The biggest buzz this past week was created by the approval for Paytm’s massive IPO, which is seen as a litmus test for fintech as a sector in India.

Elsewhere, Reliance Jio announced major gains in ARPU and profits for Q2 FY22, and is preparing further investments towards its super app.

Before we go into Paytm’s IPO and Jio’s plans, here are two stories that caught our attention:

- Under fire from Indian startups and app developers over its commissions, tech giant Google has announced a 50% cut in its share of app revenue.

- Fintech unicorn PhonePe has started charging users a commission for mobile recharges as a “small scale experiment”. See what it means here.

Paytm Plans Big Bang IPO

After Zomato’s IPO in India and Freshworks’ listing on Nasdaq, all eyes are on the Paytm IPO. The fintech giant got the final nod from SEBI for its IPO and we expect Paytm to go for listing close to Diwali.

Founded by Vijay Shekhar Sharma in 2000, Paytm began its journey as a value-added service provider, but it has evolved over the years with an array of fintech products and services, with more being added each day.

Paytm is today one of the biggest digital payments companies in India with its offering spread across digital payments like UPI, credit and debit cards, wealth management through Paytm Money, banking services through Paytm Payments Bank and more. This is considered a key strength for the company.

The fintech giant is said to be on track to break even in 12-18 months and analysts expect Paytm to lead the payments and fintech market because of its diversification. But the valuation sought in the IPO has also been called too rich by many.

It was back in July that the fintech giant had filed its DRHP in a bid to raise INR 16,600 Cr and since then there has been plenty of debate on whether Paytm’s business stands up to this tall ask.

Famously, valuation guru Stern School of Business, New York’s Aswath Damodaran valued the fintech major at $20 Bn, as per its revenue track record and the typical trading multiple associated with fintech companies.

According to Inc42 sources, Paytm is seeking a $20 Bn – $22 Bn valuation for its IPO. It was valued at $16 Bn in November 2019.

Paytm plans to use INR 4,300 Cr from the IPO proceeds to grow and strengthen its ecosystem by acquisition and retention of customers and merchants, and it plans to invest INR 2,000 Cr for new business initiatives, acquisitions and strategic partnerships.

The big challenge for Paytm is that other companies are cognisant of its diversified services base, and are gunning for it too. Walmart-owned PhonePe is looking beyond UPI towards wealth management, insurance broking, asset management license and more.

Sachin Bansal-owned Navi Technologies is another competitor and is also looking for a universal banking license. In recent weeks, BharatPe has emerged as another rival with its small finance banking license, which gives it more flexibility in banking operations than Paytm, which only has a payments bank license.

But Paytm’s depth in each fintech vertical is also a key strength for the company in the fintech slugfest. This is largely down to the fact that Paytm is often one of the early movers in new segments — it capitalises on its massive user base and technology stack to double down on new plays.

There’s a feeling that its competitors will take several years to match this scale across payments, wealth management, insurance, stock broking and more.

Indian Startups’ IPO Corner

After the unicorn buzz created in the first half of October, the past week was about the IPO and related buzz. Nykaa, Paytm and Policybazaar received SEBI’s approval for their IPOs.

- Nykaa will be making its stock market debut on October 28 at a price band of INR 1,085 – INR 1,125 per share, an Inc42 source said.

- Homegrown Google Maps alternative MapMyIndia has increased its proposed IPO offering to 9.58 Mn equity shares post allotment of specified securities, both equity and preference shares to the shareholders.

- NSE-listed online travel portal EaseMyTrip is looking to acquire businesses to expand its footprint into the “non-air” businesses such as trains, hotels, and tourism.

