With the second wave of the Covid-19 pandemic unleashing havoc all across India, the country has grudgingly slipped back into the mode of lockdowns and curfews. Industries such as travel and hospitality, which had only just begun to recover their pre-Covid volumes at the beginning of this year, are again staring at a major disruption. For the restaurant industry, particularly, the high-end dining restaurants, lockdowns have either forced closures or compelled them to open an online storefront for accepting home orders.

In such times, food aggregators such as Zomato and Swiggy have witnessed increased traction since late last year, when they had recovered their pre-Covid volumes. Their tie-ups with cloud kitchens may be the future of the food and restaurant industry for the foreseeable future given the recent surge in cases. Another company looking to leverage the presence of several cloud kitchen brands under its portfolio is Faasos’ parent Rebel Foods. However, the company’s ambitious scale and growth plans seem to have placed it on a sticky financial footing.

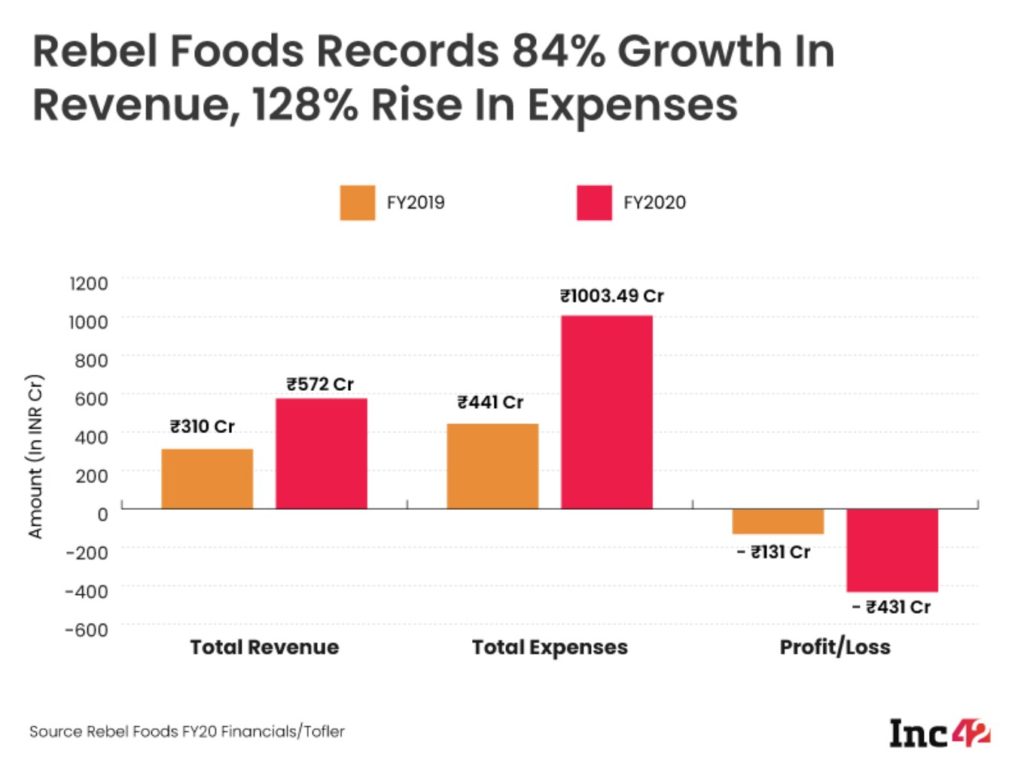

Rebel Foods’ revenue grew by 84% year-on-year (YoY) from INR 310 Cr in the fiscal year 2018-19 (FY19) to INR 572 Cr in FY20. However, during the same period, the company’s expenses shot up by 128% from INR 441 Cr in FY19 to INR 1,003.49 Cr in FY20. Thus, the company’s net loss has increased by 229% to INR 431 Cr from INR 131 Cr.

The company earns its operating revenue from the sale of food products and income from making home deliveries for orders received through its online portals. Rebel Foods has not given a breakdown on which of its brands brings in the most revenue. Founded in 2010 by Jaydeep Barman and Kallol Banerjee, Rebel Foods started out as Faasos but has since launched 11 other food brands under various pricing segments. These include Behrouz Biryani, The Biryani Life, Mandarin Oak, The Good Bowl, Oven Story and Firangi Bake.

