.

MobiKwik

IPO-bound fintech MobiKwik joined the $1 Bn club after a few of its employees exercised employee stock option plans (ESOPs). The secondary round was led by former Blackstone India head Mathew Cyriac.

In June, MobiKwik raised $20 Mn from the United Arab Emirates (UAE) sovereign wealth fund Abu Dhabi Investment Authority.

Founded in 2009 by Bipin Preet Singh and his wife Upasana Taku, MobiKwik has raised over $165 Mn in primary rounds to date. Singh and Taku collectively own a 35% stake in the Delhi NCR-based startup.

As per the DRHP, MobiKwik’s revenue from operations fell to INR 288.5 Cr in FY21 from INR 355.6 CR in the previous year (FY20), which is just over 2X higher than the INR 148.4 Cr reported in FY19 (March 2019). Consequently, total income fell to INR 302 Cr from INR 369 Cr last year. The startup’s total loss for the year jumped up to INR 110.9 Cr from INR 99.1 Cr last year, on the back of an over 20% decline in revenue.

MobiKwik is planning to go for an initial public offering (IPO) by November first week at a valuation of $1.5 Bn – $1.7 Bn, according to Inc42 sources. It had filed its draft red herring prospectus (DRHP) for INR 1,900 Cr IPO, for which it has already received the market regulator SEBI’s nod.

CarDekho

Delhi NCR-based automobile marketplace CarDekho’s parent CarDekho Group (also known as GirnarSoft) has raised $200 Mn in an equity Series E round and $50 Mn in debt led by Leapfrog Investments alongside Canyon Partners, Mirae Asset, Harbor Spring Capital and existing investors Sequoia Capital India and Sunley House.

The Pre-IPO round valued the used 4W marketplace at $1.2 Bn, up from $725 Mn in December 2019. Backed by the likes of Sequoia, HDFC Bank, Hillhouse Group and Ping An Global Voyager, CarDekho has so far raised $440 Mn in equity funding.

Founded in 2007 by Amit Jain & Anurag Jain, the search and ecommerce platform for new and used cars will use the funds to expand its car transactions and financial services businesses, with a major focus on increasing its catalogue to 10K+ used cars.

The newly minted unicorn claims to have exceeded the $100 Mn revenue run-rate last month. Apart from CarDekho, GirnarSoft also operates various auto platforms such as Gaadi.com, ZigWheels.com, BikeDekho.com, PowerDrift.com and more.

ACKO

Bengaluru-based insurance aggregator ACKO Insurance entered the unicorn club after raising $255 Mn Series D funding round. The new round of investment was co-led by General Atlantic and Multiples Private Equity. Canada Pension Plan Investment Board, Lightspeed along with existing investors, Intact Ventures and Munich Re Ventures, also participated in this round of funding. This fundraise values the startup at $1.1 Bn.

Founded in 2016 by Varun Dua and Ruchi Deepak, ACKO Insurance is a digital insurance policy provider. It claims to have one of the largest market shares in embedded insurance products like mobility and gadget insurance across large digital consumer platforms like Amazon, MakeMyTrip, Ola, Urban Company, Bajaj Finance and others. The insurance startup also covers nearly a million gig workers in the country through partnerships with companies including Zomato and Swiggy.

With this investment, ACKO has now raised a total of $450 Mn in six rounds from investors including Amazon, Accel, Elevation, Ascent Capital, Intact Ventures, Munich Re Ventures and Flipkart’s cofounder Binny Bansal, among others.

This is a running article. The story will be updated as more unicorns are added to the list…

Checkout The Indian Unicorn Tracker

The post Here Are The 33 Indian Startups That Entered The Unicorn Club In 2021 appeared first on Inc42 Media.

0 Comments