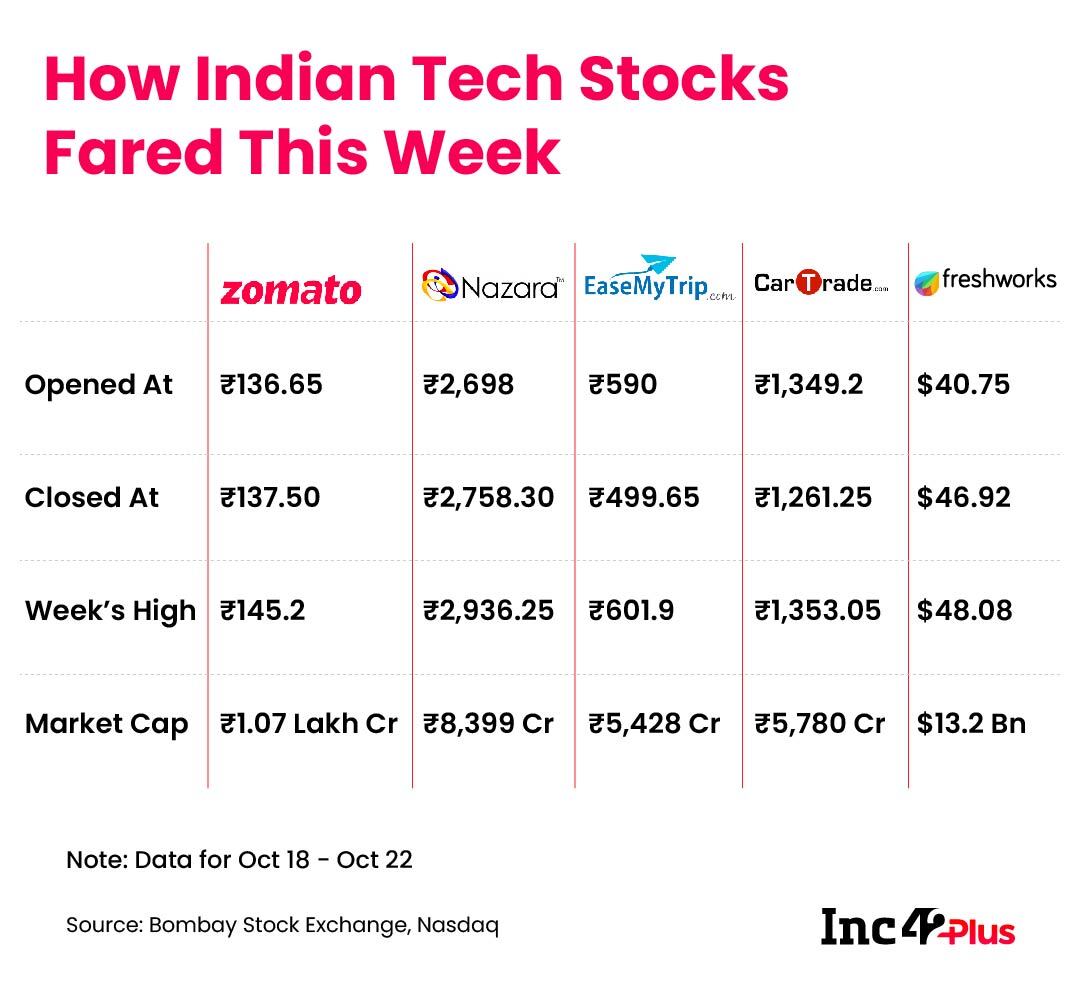

Here’s the weekly performance of listed tech companies we are tracking:

