In the payments ecosystem, fintech is taking over the traditional channels, with increased adoption of digital payments owing to the Covid-19 pandemic. In line with the transformation, like every month, the National Payments Corporation of India (NPCI) had come out with its UPI and other digital payment figures for September 2021, along with app-wise distribution for UPI transactions and volumes.

In September 2021, 3.65 Bn UPI transactions worth INR 6,54,351 Cr were recorded. In July and August 2021, the numbers were INR 6.06 Lakh Cr and INR 6.35 Cr, thus, representing the growth rate of transactions volume and value in September by 2.3%.

Compared to almost 10% month on month growth in transaction volume and 5.4% month on month growth in transaction value in August, NPCI reported just 2.8% growth in transaction volume and 2.3% growth in value respectively during September.

PhonePe & Google Pay Lead The Market, Like Always

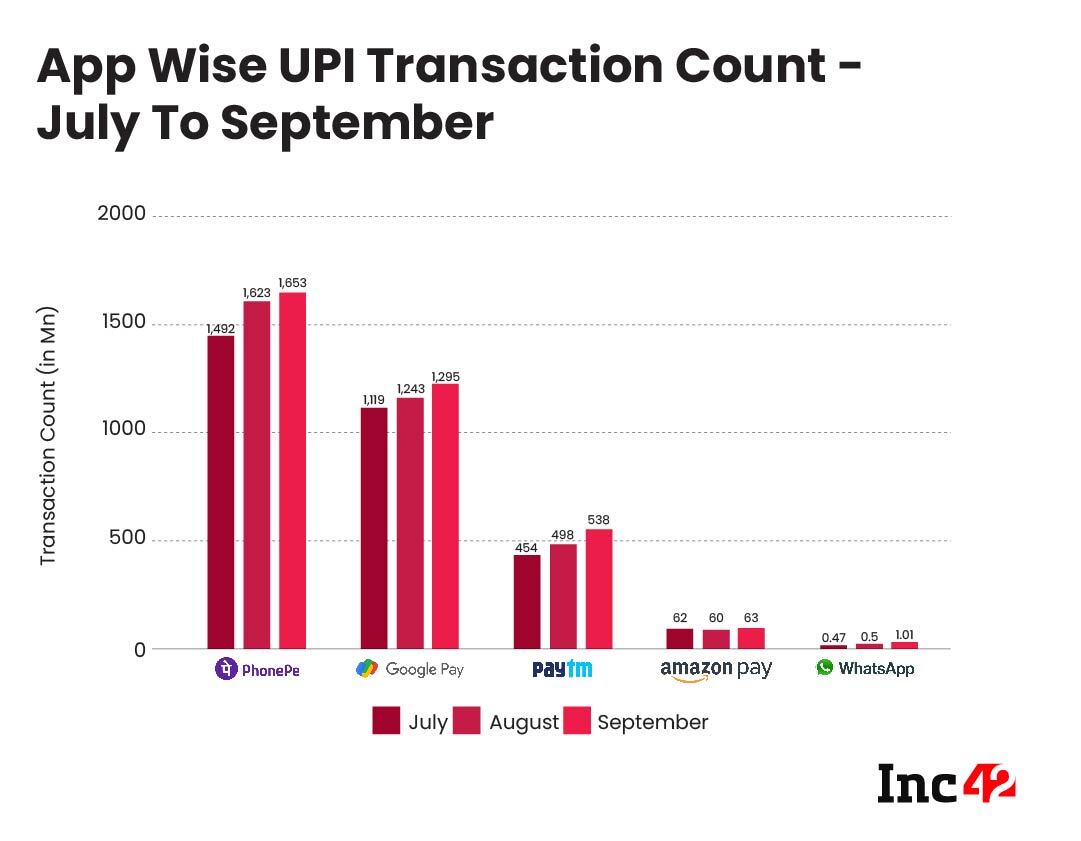

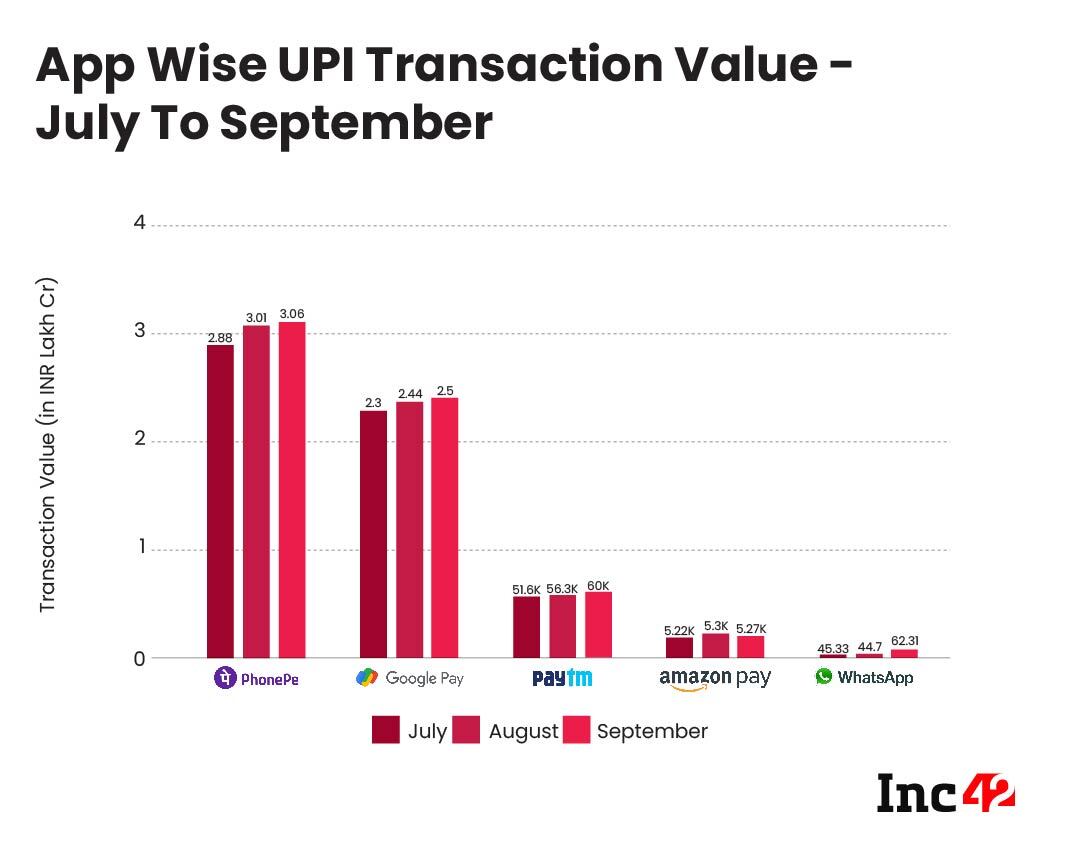

And yet again, digital payments apps PhonePe and Google Pay are the market leaders in terms of processing UPI transactions. The two have collectively processed a little under 80% of the total UPI transactions — a combined 2.9 Bn transactions worth INR 5.5 Lakh Cr.

The data posted by the NPCI shows that PhonePe carried out 44% of the total UPI transactions — 1.6 Bn transactions worth INR 3.06 Lakh Cr in September. On the other hand, with a 36% share, Google Pay recorded 1.3 Bn transactions worth INR 2.5 Lakh Cr.

PhonePe processed 1.62 Bn UPI transactions worth INR 3.01 Lakh Cr in August, compared to 1.5 Bn transactions worth INR 2.88 Lakh Cr in July. The previous numbers showcase only marginal growth in volume and a drop in count.

Far behind, but the next in line, among the leading digital payments apps are Paytm, Amazon Pay and WhatsApp Pay — in that order.

IPO-bound Paytm which is currently focused on its wallet business, stayed the third-largest UPI provider, with a 9% market growth compared to August 2021. Paytm controlled a little over 14% of the market through 53.8 Cr transactions worth INR 60,094 Cr.

