Dear reader,

Safe hai! Simple hai!

In the past few weeks, you may have seen crypto ads almost everywhere: TV, magazines and newspapers, or digital platforms like YouTube.

However much you try, you won’t be able to skip them. But we will skip this topic for a while and take a quick look at this week’s developments:

NFTs Are The Talk Of The Town: Bollywood icon Big B, actor Sunny Leone, Indian cricketers and everyone worth their celeb status are looking for a piece of the pie here.

NFTs Are The Talk Of The Town: Bollywood icon Big B, actor Sunny Leone, Indian cricketers and everyone worth their celeb status are looking for a piece of the pie here.

Money. Money Everywhere: Funding in crypto startups has shot up this year. Two unicorns, a dozen of blockchain startups and a few NFT marketplaces raised big rounds from Indian and global investors and industry influencers. Overall $520 Mn has been raised, almost 25X YOY surge.

Money. Money Everywhere: Funding in crypto startups has shot up this year. Two unicorns, a dozen of blockchain startups and a few NFT marketplaces raised big rounds from Indian and global investors and industry influencers. Overall $520 Mn has been raised, almost 25X YOY surge.

Raining Crypto Ads

Now let us go back to the big elephant in the room — the spurt of crypto campaigns and their impact.

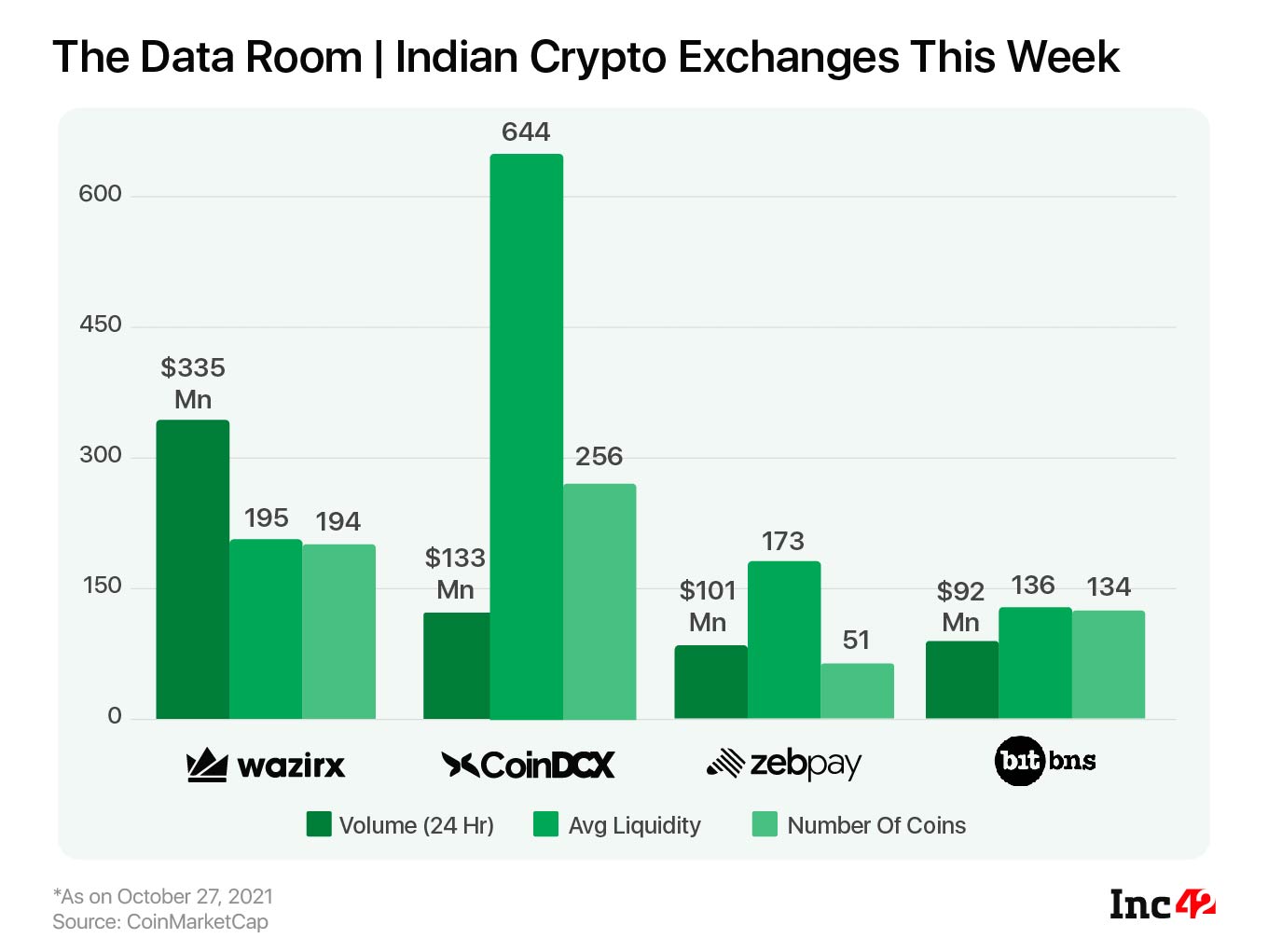

Why This Hype? The past few weeks were abuzz with crypto campaigns, but it happened for a reason. More than 15 Mn users from all over India — from Tier 1 cities to Tier 3 locations — have already put their money in crypto assets, leading to massive fund infusion. This has kicked off a crypto race where every crypto/blockchain startup wants to score in terms of user growth, trading volume and product variety.

Why This Hype? The past few weeks were abuzz with crypto campaigns, but it happened for a reason. More than 15 Mn users from all over India — from Tier 1 cities to Tier 3 locations — have already put their money in crypto assets, leading to massive fund infusion. This has kicked off a crypto race where every crypto/blockchain startup wants to score in terms of user growth, trading volume and product variety.

Big Campaigns, Big Endorsements. While CoinSwitch Kuber brought Bollywood star Ranveer Singh as its brand ambassador, CoinDCX roped in Ayushmann Khurrana for a similar role. Another crypto startup Bitbns onboarded a slew of actors, including Biswapati Sarkar of TVF fame, veteran actors Alok Nath and Archana Puran Singh, and noted singer Anup Jalota.

Big Campaigns, Big Endorsements. While CoinSwitch Kuber brought Bollywood star Ranveer Singh as its brand ambassador, CoinDCX roped in Ayushmann Khurrana for a similar role. Another crypto startup Bitbns onboarded a slew of actors, including Biswapati Sarkar of TVF fame, veteran actors Alok Nath and Archana Puran Singh, and noted singer Anup Jalota.