Indian Startup Funding Counter

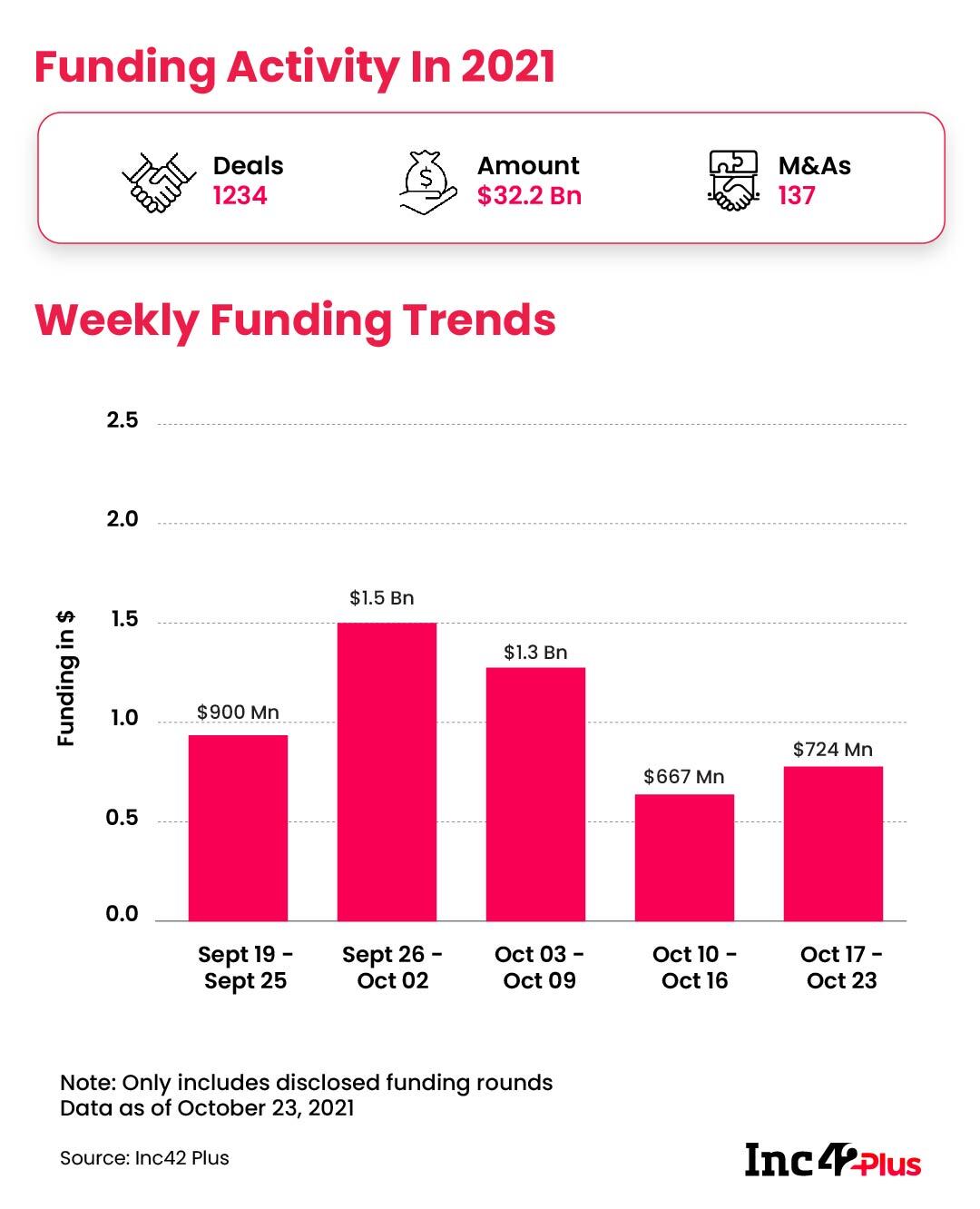

The past week’s funding tally was dominated by IPO-bound epharmacy startup PharmEasy, which raised nearly half of the total funding in the week. The healthtech unicorn secured $350 Mn in its pre-IPO round at a valuation of $5.6 Bn.

Besides this, Kunal Shah-led CRED raked in $251 Mn in its Series E from Tiger Global, Falcon Edge and others, at valuation of over $4 Bn.

Overall, the Indian startup ecosystem reported total funding of about $724 Mn across 32 deals and 12 acquisitions in the past week — seven of them by Thrasio-styled company Curefoods.