On the other hand, Amazon Pay displayed a dip in transaction volume and a marginal rise on transaction counts with 63 Mn transactions worth INR 5,270 Cr.

While WhatsApp’s UPI numbers are underwhelming considering its reach as a social networking platform, it finally crossed the 1 Mn transaction mark for the first time. The Facebook-owned messenger has recorded 1.01 Mn transactions worth INR 62 Cr in September compared to half a million transactions in July and August.

Slower Growth Better For Digital Payments Apps?

From September 2020 to September 2021, the country’s digital payments ecosystem registered a slower growth of monthly UPI transactions from 1.8 Bn to 3.6 Bn. Among the most famous and top-performing UPI apps, customer transaction value only grew marginally, perhaps signalling a relief to larger market shareholders PhonePe and Google Pay.

According to a notification released by the NPCI in November, starting from January 2021, third-party app providers (TPAP) would not be allowed to process more than 30% of the total volume of transactions occurring through their individual UPI interfaces. The guidelines aim to prevent oligopoly and risks of overload on UPI infrastructures.

While PhonePe and Google Pay currently own 44% and 36% share of the market respectively, they have been allowed until December 2023 to reduce their market cap below 30%. Thus, it would be beneficial for the digital payments apps to lose some of the customer dependence given the transaction caps implemented by the NPCI.

On the same day as the NPCI notification for the 30% cap, WhatsApp got the nod to launch its digital payments platform WhatsApp Pay with a user cap of 20 Mn. The move restrains WhatsApp from utilising its full-scale operations in India, where it has more than 400 Mn users.

Thus, the slow growth will benefit the Facebook-owned messenger, which would fall under implied legal proceedings. WhatsApp currently claims to be scaling up its UPI service in a phased manner.

The post PhonePe, Google Pay Record 80% of Total UPI Transactions In September 2021; WhatsApp Pay Records 2x Growth appeared first on Inc42 Media.

0 Comments