The Back Story: In July this year, advocates Aayush Shukla and Vikas Kumar filed a petition in Delhi High Court, seeking SEBI guidelines for crypto ads similar to mutual fund-related ad mandates. Crypto exchanges WazirX, CoinDCX and CoinSwitch Kuber also featured in the list of respondents besides SEBI and the ministry of information and broadcasting. The case will now be heard on December 3, 2021

The Back Story: In July this year, advocates Aayush Shukla and Vikas Kumar filed a petition in Delhi High Court, seeking SEBI guidelines for crypto ads similar to mutual fund-related ad mandates. Crypto exchanges WazirX, CoinDCX and CoinSwitch Kuber also featured in the list of respondents besides SEBI and the ministry of information and broadcasting. The case will now be heard on December 3, 2021

The Measures: Although capital market regulator SEBI is not on the scene yet, members of the Blockchain and Crypto Assets Council (BACC), part of IAMAI, agreed to display certain disclaimers in all crypto ads to highlight the inherent risk and thus avoid any miscommunication.

The Measures: Although capital market regulator SEBI is not on the scene yet, members of the Blockchain and Crypto Assets Council (BACC), part of IAMAI, agreed to display certain disclaimers in all crypto ads to highlight the inherent risk and thus avoid any miscommunication.

“Certain macro guidelines have already been circulated to the members. I think all of them are following the guidelines and clearly putting a disclaimer in their ads,” said Naveen Surya, advisory board member of IAMAI-BACC and chairman, Fintech Convergence Council.

But. The Challenge: Crypto is still evolving, and hence, this space lacks well-laid-out regulations that control traditional financial assets like equities and mutual funds. “In the case of MFs and equities, SEBI is the regulatory body that issues guidelines, and these become the gold standard for everybody to follow. Despite the absence of a regulatory body, we are also trying to achieve that goal,” said Manhar Garegrat, chief of staff, CoinDCX and a BACC member.

But. The Challenge: Crypto is still evolving, and hence, this space lacks well-laid-out regulations that control traditional financial assets like equities and mutual funds. “In the case of MFs and equities, SEBI is the regulatory body that issues guidelines, and these become the gold standard for everybody to follow. Despite the absence of a regulatory body, we are also trying to achieve that goal,” said Manhar Garegrat, chief of staff, CoinDCX and a BACC member.