In Spotlight: Jio Platforms

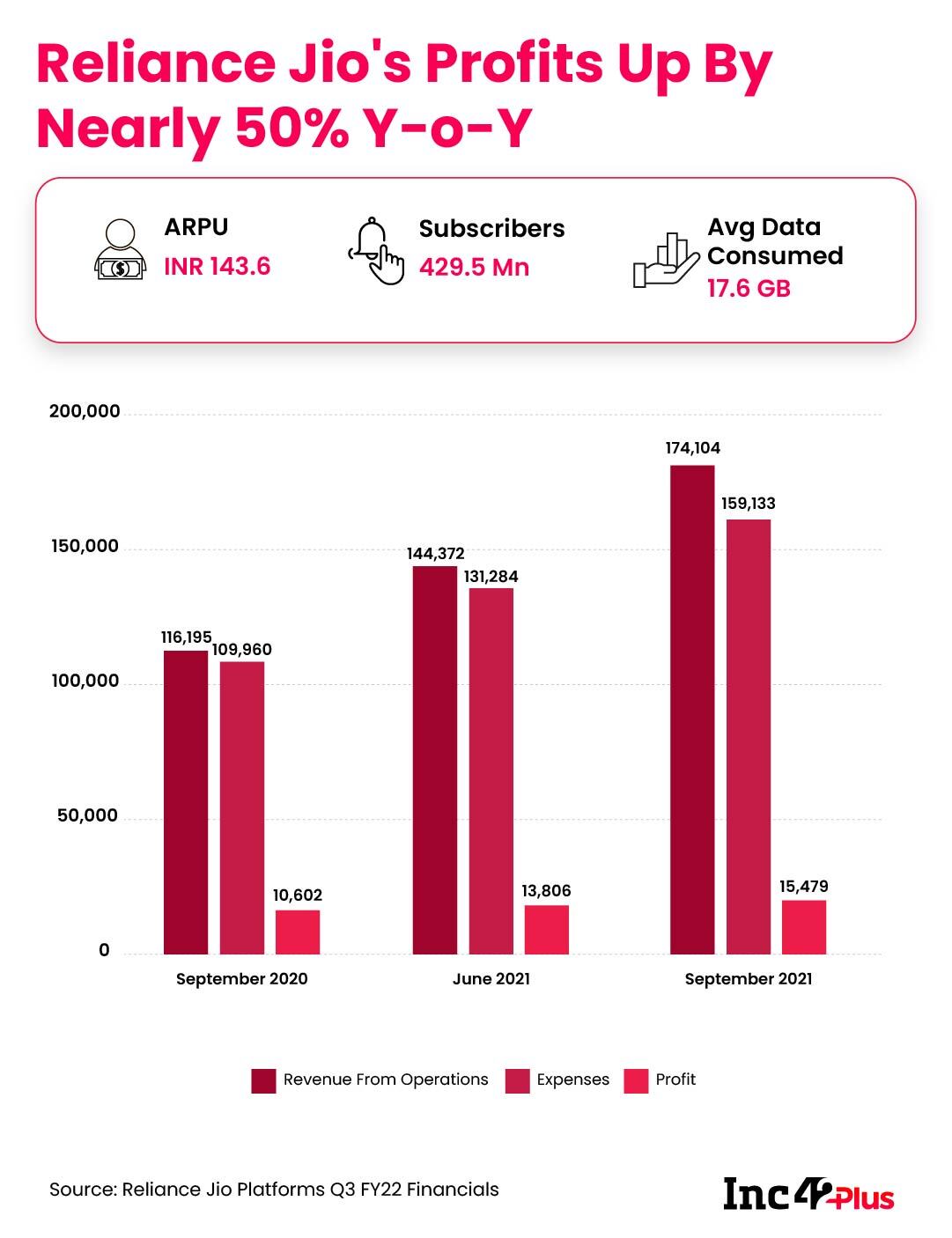

Reliance Jio continues to race ahead of the other telecom operators in the country in terms of subscriber base. It added nearly 6.5 lakh new users in August, taking the total to over 44.38 Cr.

Not just market share, Jio’s profits also grew by 23.5% YoY in Q3 FY22 at INR 3,728 Cr, up from INR 3,019 Cr last year. Average revenue per user also witnessed a growth of 3.7% to INR 143.6 in July-September compared to the previous quarter.

Jio’s total data traffic during the quarter was 23 Bn GB with 50.9% YoY growth, and its total voice traffic rose 17.6% to 1.09 Mn minutes in the same period.

Interestingly, the company’s much-anticipated “affordable” JioPhone Next, which has been co-developed with Google saw most of its features leak ahead of an official release. The launch of the phone was delayed by a couple of months.

While JioPhone Next is part of a strategy to bring in more telecom customers to the Jio digital services umbrella, another key component will be how the company’s super app ambitions grow.

Jio is also looking to invest in hyperlocal delivery startup Dunzo, participating in its $200 Mn – $250 Mn (probably Series F) round at a valuation of $800 Mn.

Top Stories

Finally, here’s a look at the other major stories and developments from the week that went by:

- Our latest edition of The Outline looks at how video commerce in the age of smartphones is just a modern version of the 90s’ teleshopping craze, fuelled by India’s creator economy and short video platforms

- “Reject Zomato”: Unacademy, where Zomato’s Deepinder Goyal was recently appointed a board member, was caught up in a communal controversy when one of its affiliates uploaded a parody of a Hindu epic.

- Like every month, in September 2021, too, PhonePe and Google Pay were the market leaders in terms of processing UPI transactions with over 80% of the combined market share.

- Against the backdrop of RBI’s framework for e-mandate-based recurring transactions, Apple is promoting wallet payments for subscription-based payments.

- US-based fintech giant Stripe has acquired Indian payment reconciliation startup Recko for an undisclosed amount.

- Continuing its acquisition spree Good Glamm Group has marked its fourth deal this year with digital media platform ScoopWhoop.

- And finally, our latest edition of India’s Crypto Economy sheds light on how gaming may be the trigger for mass adoption of blockchain — thanks to the rising NFT ecosystem.

That’s all for this week, folks. Watch out for a more data-packed newsletter every Sunday as we recap the week’s biggest stories and developments.

The post Paytm’s IPO All Set For Take-Off appeared first on Inc42 Media.

0 Comments