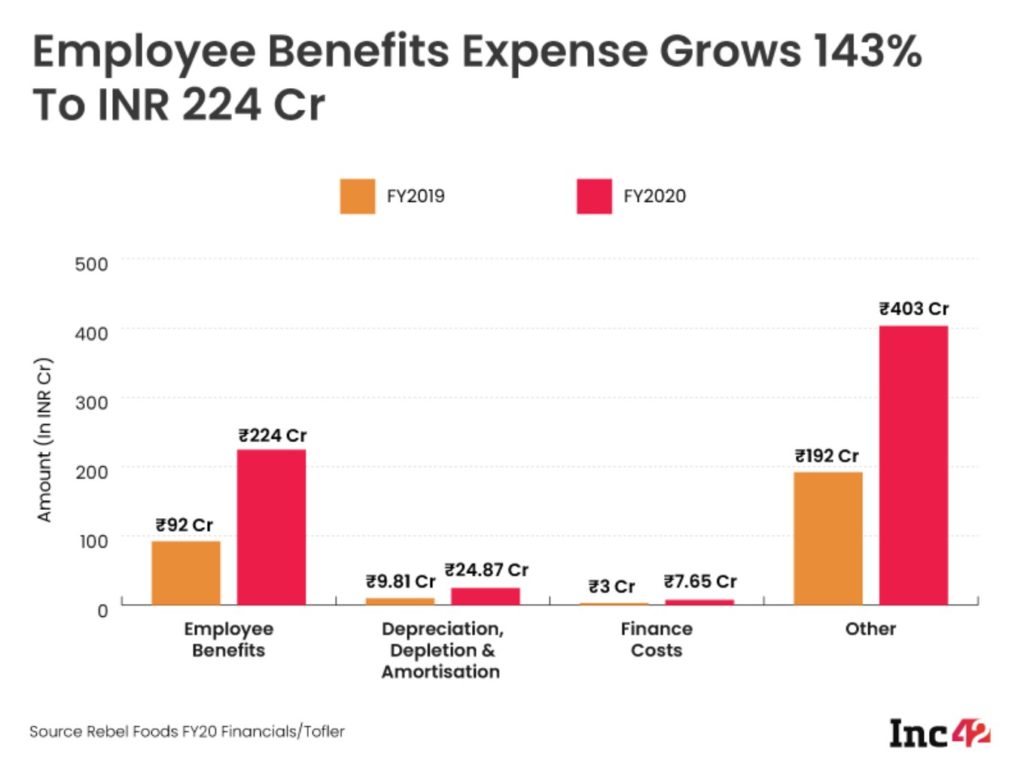

The breakup of the company’s expenses shows that spending increased across the board. Employee benefits expense increased by 143% to INR 224 Cr; depreciation, depletion and amortisation expense increased by 154% to INR 24.87 Cr; finance costs increased by 155% to INR 7.65 Cr; and, other expenses, which includes the company’s spending on rent, fuel, legal, transportation and other miscellaneous expenses, increased by 110% to INR 403 Cr.

Other expenses also include commission paid by the company to selling agents such as Zomato and Swiggy, which doubled from INR 48 Cr in FY19 to INR 96 Cr in FY20. Rebel Foods’ advertising and promotional expenses also increased by 61% to INR 117.64 Cr.

Notably, miscellaneous expenses, which grew by 148% to INR 27.95 Cr, includes the company’s spending on gas and other utilities for its cloud kitchen and shop expenses. This suggests that the company spent much of FY20 augmenting its cloud kitchen infrastructure.

Rebel Foods Chases Scale In Booming Cloud Kitchen Market

In August last year, Rebel Foods’ cofounder Banerjee told Inc42 that the company generates roughly 50% of its demand through Zomato and Swiggy, and the rest from the individual websites dedicated to each of its brands. Banerjee explained that Rebel Foods’ has two brands in the same food category, but at different price points, which helps cover more of the market and beat the competition on pricing as well, without giving up on the margins completely.

For instance, Rebel Foods has two Biryani-focussed brands, Behrouz Biryani and The Biryani Life, the latter priced considerably lower than Behrouz. So, while Rebel treats Behrouz as the premium brand which sticks to its prices, it plays the discount war with its competitors through The Biryani Life. This, after the company started facing increased competition from other D2C restaurants such as Biryani By Kilo and Biryani Blues. While the company has so far implemented this strategy only in the ‘Biryani’ category, Banerjee explained that based on customer feedback, it will look to employ the same experiment in other food categories as well. The company would do so by starting a new label from the same kitchen that is dedicated to an existing label. Its staff would need to be trained with changing product quantities and bringing in mild changes in ingredients and taste depending on the target consumer.

Rebel Foods claims to be running 325 cloud kitchens across the country, with a presence in 35 Indian cities as well as in Southeast Asia, the Middle East and Europe. It competes with several other players such as Box8, Freshmenu and Wow! Momo.

In December last year, Rebel Foods’ entered into a partnership with American fast food company The Wendy’s Company to help the latter open 250 cloud kitchens across India. These cloud kitchens will be developed and operated by Sierra Nevada Restaurants, which holds the India master franchisee for Wendy’s.

A partnership with Rebel Foods will give Wendy’s the advantage of a pan-India scale as well as local know-how. “By partnering with the Rebel Foods network of existing kitchens in India, Wendy’s will get immediate access to rapid scale across the country, at far lower levels of capital,” Kallol Banerjee of Rebel Foods had said.

According to RedSeer Management Consulting, the Indian cloud kitchen market is expected to grow from a size of $400 Mn in 2019 to become a $2 Bn industry by 2024, owing to costumer’s increased preference for ordering their food online.

The post [What The Financials] Faasos & Behrouz Biryani Parent Rebel Foods’ FY20 Loss More Than Triples To INR 431 Cr appeared first on Inc42 Media.

0 Comments