Tweet Of The Week

As crypto funding surges in the country, former Coinbase CTO Balaji Srinivasan hopes that Web3 developments will be centred around India similar to how Web2 flourished in Silicon Valley.

For Binge Reading

Crypto And The Challenges Of Financial Stability: In its latest Global Financial Stability Report, the IMF has explored different crypto assets and how they pose financial stability challenges to the global market, given the inadequate operational and regulatory frameworks in most jurisdictions. Read more about it here.

Crypto And The Challenges Of Financial Stability: In its latest Global Financial Stability Report, the IMF has explored different crypto assets and how they pose financial stability challenges to the global market, given the inadequate operational and regulatory frameworks in most jurisdictions. Read more about it here.

Australian Select Committee Recommendations: The report by the Australian Senate Select Committee on crypto regulations is out now. It recommends that the Australian government should establish a market licensing regime for crypto exchanges, with the focus on capital adequacy, auditing and responsible person tests in the treasury portfolio. It also recommends setting up a decentralised autonomous organisation company structure. India must take note of this report.

Australian Select Committee Recommendations: The report by the Australian Senate Select Committee on crypto regulations is out now. It recommends that the Australian government should establish a market licensing regime for crypto exchanges, with the focus on capital adequacy, auditing and responsible person tests in the treasury portfolio. It also recommends setting up a decentralised autonomous organisation company structure. India must take note of this report.

News Doing The Rounds

An Ordinance On The Cards? The Indian government may pass an Ordinance to regulate crypto before the 2022 Budget Session. The RBI and SEBI are likely to be the regulating authorities for crypto products/applications.

An Ordinance On The Cards? The Indian government may pass an Ordinance to regulate crypto before the 2022 Budget Session. The RBI and SEBI are likely to be the regulating authorities for crypto products/applications. Drug, Darknet And Bitcoin: Central Crime Branch, Bengaluru, arrested two drug peddlers and seized INR 60 Lakh worth of Ecstasy pills, LSD and other drugs. The accused used to procure illegal drugs from the Darknet, paid by bitcoin and used Dunzo and Swiggy for delivery.

Drug, Darknet And Bitcoin: Central Crime Branch, Bengaluru, arrested two drug peddlers and seized INR 60 Lakh worth of Ecstasy pills, LSD and other drugs. The accused used to procure illegal drugs from the Darknet, paid by bitcoin and used Dunzo and Swiggy for delivery. Nigeria’s CBDC Goes Live: After banning crypto transactions across its banking system in February, Nigeria unveiled its CBDC called eNaira earlier this week. The CBDC will co-exist with its fiat money. Both eNaira speed wallet and eNaira merchant wallet are available on Google and Apple stores.

Nigeria’s CBDC Goes Live: After banning crypto transactions across its banking system in February, Nigeria unveiled its CBDC called eNaira earlier this week. The CBDC will co-exist with its fiat money. Both eNaira speed wallet and eNaira merchant wallet are available on Google and Apple stores. Visa, Mastercard Embrace Crypto, Will RuPay? While Visa partnered with Crypto.com, a Hong Kong-based issuer of cryptocurrency-backed prepaid cards, to support crypto transactions using the USD Coin (a stablecoin), Mastercard tied up with Bakkt to enable consumers to buy, sell and hold crypto assets. It will also streamline the issuance of branded crypto debit and credit cards.

Visa, Mastercard Embrace Crypto, Will RuPay? While Visa partnered with Crypto.com, a Hong Kong-based issuer of cryptocurrency-backed prepaid cards, to support crypto transactions using the USD Coin (a stablecoin), Mastercard tied up with Bakkt to enable consumers to buy, sell and hold crypto assets. It will also streamline the issuance of branded crypto debit and credit cards.

The big question: Will the National Payments Corporation of India (NPCI), an umbrella organisation in charge of retail payments and settlements, follow suit and create a similar ecosystem to crypto-power RuPay cards?

The big question: Will the National Payments Corporation of India (NPCI), an umbrella organisation in charge of retail payments and settlements, follow suit and create a similar ecosystem to crypto-power RuPay cards?

Till Next Week,

Suprita Anupam

The post India’s Crypto Economy | It’s Raining Crypto Ads ☔️ appeared first on Inc42 Media.

0 Comments